Question

Discuss what is meant by the mean-variance framework in the context of portfolio choice Consider a portfolio problem with n risky assets. Explain how one

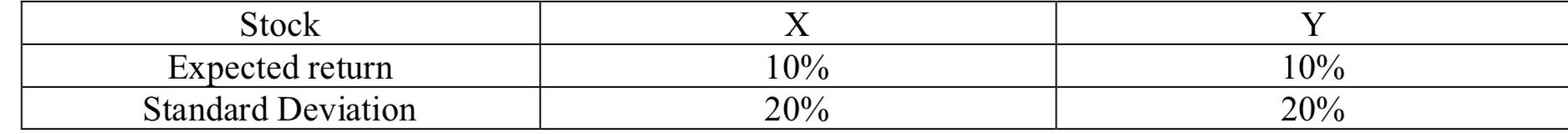

Suppose that the correlation between the two expected returns is equal to zero. An investment manager has constructed a portfolio made up of 50% of stock X and 50% of stock Y. Another manager makes the following comment: "Since the expected returns and standard deviations of the two stocks are the same and their returns are not correlated, it does not make sense to combine A and B in a portfolio."

State whether you agree with this statement and provide a proof of your argument using the numbers in the table.

Suppose that the correlation between the two expected returns is equal to one. Would you agree in this case that combining these stocks in a portfolio does not bring any benefit in terms of risk reduction? Provide proof of your argument using the numbers in the table.

Stock Expected return Standard Deviation X 10% 20% Y 10% 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In the context of portfolio choice the meanvariance framework is a fundamental approach developed by Harry Markowitz to help investors make optimal decisions regarding their investment portfolios It i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started