Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss whether input tax credits would be available for the following acquisitions: 1. The purchase of books by a bookshop from a publisher 2.

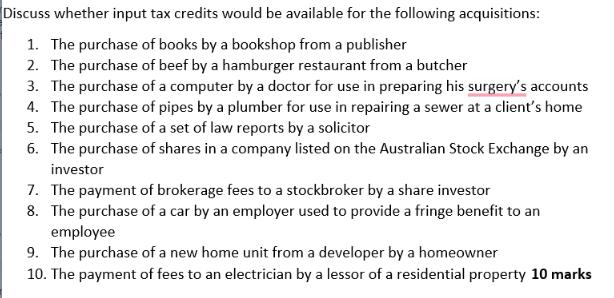

Discuss whether input tax credits would be available for the following acquisitions: 1. The purchase of books by a bookshop from a publisher 2. The purchase of beef by a hamburger restaurant from a butcher 3. The purchase of a computer by a doctor for use in preparing his surgery's accounts 4. The purchase of pipes by a plumber for use in repairing a sewer at a client's home 5. The purchase of a set of law reports by a solicitor 6. The purchase of shares in a company listed on the Australian Stock Exchange by an investor 7. The payment of brokerage fees to a stockbroker by a share investor 8. The purchase of a car by an employer used to provide a fringe benefit to an employee 9. The purchase of a new home unit from a developer by a homeowner 10. The payment of fees to an electrician by a lessor of a residential property 10 marks

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Input tax credits also known as input tax deductions or input tax refunds are typically associated with the Goods and Services Tax GST system in Austr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started