Answered step by step

Verified Expert Solution

Question

1 Approved Answer

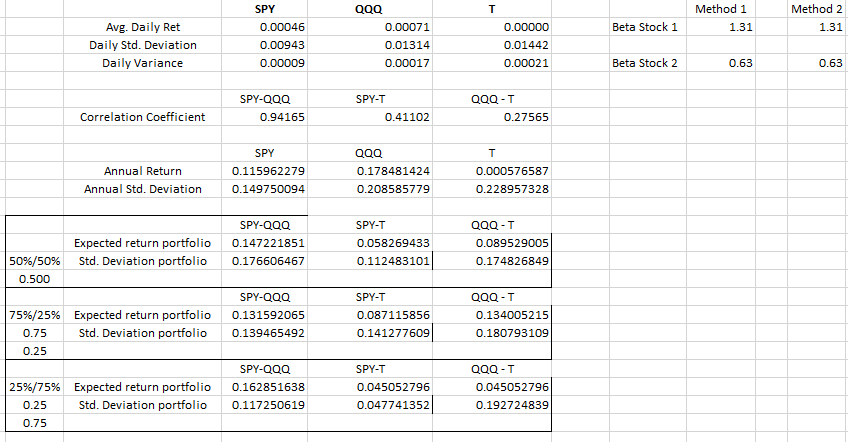

Discuss your findings. This should include: A discussion of the main statistics, such as the expected return for each stock, the standard deviation for each

Discuss your findings. This should include:

- A discussion of the main statistics, such as

- the expected return for each stock,

- the standard deviation for each stock, the expected return of the portfolio of the two stocks you selected using the various percentages allocated to each (50%-50%, 75%-25%, 25%-75%) provided in the sheet,

- the standard deviation for each portfolio of the two stocks you selected using the various percentages allocated to each (50%-50%, 75%-25%, 25%-75%),

- the beta of each stock,

- the beta of a portfolio of the two stocks using the percentages allocated to each (50%-50%, 75%-25%, 25%-75%).

- Be sure to discuss some of the key concepts too (e.g., point out the standard deviation of the portfolio is less than the weighted average of the standard deviations of the stocks in the portfolio)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started