Answered step by step

Verified Expert Solution

Question

1 Approved Answer

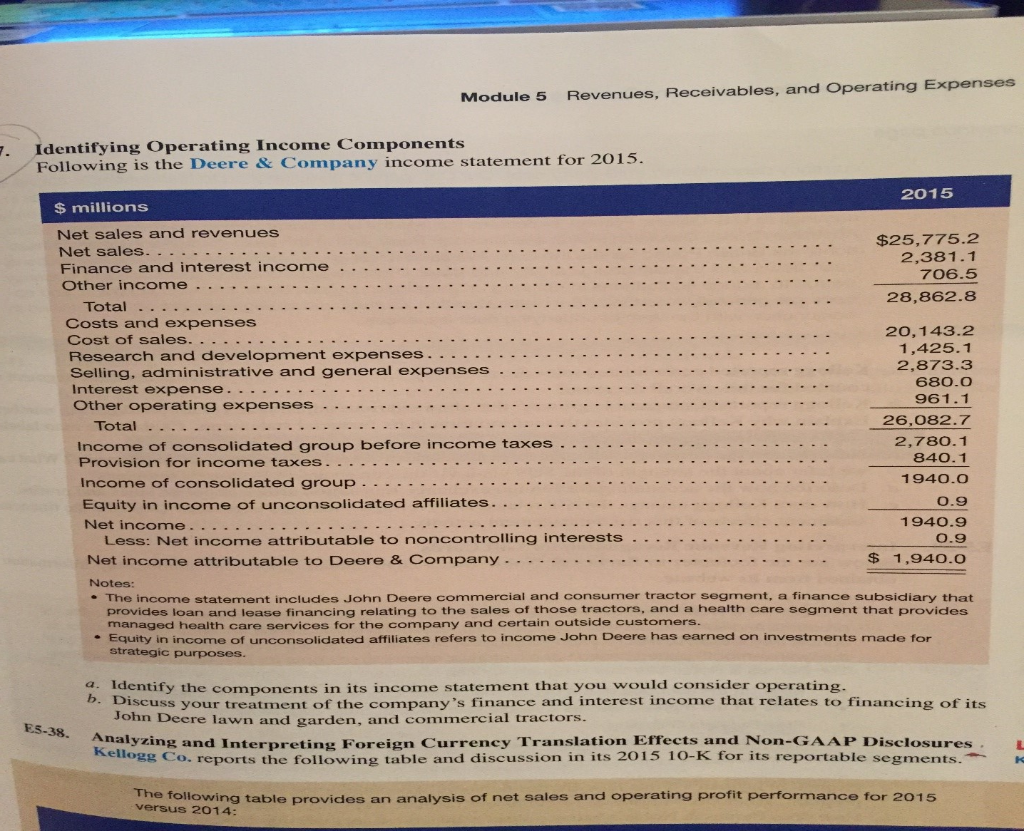

Discuss your treatment of the company's finance and interest income that relates to financing of its John Deere lawn and garden, and commericial tractors. odule

Discuss your treatment of the company's finance and interest income that relates to financing of its John Deere lawn and garden, and commericial tractors.

odule 5 Revenues, Receivables, and Operating Expenses Identifying Operating Income Components Following is the Deere & Company income statement for 2015 2015 $ millions Net sales and revenues Finance and interest income . . . . . . . .---- . . . . . . . . .- . . . . . . . . $25,775.2 2,381.1 706.5 . 28,862.8 Total .. Costs and expenses Cost of sales. _.. . - .-.. --.. -..-. --. -... - --. -. . Research and development expenses..-. -. -. ...- . . - Selling, administrative and general expenses .---. . . . . . . ..-n-n n n n 20,143.2 1,425.1 2,873.3 680.O 961.1 26,082.7 2,780.1 840.1 1940.o 0.9 1940.9 0.9 $ 1,940.0 Total Income of consolidated group before income taxes ..-.... . -..-- -. .. . . Provision for income taxes..-...- . Equity in income of unconsolidated affiliates. . ..--. Less: Net income attributable to noncontrolling interests Net income attributable to Deere & Company.. . . . . . . . . . . . . . . . . . . . . . Notes: . The income statement includes John Deere commercial and consumer tractor segment, a finance subsidiary that managed health care services for the company and certain outside customers Equity in income of unconsolidated affiliates refers to income John Deere has earned on investments made for strategic purposes. a. Identify the components in its income statement that you would consider operating. Discuss your treatment of the company's finance and interest income that relates to financing of its John Deere lawn and garden, and commercial tractors. ES-3 38. Analyzing and Inteing Foreign Currency Translation Effects and Non-GAAP Disclosures ellogg Co. reports the following table and discussion in its 2015 10-K for its reportable segments The following table provides an analysis of net sales and operating profit performance for 2015 versuS 2014Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started