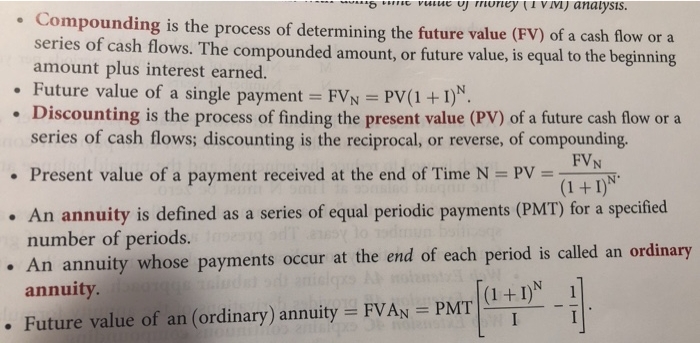

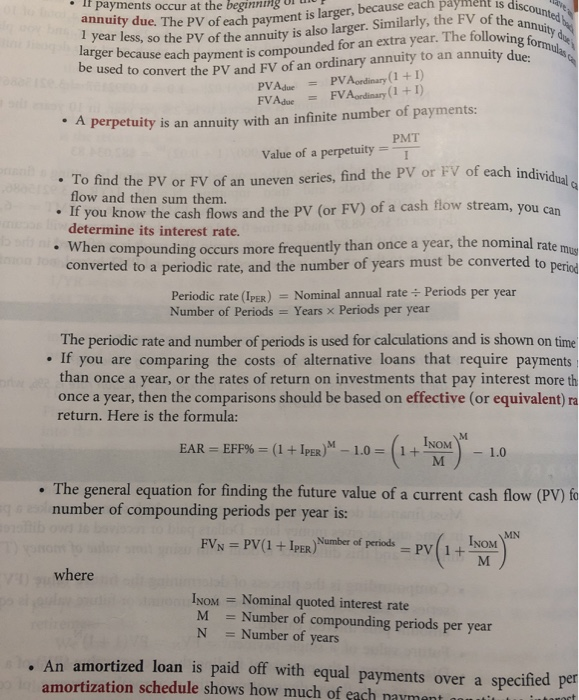

Discussion 1 Read the chapter summary on pages 176-178. Imagine you are responsible for explaining any 3 key terms from the chapter to your coworkers. Create a verbal depiction, PowerPoint presentation, or similar graphic representation, to demonstrate the terms in a meaningful and memorable way. - WR C vurue UJ money (IVM) analysis. Compounding is the process of determining the future value (FV) of a cash flow or a series of cash flows. The compounded amount, or future value, is equal to the beginning amount plus interest earned. Future value of a single payment = FVN = PV(1+1). Discounting is the process of finding the present value (PV) of a future cash flow or a series of cash flows; discounting is the reciprocal, or reverse, of compounding. ny FVN Present value of a payment received at the end of Time N = PV = 7 = (1+IN An annuity is defined as a series of equal periodic payments (PMT) for a specified number of periods. An annuity whose payments occur at the end of each period is called an ordinary annuity. Future value of an (ordinary) annuity = FVAN = PMT (1+IN discounted be annuit de ving formidas If payments occur at the beginningur annuity due. The PV of each payment islam ment is larger, because each payment is dis car less, so the PV of the annuity is also larger. Similarly, the FV of the a Decause each payment is compounded for an extra year. The following e used to convert the PV and FV of an ordinary annuity to an annuity due: PVAdue = PVAordinary (1+1) FVAdue = FVA ordinary (1+1) . A * A perpetuity is an annuity with an infinite number of payments: Value of a perpetuity = itu PMT widual To find the PV or FV of an uneven series, find the PV or FV of each individu flow and then sum them. If you know the cash flows and the PV (or FV) of a cash flow stream, you can determine its interest rate. When compounding occurs more frequently than once a year, the nominal raten converted to a periodic rate, and the number of years must be converted to period b . When con Periodic rate (IPER) = Nominal annual rate - Periods per year Number of Periods = Years x Periods per year The periodic rate and number of periods is used for calculations and is shown on time . If you are comparing the costs of alternative loans that require payments than once a year, or the rates of return on investments that pay interest more th once a year, then the comparisons should be based on effective (or equivalent) ra return. Here is the formula: EAR = EFF% = (1 + Ipex)" 1.0 = (1 + INOM) - 1.0 . The general equation for finding the future value of a current cash flow (PV) fo number of compounding periods per year is: FVN = PV(1 + IPER) Number of periods 70 where INOM = Nominal quoted interest rate M = Number of compounding periods per year N = Number of years An amortized loan is paid off with equal payments over a specified per amortization schedule shows how much of each nayment con s tamorf Discussion 1 Read the chapter summary on pages 176-178. Imagine you are responsible for explaining any 3 key terms from the chapter to your coworkers. Create a verbal depiction, PowerPoint presentation, or similar graphic representation, to demonstrate the terms in a meaningful and memorable way. - WR C vurue UJ money (IVM) analysis. Compounding is the process of determining the future value (FV) of a cash flow or a series of cash flows. The compounded amount, or future value, is equal to the beginning amount plus interest earned. Future value of a single payment = FVN = PV(1+1). Discounting is the process of finding the present value (PV) of a future cash flow or a series of cash flows; discounting is the reciprocal, or reverse, of compounding. ny FVN Present value of a payment received at the end of Time N = PV = 7 = (1+IN An annuity is defined as a series of equal periodic payments (PMT) for a specified number of periods. An annuity whose payments occur at the end of each period is called an ordinary annuity. Future value of an (ordinary) annuity = FVAN = PMT (1+IN discounted be annuit de ving formidas If payments occur at the beginningur annuity due. The PV of each payment islam ment is larger, because each payment is dis car less, so the PV of the annuity is also larger. Similarly, the FV of the a Decause each payment is compounded for an extra year. The following e used to convert the PV and FV of an ordinary annuity to an annuity due: PVAdue = PVAordinary (1+1) FVAdue = FVA ordinary (1+1) . A * A perpetuity is an annuity with an infinite number of payments: Value of a perpetuity = itu PMT widual To find the PV or FV of an uneven series, find the PV or FV of each individu flow and then sum them. If you know the cash flows and the PV (or FV) of a cash flow stream, you can determine its interest rate. When compounding occurs more frequently than once a year, the nominal raten converted to a periodic rate, and the number of years must be converted to period b . When con Periodic rate (IPER) = Nominal annual rate - Periods per year Number of Periods = Years x Periods per year The periodic rate and number of periods is used for calculations and is shown on time . If you are comparing the costs of alternative loans that require payments than once a year, or the rates of return on investments that pay interest more th once a year, then the comparisons should be based on effective (or equivalent) ra return. Here is the formula: EAR = EFF% = (1 + Ipex)" 1.0 = (1 + INOM) - 1.0 . The general equation for finding the future value of a current cash flow (PV) fo number of compounding periods per year is: FVN = PV(1 + IPER) Number of periods 70 where INOM = Nominal quoted interest rate M = Number of compounding periods per year N = Number of years An amortized loan is paid off with equal payments over a specified per amortization schedule shows how much of each nayment con s tamorf