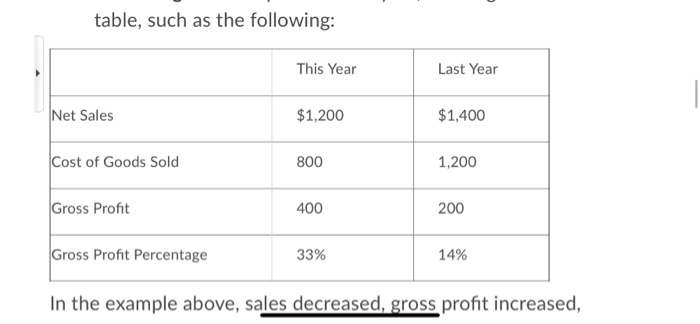

Discussion Requirements 1. Answer all of the following questions and do NOT cut and paste from your company SEC report. Note 1 includes accounting information. What is the fiscal year for your SEC 10-K Company? This may be June 30 each year, or it may be the Sunday closest to the last day of January, or some other description. Inventory: How is Inventory described for your SEC 10-K company? LIFO, FIFO, and/or average cost? Relate your answer to topics in our course. Income Statement: Is it a single-step or multi- step income statement? Calculate the Gross Profit and the Gross Profit Percentage for this year and last year, creating a small table, such as the following: table, such as the following: This Year Last Year Net Sales $1,200 $1,400 Cost of Goods Sold 800 1,200 Gross Profit 400 200 Gross Profit Percentage 33% 14% In the example above, sales decreased, gross profit increased, In the example above, sales decreased, gross profit increased, and the gross profit percentage increased. Therefore, sales are more profitable. We made 33 cents of gross profit on every dollar of sales this year, but only 14 cents of gross profit on every dollar of sales last year. Sales decreased, but sales are actually generating more profit overall, both as an absolute dollar value and as a percentage. Discussion Requirements 1. Answer all of the following questions and do NOT cut and paste from your company SEC report. Note 1 includes accounting information. What is the fiscal year for your SEC 10-K Company? This may be June 30 each year, or it may be the Sunday closest to the last day of January, or some other description. Inventory: How is Inventory described for your SEC 10-K company? LIFO, FIFO, and/or average cost? Relate your answer to topics in our course. Income Statement: Is it a single-step or multi- step income statement? Calculate the Gross Profit and the Gross Profit Percentage for this year and last year, creating a small table, such as the following: table, such as the following: This Year Last Year Net Sales $1,200 $1,400 Cost of Goods Sold 800 1,200 Gross Profit 400 200 Gross Profit Percentage 33% 14% In the example above, sales decreased, gross profit increased, In the example above, sales decreased, gross profit increased, and the gross profit percentage increased. Therefore, sales are more profitable. We made 33 cents of gross profit on every dollar of sales this year, but only 14 cents of gross profit on every dollar of sales last year. Sales decreased, but sales are actually generating more profit overall, both as an absolute dollar value and as a percentage