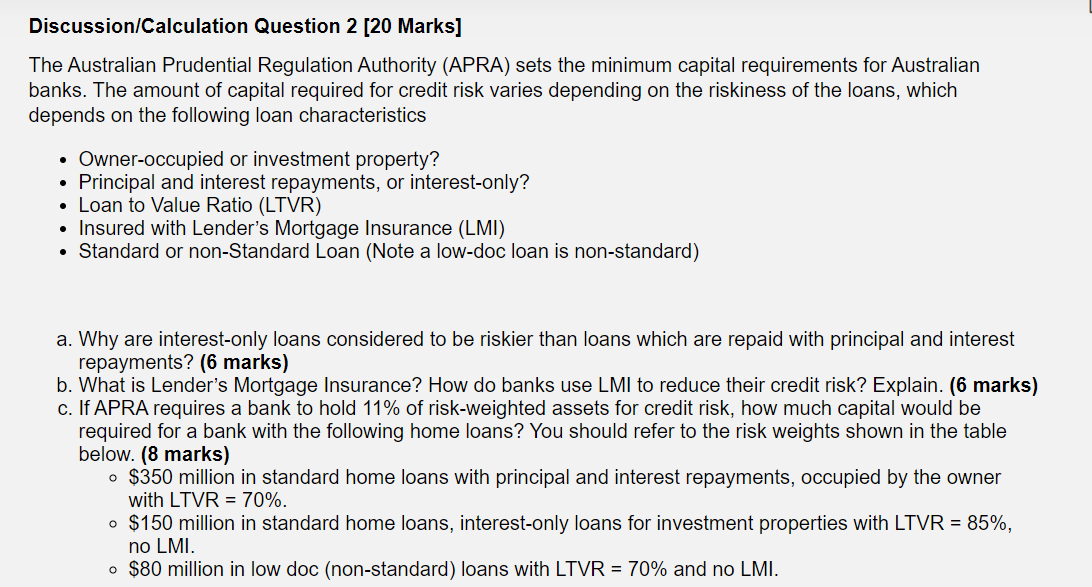

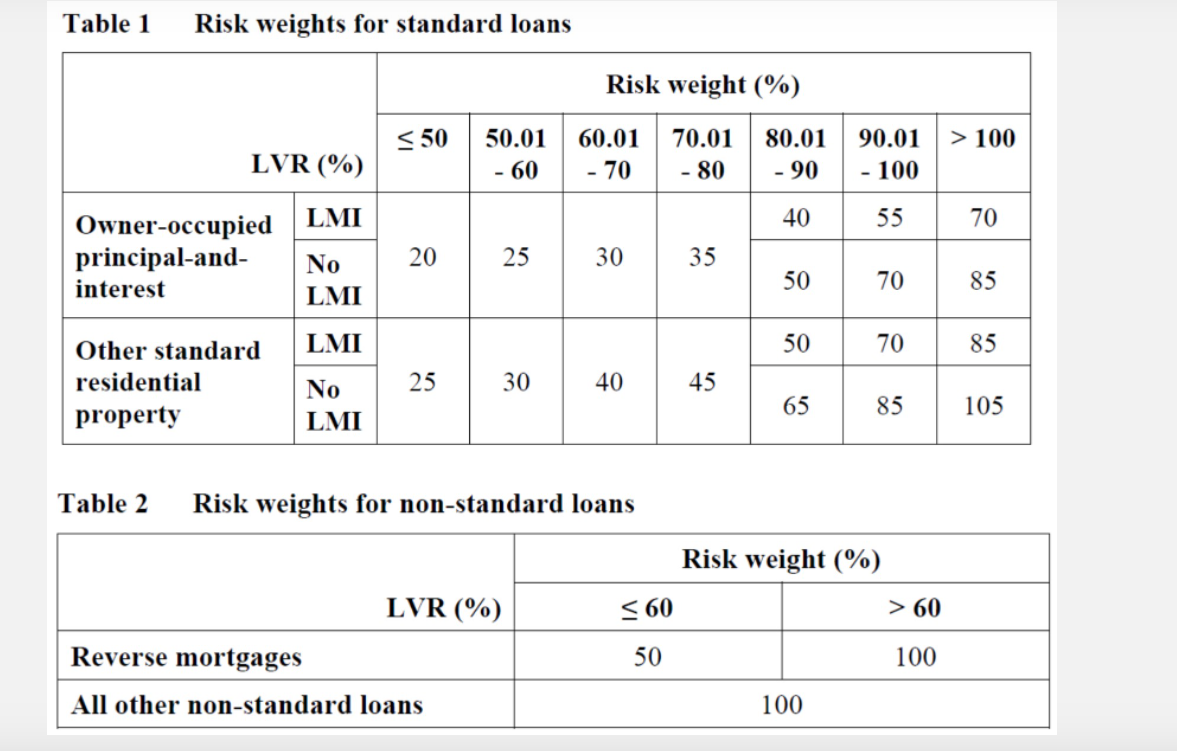

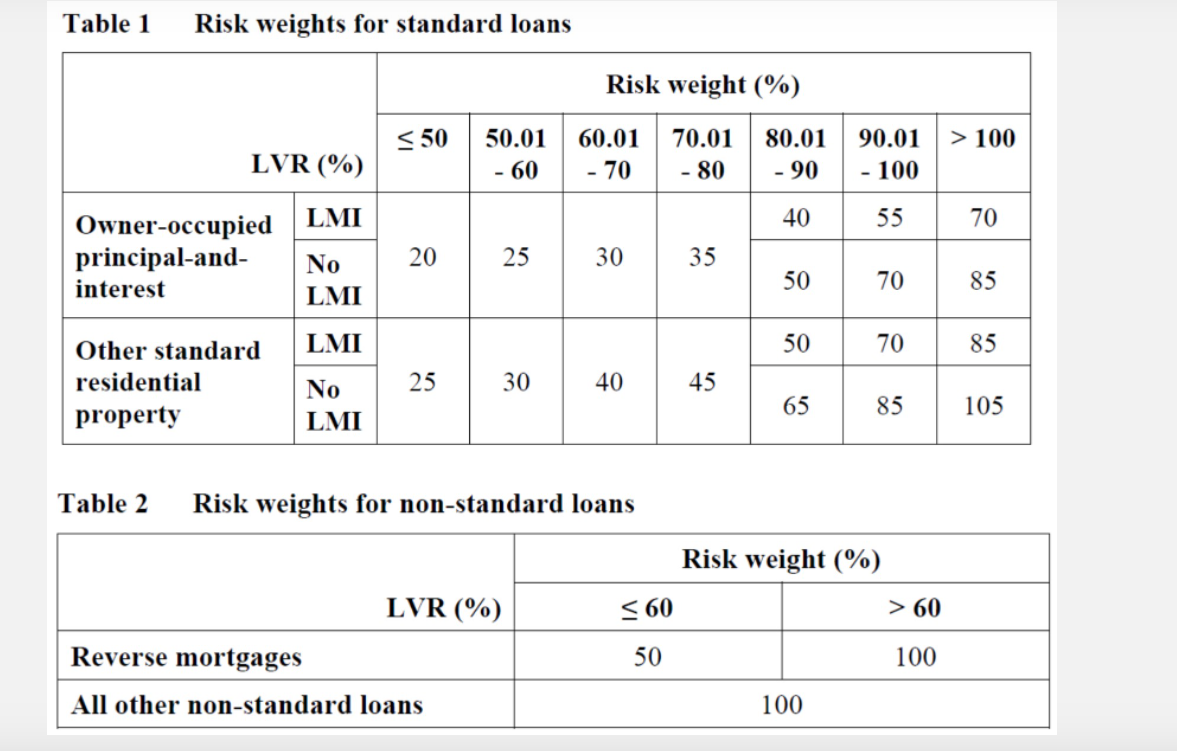

Discussion/Calculation Question 2 [20 Marks] The Australian Prudential Regulation Authority (APRA) sets the minimum capital requirements for Australian banks. The amount of capital required for credit risk varies depending on the riskiness of the loans, which depends on the following loan characteristics . Owner-occupied or investment property? Principal and interest repayments, or interest-only? Loan to Value Ratio (LTVR) Insured with Lender's Mortgage Insurance (LMI) Standard or non-Standard Loan (Note a low-doc loan is non-standard) . a. Why are interest-only loans considered to be riskier than loans which are repaid with principal and interest repayments? (6 marks) b. What is Lender's Mortgage Insurance? How do banks use LMI to reduce their credit risk? Explain. (6 marks) c. If APRA requires a bank to hold 11% of risk-weighted assets for credit risk, how much capital would be required for a bank with the following home loans? You should refer to the risk weights shown in the table below. (8 marks) o $350 million in standard home loans with principal and interest repayments, occupied by the owner with LTVR = 70%. o $150 million in standard home loans, interest-only loans for investment properties with LTVR = 85%, no LMI. o $80 million in low doc (non-standard) loans with LTVR = 70% and no LMI. Table 1 Risk weights for standard loans Risk weight (%) = 50 80.01 90.01 > 100 LVR (%) 50.01 - 60 60.01 - 70 70.01 - 80 - 90 - 100 40 55 70 20 25 30 35 50 70 85 Owner-occupied LMI principal-and- No interest LMI Other standard LMI residential No property LMI 50 70 85 25 30 40 45 65 85 105 Table 2 Risk weights for non-standard loans Risk weight (%) LVR (%) 60 Reverse mortgages 50 100 All other non-standard loans 100 Discussion/Calculation Question 2 [20 Marks] The Australian Prudential Regulation Authority (APRA) sets the minimum capital requirements for Australian banks. The amount of capital required for credit risk varies depending on the riskiness of the loans, which depends on the following loan characteristics . Owner-occupied or investment property? Principal and interest repayments, or interest-only? Loan to Value Ratio (LTVR) Insured with Lender's Mortgage Insurance (LMI) Standard or non-Standard Loan (Note a low-doc loan is non-standard) . a. Why are interest-only loans considered to be riskier than loans which are repaid with principal and interest repayments? (6 marks) b. What is Lender's Mortgage Insurance? How do banks use LMI to reduce their credit risk? Explain. (6 marks) c. If APRA requires a bank to hold 11% of risk-weighted assets for credit risk, how much capital would be required for a bank with the following home loans? You should refer to the risk weights shown in the table below. (8 marks) o $350 million in standard home loans with principal and interest repayments, occupied by the owner with LTVR = 70%. o $150 million in standard home loans, interest-only loans for investment properties with LTVR = 85%, no LMI. o $80 million in low doc (non-standard) loans with LTVR = 70% and no LMI. Table 1 Risk weights for standard loans Risk weight (%) = 50 80.01 90.01 > 100 LVR (%) 50.01 - 60 60.01 - 70 70.01 - 80 - 90 - 100 40 55 70 20 25 30 35 50 70 85 Owner-occupied LMI principal-and- No interest LMI Other standard LMI residential No property LMI 50 70 85 25 30 40 45 65 85 105 Table 2 Risk weights for non-standard loans Risk weight (%) LVR (%) 60 Reverse mortgages 50 100 All other non-standard loans 100