Question: dison Ford & 1 12/07/219:28 PM = Homework: Assign... Question 6, P12-4 (simil... HW Score: 88%, 88 of 100 points Part 1 of 2 Save

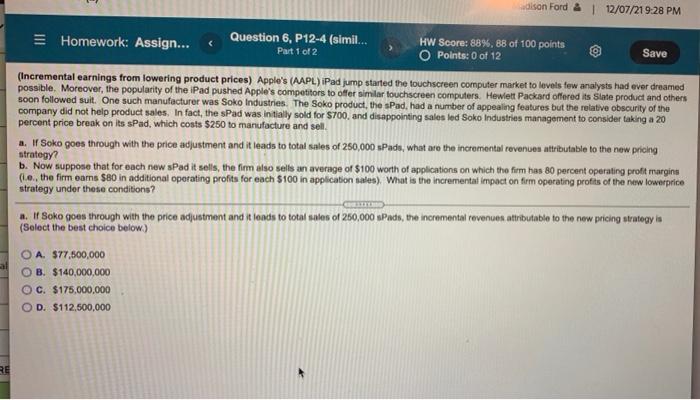

dison Ford & 1 12/07/219:28 PM = Homework: Assign... Question 6, P12-4 (simil... HW Score: 88%, 88 of 100 points Part 1 of 2 Save O Points: 0 of 12 (Incremental earnings from lowering product prices) Apple's (AAPL) iPad jump started the touchscreen computer market to levels tow analysts had ever dreamed possible. Moreover, the popularity of the iPad pushed Apple's competitors to offer similar touchscreen computers. Hewlett Packard offered its Slate product and others soon followed suit. One such manufacturer was Soko Industries. The Soko product, the sPad, had a number of appealing features but the relative obscurity of the company did not help product sales. In fact, the spad was initially sold for $700, and disappointing sales led Soko Industries management to consider taking a 20 percent price break on its sPad, which costs $250 to manufacture and sell. a. If Soko goes through with the price adjustment and it leads to total sales of 250,000 sPado, what are the incremental revenues attributable to the new pricing strategy? b. Now suppose that for each new sPad it sells, the firm also sells an average of $100 worth of applications on which the firm has 80 percent operating profit margins (ie the firm cams $80 in additional operating profits for each $100 in application sales) What is the incrementat impact on firm operating profits of the new lowerprice strategy under these conditions? . Soko goes through with the price adjustment and it leads to total sales of 250,000 sPads, the incremental revenues attributable to the new pricing strategy is (Select the best choice below) A. $77,500,000 OB. $140,000,000 OC. $175,000,000 OD. $112.500,000 al RE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts