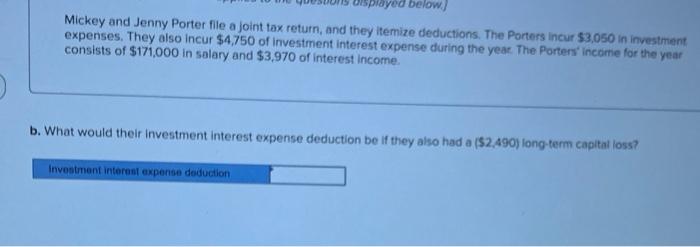

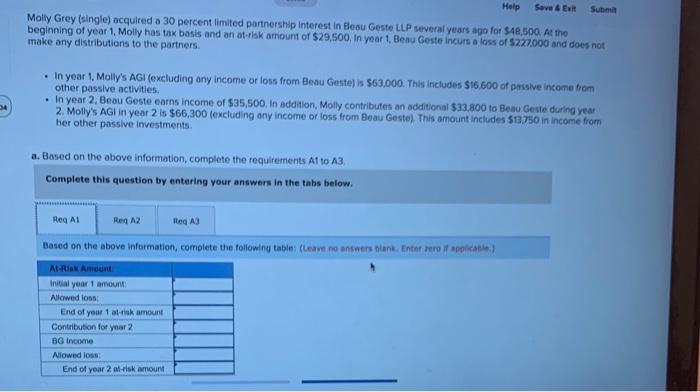

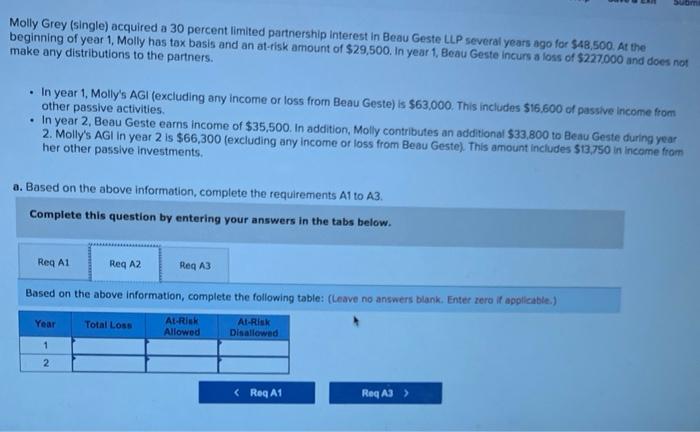

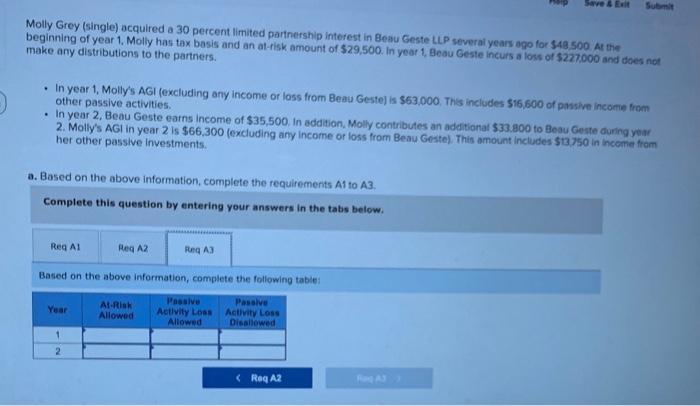

Displayed below.) Mickey and Jenny Porter file a joint tax return, and they itemize deductions. The Porters incur $3,050 in investment expenses. They also incur $4,750 of investment interest expense during the year. The Porters' income for the year consists of $171,000 in salary and $3,970 of interest income. b. What would their investment interest expense deduction be if they also had a ($2,490) long-term capital loss? Investment interest expense deduction Help Save & Exit Submi Molly Grey (single) acquired a 30 percent limited partnership Interest in Beau Geste LLP several years ago for $48.500. At the beginning of year 1, Molly has tax bosis and an at-risk amount of $29,500. In year 1 Beau Geste incurs a loss of $277.000 and does not make any distributions to the partners. In year 1, Molly's AG (excluding any income or loss from Beau Geste) is $63,000. This includes $16.600 of passive Income from other passive activities. . In year 2, Beau Geste earns income of $35,500. In addition, Molly contributes an additional $33,800 to Beau Geste during year 2. Molly's AG in year 2 is $66,300 (excluding any income or loss from Beau Gestel. This amount includes $3750 in income from her other passive investments. 34 a. Based on the above information, complete the requirements A1 to A3 Complete this question by entering your answers in the tabs below. Reg A1 Req AZ Req A3 Based on the above information, complete the following table (eave no answers blank Enterprif applicatie At-Rik Amount Initial your 1 amount Allowed loos End of your 1 at risk amount Contribution for year 2 B Income Allowed loss End of your 2 at-risk amount Suom Molly Grey (single) acquired a 30 percent limited partnership Interest in Beau Geste LLP several years ago for $48,500. At the beginning of year 1, Molly has tax basis and an at-risk amount of $29,500. In year 1, Beau Geste incurs a loss of $227.000 and does not make any distributions to the partners. In year 1, Molly's AG (excluding any income or loss from Beau Geste) is $63,000. This includes $16.600 of passive income from other passive activities. In year 2, Beau Geste earns income of $35,500. In addition, Molly contributes an additional $33,800 to Beau Geste during year 2. Molly's AGI In year 2 is $66,300 (excluding any income or loss from Beau Geste). This amount includes $13.750 in income from her other passive Investments. a. Based on the above information, complete the requirements Alto A3. Complete this question by entering your answers in the tabs below. Reg A1 Req A2 Reg 13 Based on the above information, complete the following table: (Leave no answers blank. Enter zero if applicable) Year Total Loss At-RIER Allowed Al-Risk Disallowed 1 2 Submit Molly Grey (single) acquired a 30 percent limited partnership interest in Beau Geste LLP several years ago for $48.500. At the beginning of year 1. Molly has tax basis and an at-risk amount of 529,500. In year 1, Beau Geste incurs a loss of $227.000 and does not make any distributions to the partners. In year 1, Molly's AGI (excluding any income or loss from Beau Geste) is $63,000. This includes $15,600 of passive income from other passive activities. . In year 2. Beau Geste earns income of $35,500. In addition, Molly contributes an additional $33.800 to Beau Geste during your 2. Molly's AG in year 2 is $66,300 (excluding any income or loss from Beau Geste). This amount includes $13.750 in income from her other passive Investments. a. Based on the above information, complete the requirements A1 to A3. Complete this question by entering your answers in the tabs below. Reg AI Reg A2 RAGAS Based on the above information, complete the following table Year At Risk Allowed Passive Activity Los Allowed Pasalve Activity Loss Disallowed 1 2