Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dispos l of Fixed Asset Equipment acquired on January 3 , 2 0 Y 1 , at a cost of $ 4 1 2 ,

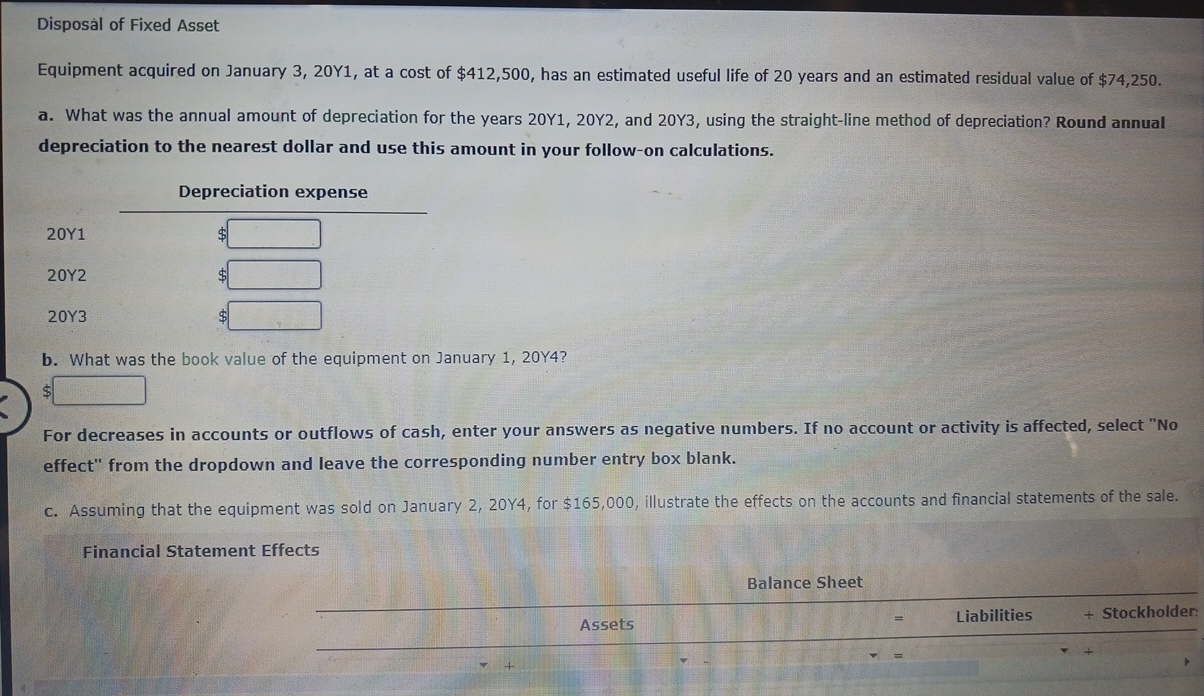

Disposl of Fixed Asset

Equipment acquired on January at a cost of $ has an estimated useful life of years and an estimated residual value

a What was the annual amount of depreciation for the years and using the straightline method of depreciation? Round annual depreciation to the nearest dollar and use this amount in your followon calculations.

Depreciation expense

$

b What was the book value of the equipment on January

$

For decreases in accounts or outflows of cash, enter your answers as negative numbers. If no account or activity is affected, select No effect" from the dropdown and leave the corresponding number entry box blank.

c Assuming that the equipment was sold on January for $ illustrate the effects on the accounts and financial statements of the sale.

Financial Statement Effects

Balance Sheet

Assets

Liabilities

Stockholder:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started