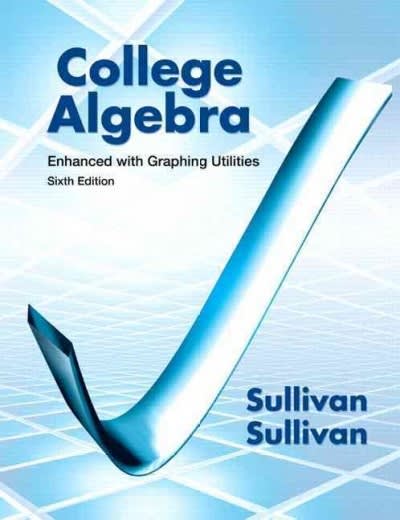

/-Distribution Area in Right Tail 11.25 11.20 0.15 1.10 0.025 1.112 0.005 10.0025 1.0OO 1.376 1.963 3.078 6.314 12.706 15.894 31.821 63.657 127.321 318.309 636.619 0816 1.061 1.386 1.186 2.920 4.849 6.965 9.925 14.089 22.327 31 594 0.765 1.250 1.638 2.353 3.182 3.482 4.541 5.841 7.453 10.215 12.924 0.741 0.941 1.190 1.533 2.132 2.776 2.999 3.747 4.604 5.598 7.173 8.610 0.727 0.920 1.156 1.476 2.015 2.571 2.757 3.365 4.032 4,773 5.893 6.869 0.718 0.906 1.134 1.440 1.943 2.447 2.612 3.143 3.707 4.317 5.208 5.959 0.711 0.896 1.119 1.415 1.895 2.365 2.517 2.998 3.499 4.029 4.785 5.408 0.706 0.869 1.108 1.397 1,860 2 306 2.449 2.896 3.355 3.83 4.501 5.041 0.703 0.883 1.100 1.383 1.8.13 2.262 2.398 2.821 3.250 3.690 4.297 4.781 10 0.700 0.879 1.093 1.372 1.812 2 228 2.359 2.764 3.169 3.581 4.144 4.587 11 0.697 0.876 1.363 1.796 2 201 2.328 2.718 3.106 3.497 4.025 4.437 12 0.695 0.873 1.083 1.356 1.782 2.179 2.303 2.681 3.055 3,428 3,930 4.318 13 0.694 0.870 1.079 1.350 1.771 2.160 2.282 2.650 3.012 3.372 3.852 4.221 14 0.692 0.868 1.076 1.345 1.761 2 145 2 624 2.977 3.326 3.787 4.140 15 0.691 0.866 1.074 1.341 1.753 2131 2.249 2.602 2.947 3.286 1,731 4.073 16 0.690 0.865 L.071 1.337 1,746 2.120 2.235 2.583 2.921 3.252 3.686 4.015 17 0.689 0.863 1.069 1.333 1.740 2.110 2.224 2.567 2.898 3.222 3.646 3.965 1.8 0.862 1.067 1.330 1,734 2 101 2.214 2.552 2.878 3,147 3,610 3927 19 0.861 1.0656 1.328 1.729 2.093 2.205 2.539 2.861 3.174 3.579 3.883 20 0.687 0.860 1.064 1.325 1.725 2.086 2.197 2.528 2.845 3.153 3.552 3.850 21 0.686 0.859 1.063 1.323 1.721 2.080 2.189 2.518 2.831 3.135 3.527 3.819 22 0.686 0.858 1.061 1.321 1.717 2074 2.183 2 508 2.819 3.119 3.505 3.792 23 0.685 0.858 1.060 1.319 1.714 2.069 2.177 2.500 2.807 3.104 3.485 3.768 24 0.685 0.857 1.054 1.318 1.711 2.064 2.172 2.492 2.797 1,091 3.467 3.745 25 0.684 0.856 1.058 1.316 1.708 2.060 2.167 2.485 2.787 3.078 3.450 3.725 0.684 0.856 1.058 1.315 1,706 2.056 2.162 2.479 2.779 3.067 3.435 3.707 0.684 0.855 1.057 1.314 1.703 2.052 2.158 2.473 2.771 3.057 3.421 3-690 28 0.683 0.855 1.056 1.313 1.701 2 048 2.154 2467 2.763 3.047 3.408 3.674 29 0.683 0.854 1.055 1.311 1.699 2045 2.150 2.462 2.756 3.038 3.396 3.659 30 (.683 0.854 1.055 1.310 1.697 2.042 2.147 2.457 2.750 3.0.30 3.385 3.646 31 0.682 0.853 1.054 1.309 1.696 2.040 2.144 2.453 2.744 3.022 3.375 3.633 32 0.682 0.853 1.054 1.309 1.694 2 037 2.141 2.449 2.738 3,015 3.365 3.622 33 0.682 0.853 1.053 1.308 1.692 2.035 2.1.38 2.445 2.733 3.008 3.356 3.611 34 0.682 0.852 1.052 1.307 1.691 2 032 2.136 2.441 2.728 3.002 3.348 3.601 35 0.682 0.852 1.052 1.306 1.690 2 030 2.133 2.438 2.724 2.996 3.340 3.591 36 0.681 0.852 1.052 1.306 1.688 2028 2.131 2 434 2.719 2.990 0.681 0.851 1.051 1.305 1.687 2.026 2.129 2.431 2.715 2.985 3.326 3.574 38 0.681 0.851 1.051 1.304 1.686 2 0124 2.127 2.429 2.712 2.980 3.319 3.566 39 0.681 0.851 1.0:50 1.304 1.685 2 023 2.125 2.426 2.708 2.976 3.313 3.558 40 0.681 0.851 1.051 1.3027 1.684 2.021 2.123 2.423 2.704 2.971 3.307 3.551 50 0.679 0.849 1.047 1.20 1.676 2.009 2.109 2.403 2.678 2.937 3.261 3.496 60 0.679 0.848 1.045 1.296 1,671 2.000 2.099 2.390 2.660 2.915 3.232 3.460 70 0-678 0.847 1.044 1.294 1.667 1.994 2.093 2.381 2.648 2.899 3.211 3.435 0.678 0.846 1.043 1.292 1.664 1.990 2.088 2.374 2.639 2.887 3.195 3.416 90 0.677 0.846 1.047 1.291 1.662 1.987 2.084 2.368 2.632 2.878 3.183 3.402 100 0.677 0.845 1.042 1.290 1,660 1.984 2.081 2.364 2.626 2.871 3.174 3.390 0.675 0.842 1.037 1.282 1.646 1.962 2.056 2.330 2.581 2.813 3.098 3.300 0.674 0.842 1.036 1.282 1.645 1.960 2.054 2.326 2.576 2.807 3.090 3.291 1.25 0.20 0.15 0.10 0.05 0.025 0.02 0.01 0.005 0.0025 0.001 0.0005In a random sample of 100 audited estate tax returns, it was determined that the mean amount of additional tax owed was $3499 with a standard deviation of $2526. Construct and interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. Click the icon to view the t-distribution table. The lower bound is $ . (Round to the nearest dollar as needed.) The upper bound is $ . (Round to the nearest dollar as needed.) Interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. Choose the correct answer below. O A. One can be 90% confident that the mean additional tax owed is between the lower and upper bounds. O B. One can be 90% confident that the mean additional tax owed is less than the lower bound. O C. One can be 90% confident that the mean additional tax owed is greater than the upper bound