Question

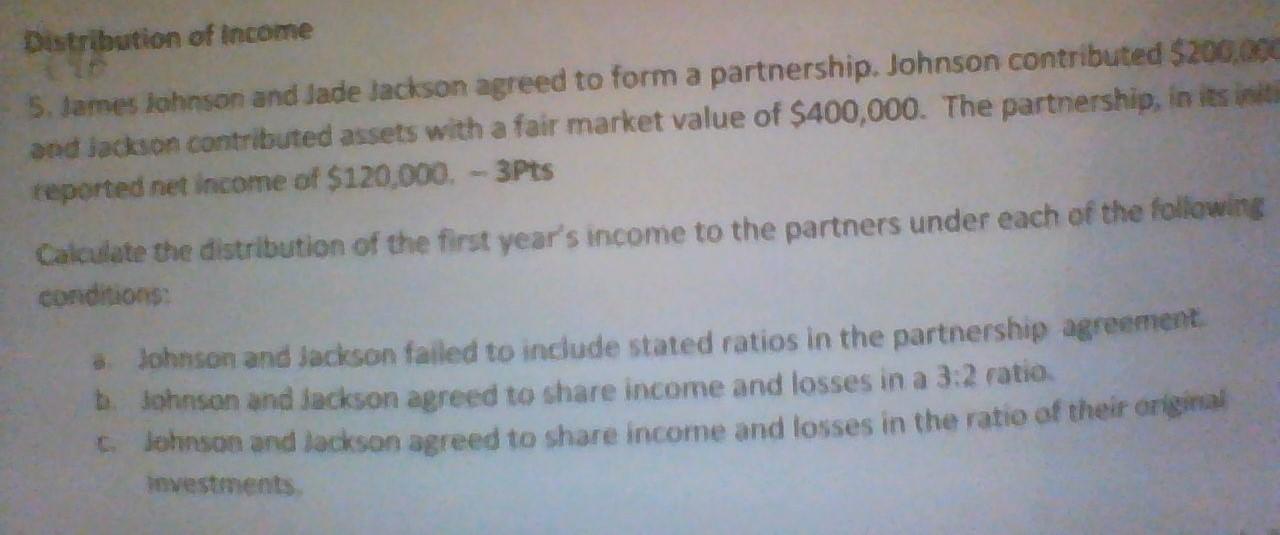

Distribution of Income 5. James Johnson and Jade Jackson agreed to form a partnership. Johnson contributed $200,000 and Jackson contributed assets with a fair

Distribution of Income 5. James Johnson and Jade Jackson agreed to form a partnership. Johnson contributed $200,000 and Jackson contributed assets with a fair market value of $400,000. The partnership, in its initi reported net income of $120,000.-3Pts Calculate the distribution of the first year's income to the partners under each of the following conditions: Johnson and Jackson failed to include stated ratios in the partnership agreement b Johnson and Jackson agreed to share income and losses in a 3:2 ratio. Clohnson and lackson agreed to share income and losses in the ratio of their original investments

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

39th Edition

978-1305399884

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App