Question

Ditto Manufacturing Company uses a job-order costing system and applies overhead to production jobs with a predetermined rate based on direct labor dollars. Ditto provides

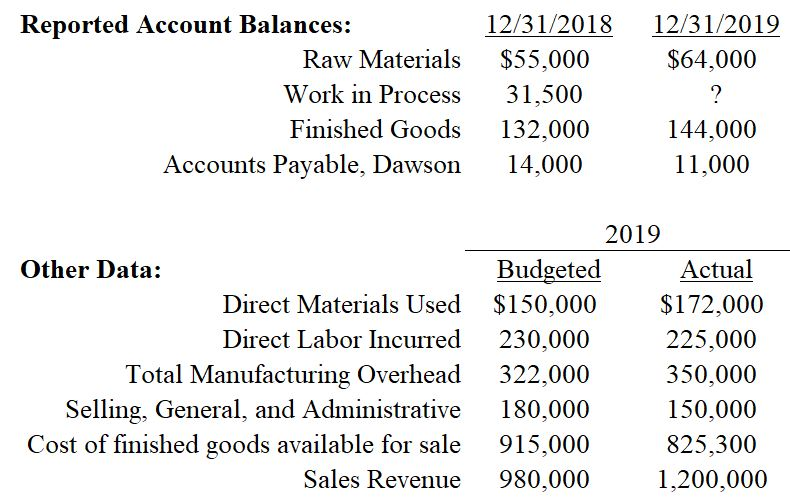

Ditto Manufacturing Company uses a job-order costing system and applies overhead to production jobs with a predetermined rate based on direct labor dollars. Ditto provides the below information about the 2019 factory operations and explains that the company purchases 100% of its raw materials on account from vendor, Dawson Company and disposes of over/under applied overhead using the method we discussed in class.

Consider Ditto's Work-in-Process inventory balance reported at 12/31/2019. Assume further that at 12/31/2019 the company had a single job in process, job #202 that was started in 2019 and completed in early 2020. Per the job cost record, job #202 had $7,000 of direct materials requistioned and charged to it during 2019. How much direct labor was charged to job #202 in 2019?

| A. | $18,000 | |

| B. | $9,800 | |

| C. | $5,000 | |

| D. | $21,000 | |

| E. | $25,200 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started