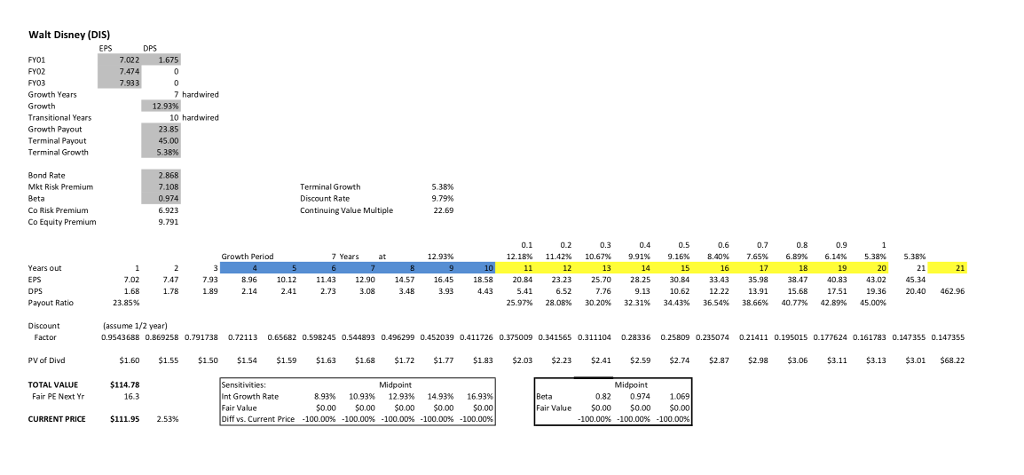

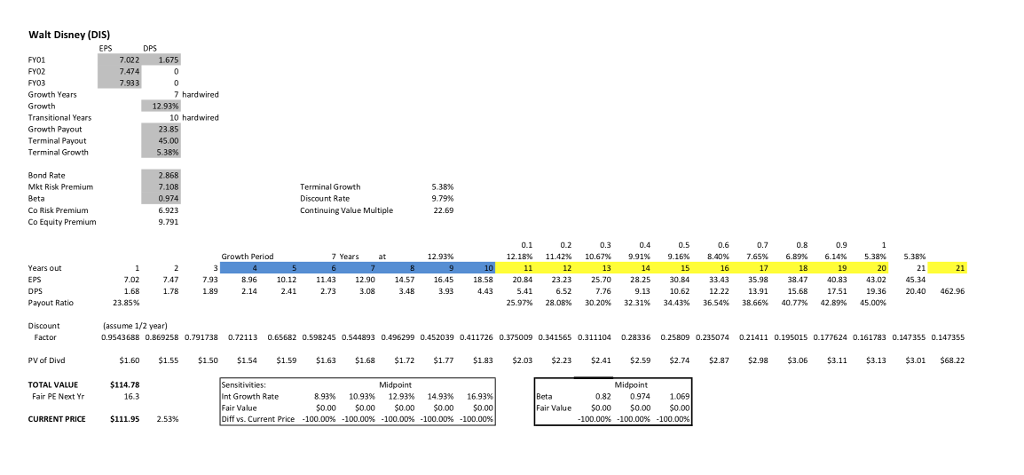

Dividend Discount Model Create an updated version of the Walt Disney Spreadsheet attached. Match the spreadsheet format as closely as possible

Walt Disney (DIS) EPS 022 7.474 7.933 Growth Years Transitional Years Growth Payout Terminal Payout Terminal Growth 10 hardwired Bond Rate Mkt Risk Premium Terminal Growth Discount Rate Continuing Value Multiple 5.38% 9.79% Co Risk Premium Co Equity Premium 9.791 0.1 12.18% 0.6 8.40% 0.7 7.65% Growth Period 7 Years at 12.93% 11.42% 10.67% 9.91% 9.16% 6.89% 6.14% 5.38% S.38% Years ou EPS 7.47 1.78 7.93 189 8.96 10.12 11.43 12.90 14.57 16.45 18.58 20.84 23.23 25.70 28.25 30.84 33.43 35.98 38.47 40.83 43.02 5.34 2.14 1.68 23.85% 2.41 2.73 3.08 .76 3020% 9.13 10.62 12.22 13.91 15.68 17.51 19.36 20.40 462.96 Payout Ratio 25.97% 28.08% 32 31% 3443% 3654% 3866% 40.77% 42.89% 4500% (assume 1/2 year) 0.9543688 0.869258 0.791738 0.72113 0.6S682 0.598245 0.544893 0.496299 0.452039 0.411726 0.375009 0.341565 0.311104 .28336 0.25809 0.235074 0.21411 0.195015 0.177624 0.161783 0.147355 0.147355 PV of Divd $1.60 $1.55 $150 $1.54 $1.59 $163 1.68 $1.72 $1.77 183 $2.03 2.23 2.41 $2.59 $2.74 $2.7 $2.98 3.06 3.11 $3.13 $3.01 $68.22 TOTAL VALUE $114.78 Fair PE Next Yr Int Growth Rate Fair Value Diff vs. Current Price 893% 1093% 12.93% 14.93% 16 93% 5000 $0.00 $0.00 $0.00 $0.00 -100.00% Beta 0.82 0974 1069 Fair Value $0.00 0.00 $0.00 100.00%-100.00%-100.00% CURRENT PRICE $111.95 2.53% -100.00% -100.00% -100.00% -100.00% Walt Disney (DIS) EPS 022 7.474 7.933 Growth Years Transitional Years Growth Payout Terminal Payout Terminal Growth 10 hardwired Bond Rate Mkt Risk Premium Terminal Growth Discount Rate Continuing Value Multiple 5.38% 9.79% Co Risk Premium Co Equity Premium 9.791 0.1 12.18% 0.6 8.40% 0.7 7.65% Growth Period 7 Years at 12.93% 11.42% 10.67% 9.91% 9.16% 6.89% 6.14% 5.38% S.38% Years ou EPS 7.47 1.78 7.93 189 8.96 10.12 11.43 12.90 14.57 16.45 18.58 20.84 23.23 25.70 28.25 30.84 33.43 35.98 38.47 40.83 43.02 5.34 2.14 1.68 23.85% 2.41 2.73 3.08 .76 3020% 9.13 10.62 12.22 13.91 15.68 17.51 19.36 20.40 462.96 Payout Ratio 25.97% 28.08% 32 31% 3443% 3654% 3866% 40.77% 42.89% 4500% (assume 1/2 year) 0.9543688 0.869258 0.791738 0.72113 0.6S682 0.598245 0.544893 0.496299 0.452039 0.411726 0.375009 0.341565 0.311104 .28336 0.25809 0.235074 0.21411 0.195015 0.177624 0.161783 0.147355 0.147355 PV of Divd $1.60 $1.55 $150 $1.54 $1.59 $163 1.68 $1.72 $1.77 183 $2.03 2.23 2.41 $2.59 $2.74 $2.7 $2.98 3.06 3.11 $3.13 $3.01 $68.22 TOTAL VALUE $114.78 Fair PE Next Yr Int Growth Rate Fair Value Diff vs. Current Price 893% 1093% 12.93% 14.93% 16 93% 5000 $0.00 $0.00 $0.00 $0.00 -100.00% Beta 0.82 0974 1069 Fair Value $0.00 0.00 $0.00 100.00%-100.00%-100.00% CURRENT PRICE $111.95 2.53% -100.00% -100.00% -100.00% -100.00%