Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dividend Treatment for Cash Distributions Exercises DEF corporation distributes $50,000 in cash on 7/1/2023 to Shirly, an individual shareholder. For 2023, DEF has $10,000 in

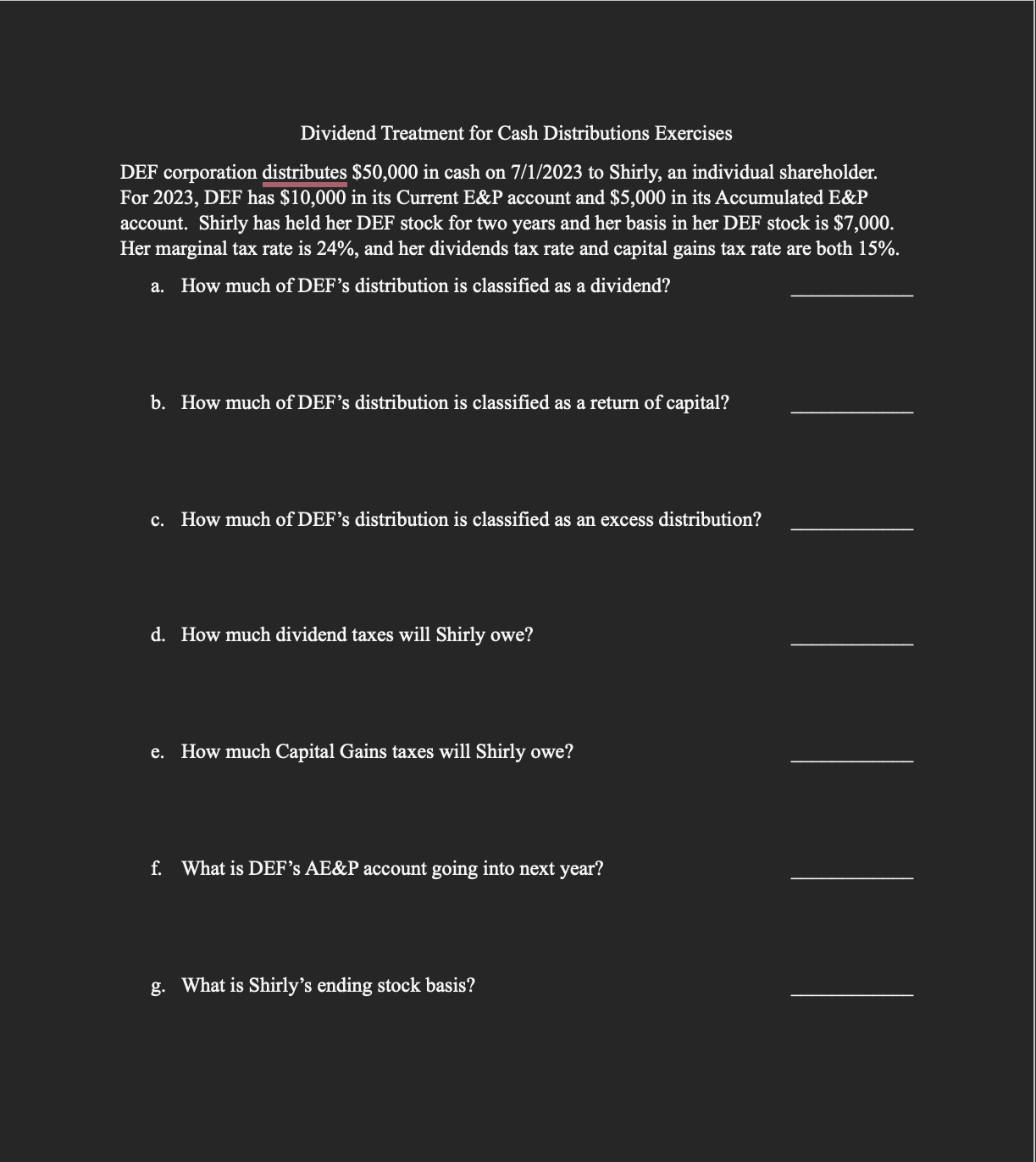

Dividend Treatment for Cash Distributions Exercises DEF corporation distributes $50,000 in cash on 7/1/2023 to Shirly, an individual shareholder. For 2023, DEF has $10,000 in its Current E\&P account and \$5,000 in its Accumulated E\&P account. Shirly has held her DEF stock for two years and her basis in her DEF stock is $7,000. Her marginal tax rate is 24%, and her dividends tax rate and capital gains tax rate are both 15%. a. How much of DEF's distribution is classified as a dividend? b. How much of DEF's distribution is classified as a return of capital? c. How much of DEF's distribution is classified as an excess distribution? d. How much dividend taxes will Shirly owe? e. How much Capital Gains taxes will Shirly owe? f. What is DEF's AE\&P account going into next year? g. What is Shirly's ending stock basis

Dividend Treatment for Cash Distributions Exercises DEF corporation distributes $50,000 in cash on 7/1/2023 to Shirly, an individual shareholder. For 2023, DEF has $10,000 in its Current E\&P account and \$5,000 in its Accumulated E\&P account. Shirly has held her DEF stock for two years and her basis in her DEF stock is $7,000. Her marginal tax rate is 24%, and her dividends tax rate and capital gains tax rate are both 15%. a. How much of DEF's distribution is classified as a dividend? b. How much of DEF's distribution is classified as a return of capital? c. How much of DEF's distribution is classified as an excess distribution? d. How much dividend taxes will Shirly owe? e. How much Capital Gains taxes will Shirly owe? f. What is DEF's AE\&P account going into next year? g. What is Shirly's ending stock basis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started