Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dividend Yield on Common Stock = Price - Earnings = Dividend Payout = Cash Flow per Share = Inventory Turnover = Fixed Assets Turnover =

Dividend Yield on Common Stock =

Price - Earnings =

Dividend Payout =

Cash Flow per Share =

Inventory Turnover =

Fixed Assets Turnover =

Total Assets Turnover =

Accounts Receivable Turnover =

Average Collecting Period =

Current Ratio =

Quick Ratio =

Inventory to Net Working Capital =

Return on Total Assets = Net Income/Total Assets

Return on Stockholders Equity =

Return on Common Equity =

Operating Profit Margin =

Net Profit Margin =

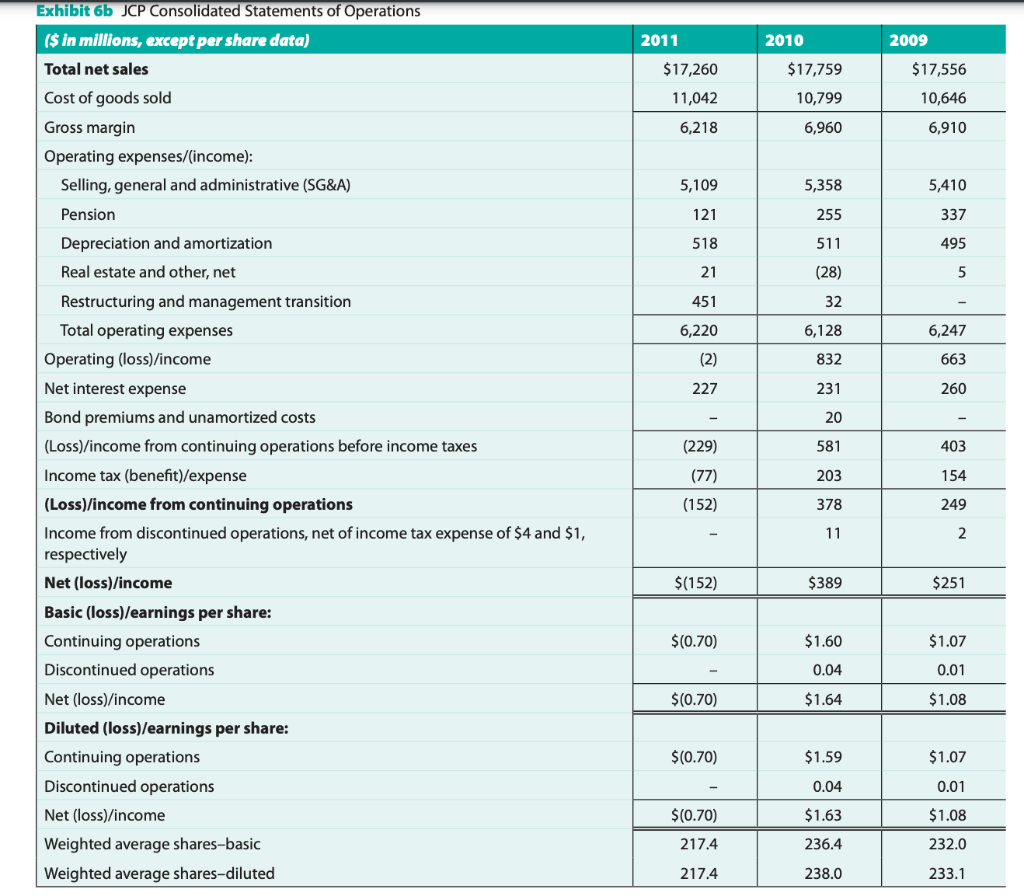

2011 2010 2009 $17,260 $17,759 $17,556 11,042 10,799 10,646 6,218 6,960 6,910 5,109 5,358 5,410 121 255 337 518 511 495 21 (28) 5 451 32 6,220 6,128 6,247 (2) 832 663 227 231 260 20 Exhibit 6b JCP Consolidated Statements of Operations ($ in millions, except per share data) Total net sales Cost of goods sold Gross margin Operating expenses/(income): Selling, general and administrative (SG&A) Pension Depreciation and amortization Real estate and other, net Restructuring and management transition Total operating expenses Operating (loss)/income Net interest expense Bond premiums and unamortized costs (Loss)/income from continuing operations before income taxes Income tax (benefit)/expense (Loss)/income from continuing operations Income from discontinued operations, net of income tax expense of $4 and $1, respectively Net (loss)/income Basic (loss)/earnings per share: Continuing operations Discontinued operations Net (loss)/income Diluted (loss)/earnings per share: Continuing operations Discontinued operations Net (loss)/income Weighted average shares-basic Weighted average shares-diluted (229) 581 403 203 154 (77) (152) 378 249 11 2 $(152) $389 $251 $(0.70) $1.60 $1.07 0.04 0.01 $(0.70) $1.64 $1.08 $(0.70) $1.59 $1.07 0.04 0.01 $(0.70) $1.63 $1.08 217.4 236.4 232.0 217.4 238.0 233.1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started