Answered step by step

Verified Expert Solution

Question

1 Approved Answer

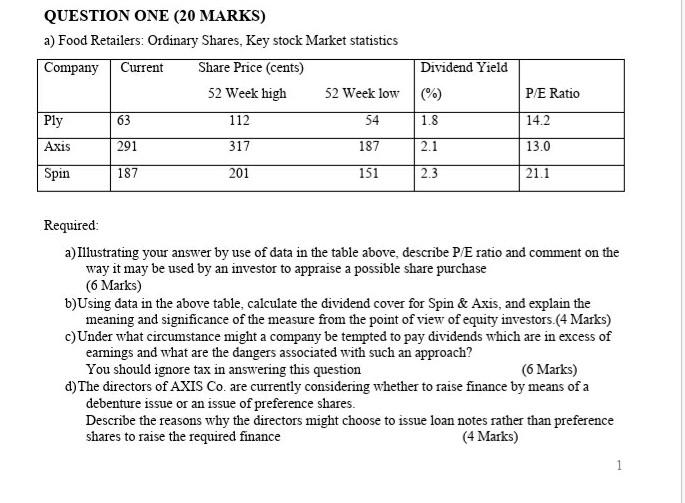

Dividend Yield QUESTION ONE (20 MARKS) a) Food Retailers: Ordinary Shares, Key stock Market statistics Company Current Share Price (cents) 52 Week high 52 Week

Dividend Yield QUESTION ONE (20 MARKS) a) Food Retailers: Ordinary Shares, Key stock Market statistics Company Current Share Price (cents) 52 Week high 52 Week low Ply 63 112 54 291 317 187 PE Ratio 1.8 14.2 Axis 2.1 13.0 Spin 187 201 151 2.3 21.1 Required: a) Illustrating your answer by use of data in the table above, describe PE ratio and comment on the way it may be used by an investor to appraise a possible share purchase (6 Marks) b)Using data in the above table, calculate the dividend cover for Spin & Axis, and explain the meaning and significance of the measure from the point of view of equity investors.(4 Marks) c) Under what circumstance might a company be tempted to pay dividends which are in excess of earnings and what are the dangers associated with such an approach? You should ignore tax in answering this question (6 Marks) d) The directors of AXIS Co. are currently considering whether to raise finance by means of a debenture issue or an issue of preference shares. Describe the reasons why the directors might choose to issue loan notes rather than preference shares to raise the required finance (4 Marks) 1 Dividend Yield QUESTION ONE (20 MARKS) a) Food Retailers: Ordinary Shares, Key stock Market statistics Company Current Share Price (cents) 52 Week high 52 Week low Ply 63 112 54 291 317 187 PE Ratio 1.8 14.2 Axis 2.1 13.0 Spin 187 201 151 2.3 21.1 Required: a) Illustrating your answer by use of data in the table above, describe PE ratio and comment on the way it may be used by an investor to appraise a possible share purchase (6 Marks) b)Using data in the above table, calculate the dividend cover for Spin & Axis, and explain the meaning and significance of the measure from the point of view of equity investors.(4 Marks) c) Under what circumstance might a company be tempted to pay dividends which are in excess of earnings and what are the dangers associated with such an approach? You should ignore tax in answering this question (6 Marks) d) The directors of AXIS Co. are currently considering whether to raise finance by means of a debenture issue or an issue of preference shares. Describe the reasons why the directors might choose to issue loan notes rather than preference shares to raise the required finance (4 Marks) 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started