Answered step by step

Verified Expert Solution

Question

1 Approved Answer

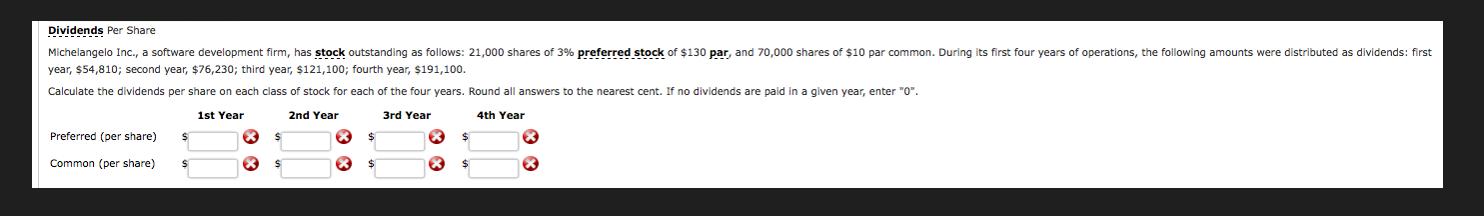

Dividends Per Share Michelangelo Inc., a software development firm, has stock outstanding as follows: 21,000 shares of 3% preferred stock of $130 par, and

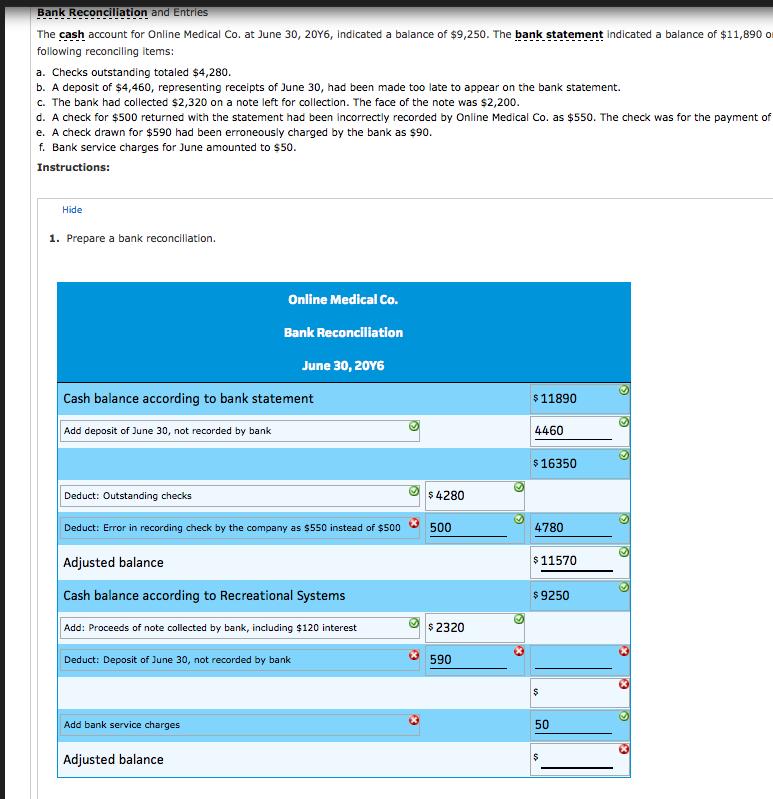

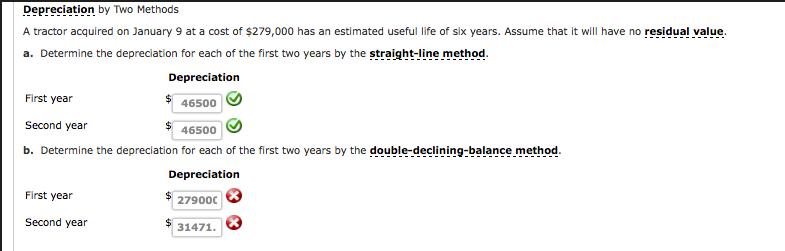

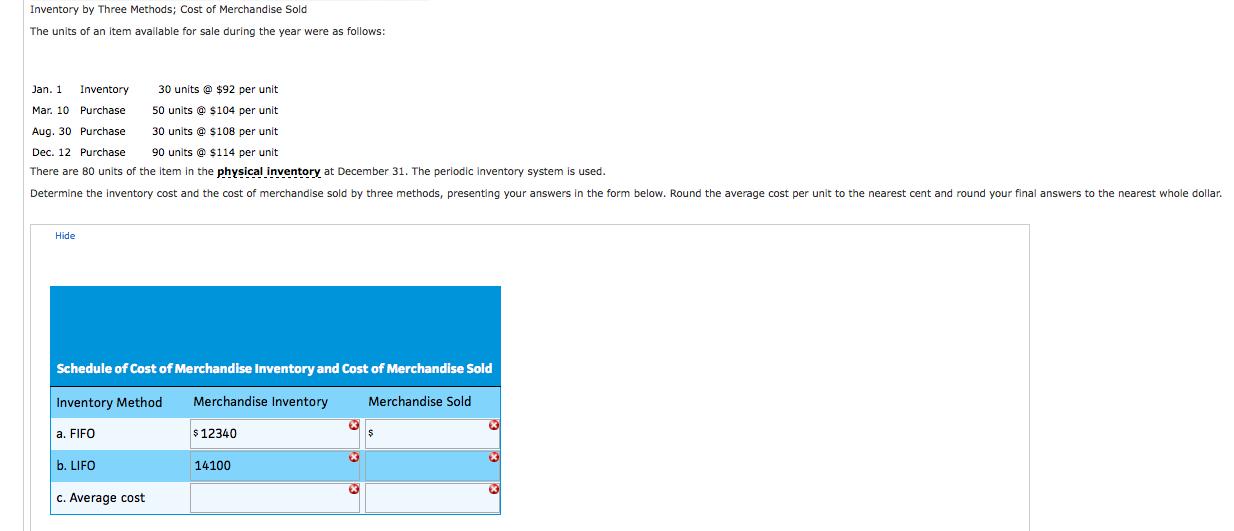

Dividends Per Share Michelangelo Inc., a software development firm, has stock outstanding as follows: 21,000 shares of 3% preferred stock of $130 par, and 70,000 shares of $10 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $54,810; second year, $76,230; third year, $121,100; fourth year, $191,100. Calculate the dividends per share on each class of stock for each of the four years. Round all answers to the nearest cent. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred (per share) Common (per share) X S X $ Bank Reconciliation and Entries The cash account for Online Medical Co. at June 30, 20Y6, indicated a balance of $9,250. The bank statement indicated a balance of $11,890 or following reconciling items: a. Checks outstanding totaled $4,280. b. A deposit of $4,460, representing receipts of June 30, had been made too late to appear on the bank statement. c. The bank had collected $2,320 on a note left for collection. The face of the note was $2,200. d. A check for $500 returned with the statement had been incorrectly recorded by Online Medical Co. as $550. The check was for the payment of e. A check drawn for $590 had been erroneously charged by the bank as $90. f. Bank service charges for June amounted to $50. Instructions: Hide 1. Prepare a bank reconciliation. Add deposit of June 30, not recorded by bank Online Medical Co. Bank Reconciliation Cash balance according to bank statement June 30, 2016 Deduct: Outstanding checks Deduct: Error in recording check by the company as $550 instead of $500 Add bank service charges Adjusted balance Adjusted balance Cash balance according to Recreational Systems Add: Proceeds of note collected by bank, including $120 interest Deduct: Deposit of June 30, not recorded by bank $ 4280 500 $ 2320 590 $11890 4460 $ 16350 4780 $ 11570 $9250 $ 50 $ S 16 x > 3 Depreciation by Two Methods A tractor acquired on January 9 at a cost of $279,000 has an estimated useful life of six years. Assume that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. Depreciation 46500 First year Second year 46500 b. Determine the depreciation for each of the first two years by the double-declining-balance method. Depreciation First year Second year 279000 31471. Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: Jan. 1 Mar. 10 Inventory Purchase Purchase. Aug. 30 Dec. 12 Purchase 90 units @ $114 per unit. There are 80 units of the item in the physical inventory at December 31. The periodic Inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods, presenting your answers in the form below. Round the average cost per unit to the nearest cent and round your final answers to the nearest whole dollar. Hide 30 units@ $92 per unit. 50 units @ $104 per unit 30 units @ $108 per unit Schedule of Cost of Merchandise Inventory and Cost of Merchandise Sold Inventory Method Merchandise Inventory a. FIFO b. LIFO c. Average cost $12340 14100 * Merchandise Sold $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

cumulative Preferred dividend per year 30000203 18000 Year 1 Year 2 Year 3 Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started