Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dividends Policy (CLO #3). In 2023, Blue Sky Company is to distribute $150,000 as cash dividends, its outstanding common Share has a par value

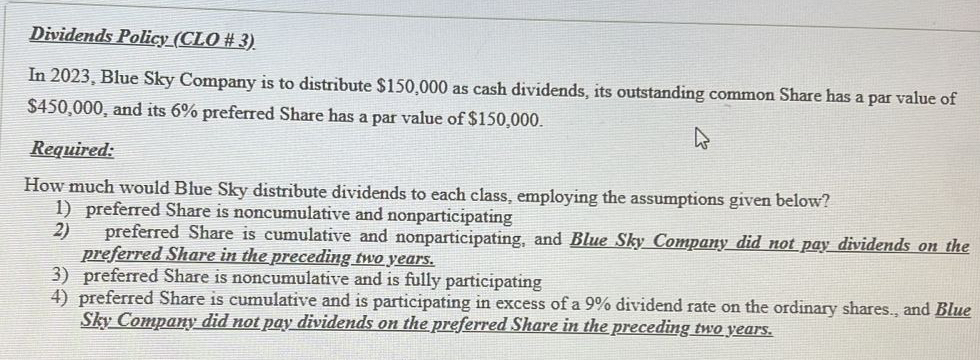

Dividends Policy (CLO #3). In 2023, Blue Sky Company is to distribute $150,000 as cash dividends, its outstanding common Share has a par value of $450,000, and its 6% preferred Share has a par value of $150,000. Required: How much would Blue Sky distribute dividends to each class, employing the assumptions given below? 1) preferred Share is noncumulative and nonparticipating 2) preferred Share is cumulative and nonparticipating, and Blue Sky Company did not pay dividends on the preferred Share in the preceding two years. 3) preferred Share is noncumulative and is fully participating 4) preferred Share is cumulative and is participating in excess of a 9% dividend rate on the ordinary shares., and Blue Sky Company did not pay dividends on the preferred Share in the preceding two years.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the dividends distribution to each class under the given assumptions we need to consider the preferences and characteristics of each clas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6641d0a402197_988480.pdf

180 KBs PDF File

6641d0a402197_988480.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started