Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dividing Partnership Net Income Steve Jack and Chelsy Boxer formed a partnership, dividing income as follows: 1. Annual salary allowance to Boxer of $191,400.

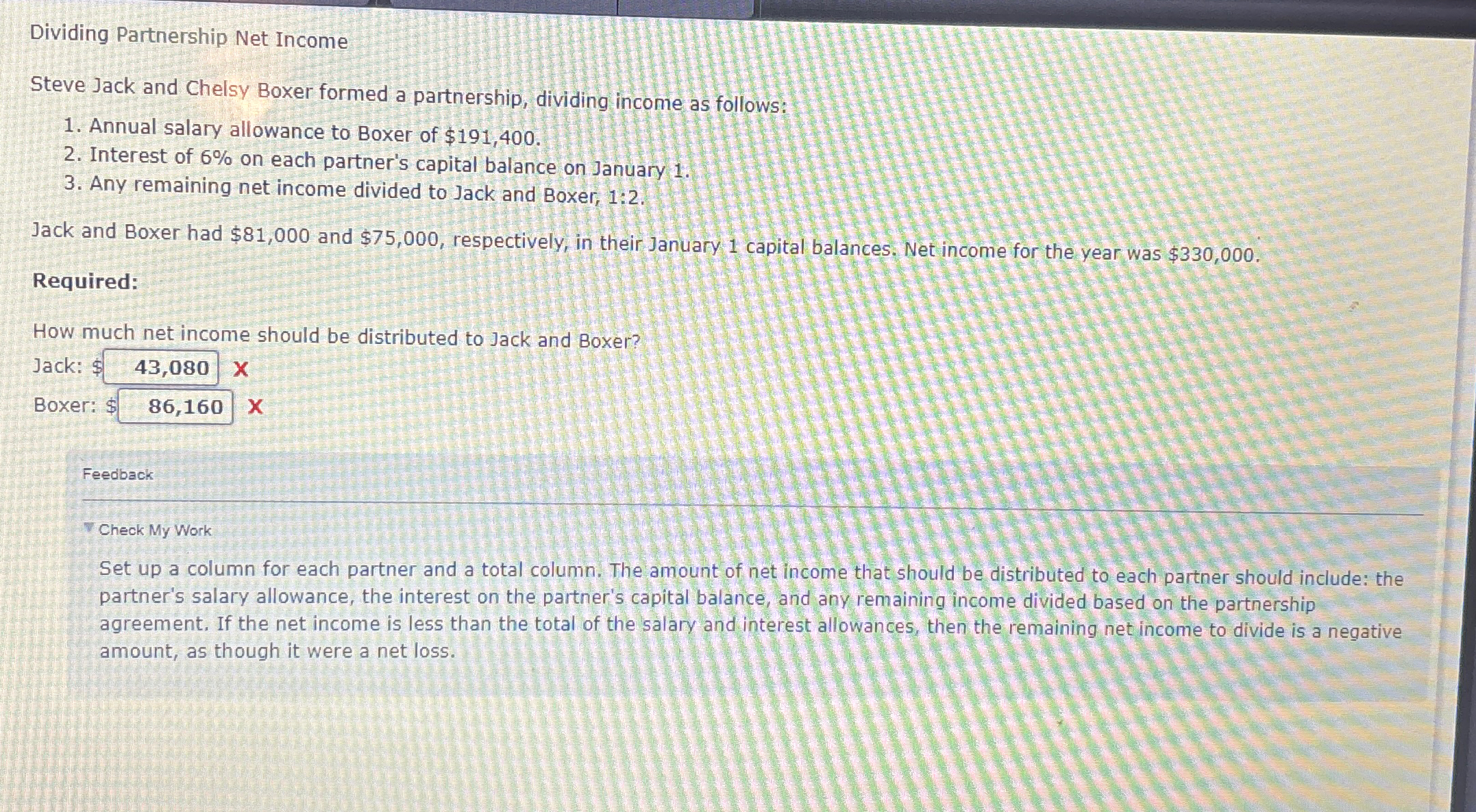

Dividing Partnership Net Income Steve Jack and Chelsy Boxer formed a partnership, dividing income as follows: 1. Annual salary allowance to Boxer of $191,400. 2. Interest of 6% on each partner's capital balance on January 1. 3. Any remaining net income divided to Jack and Boxer, 1:2. Jack and Boxer had $81,000 and $75,000, respectively, in their January 1 capital balances. Net income for the year was $330,000. Required: How much net income should be distributed to Jack and Boxer? Jack: $ 43,080 X Boxer: $ 86,160 X Feedback Check My Work Set up a column for each partner and a total column. The amount of net income that should be distributed to each partner should include: the partner's salary allowance, the interest on the partner's capital balance, and any remaining income divided based on the partnership agreement. If the net income is less than the total of the salary and interest allowances, then the remaining net income to divide is a negative amount, as though it were a net loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the net income that should be distributed to Jack and Boxer we can follow these ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started