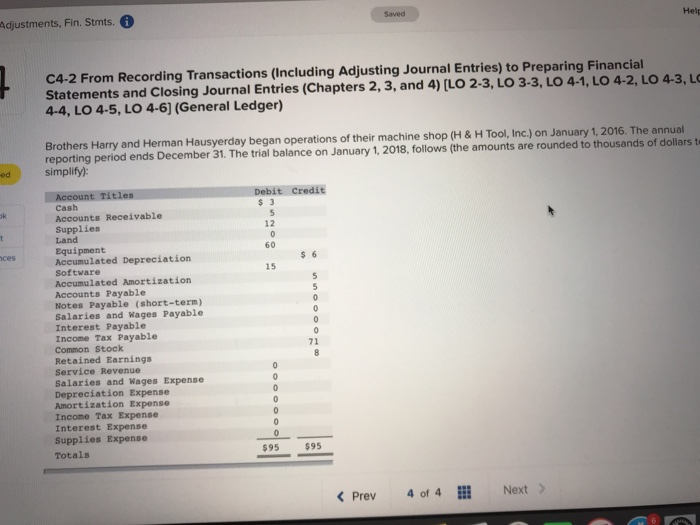

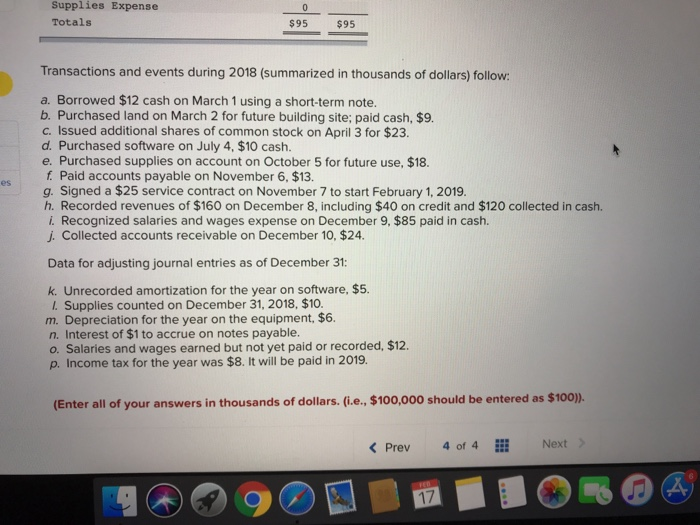

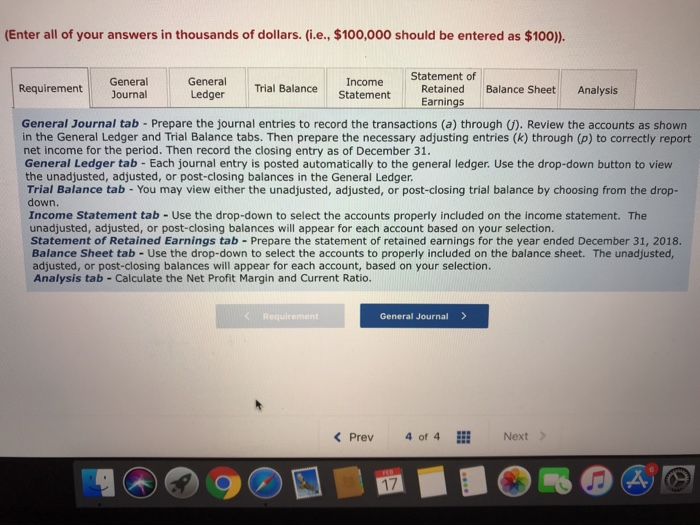

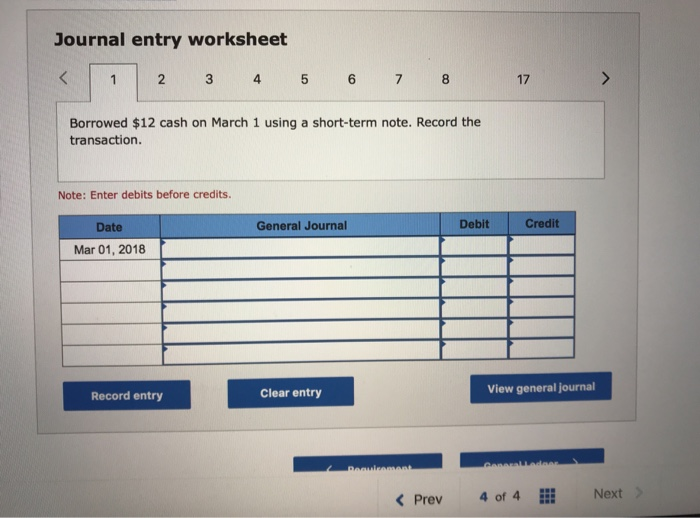

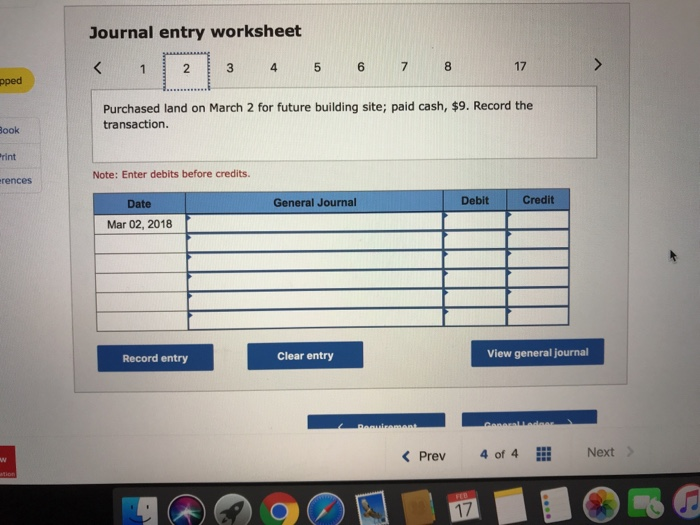

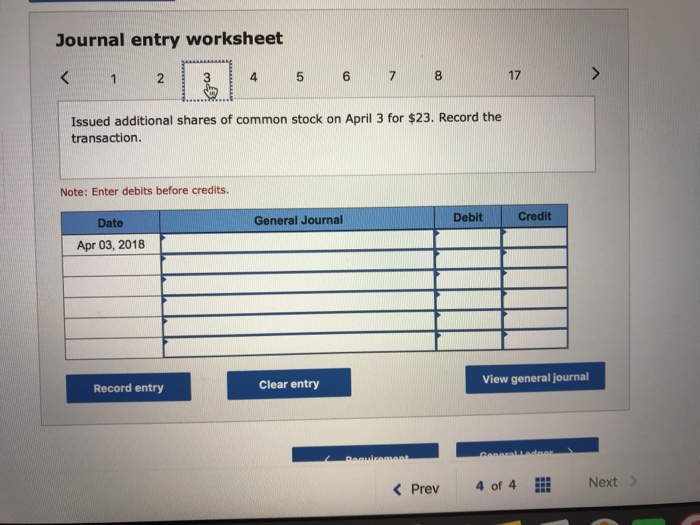

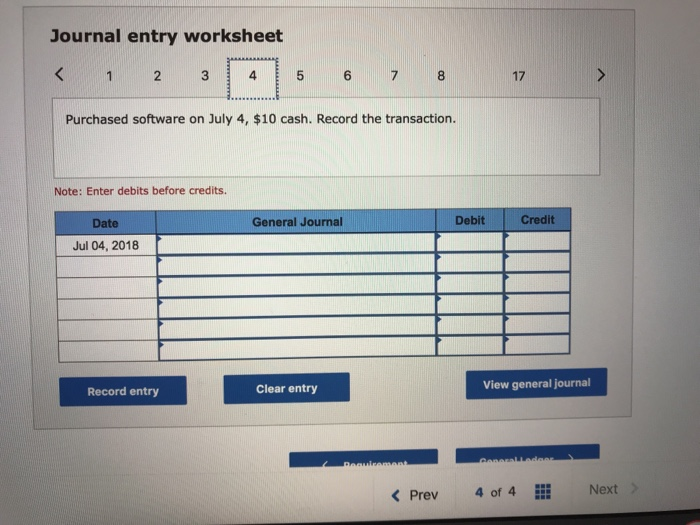

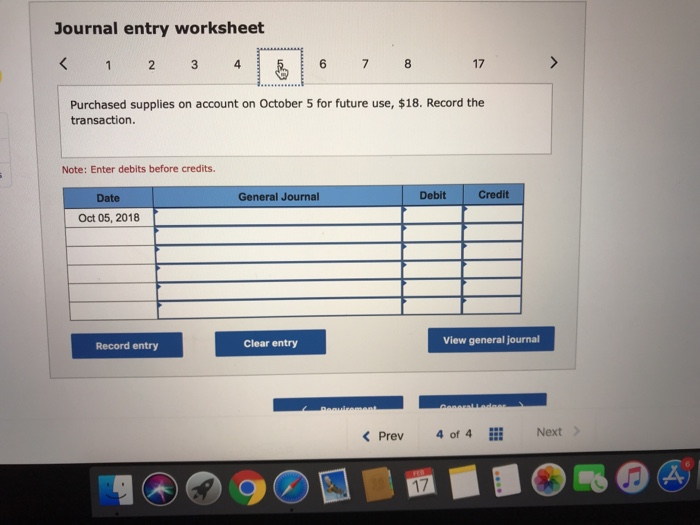

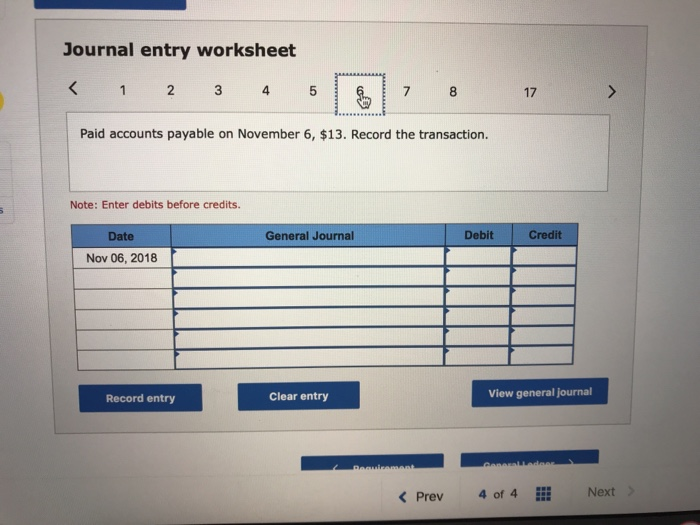

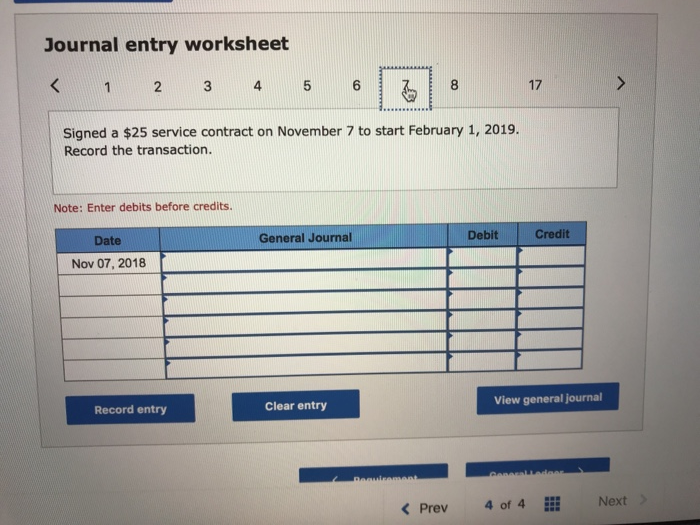

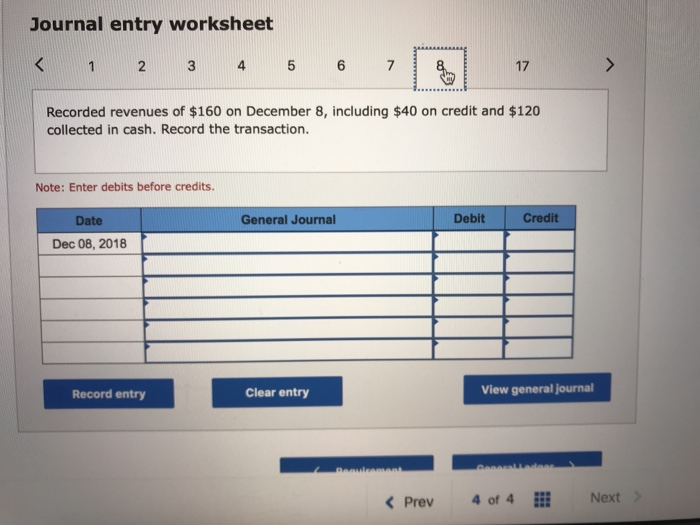

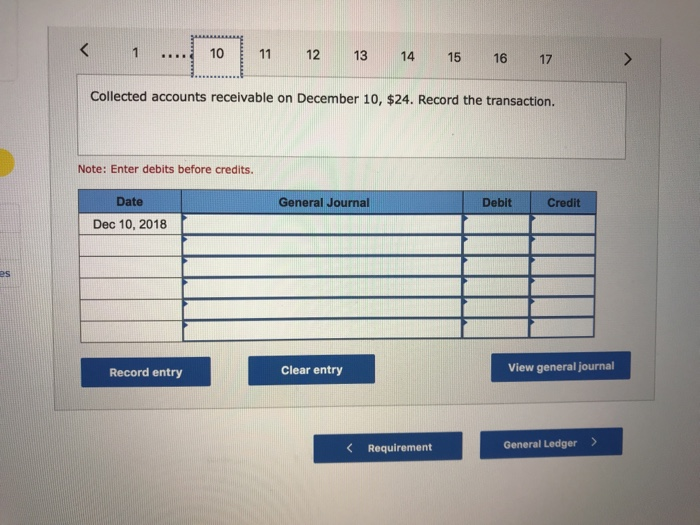

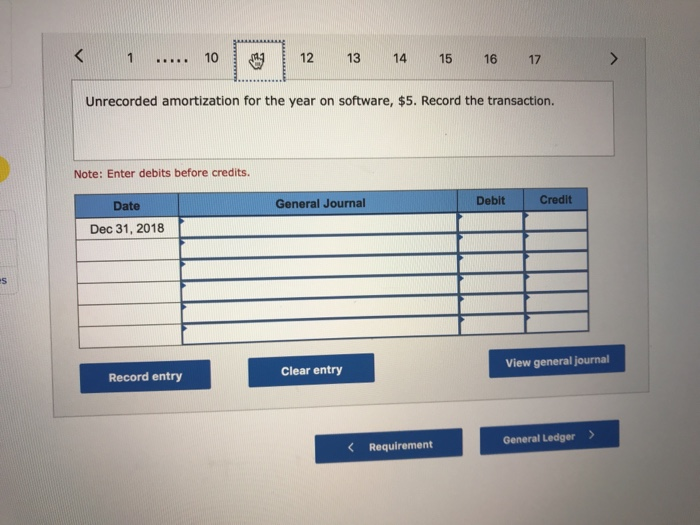

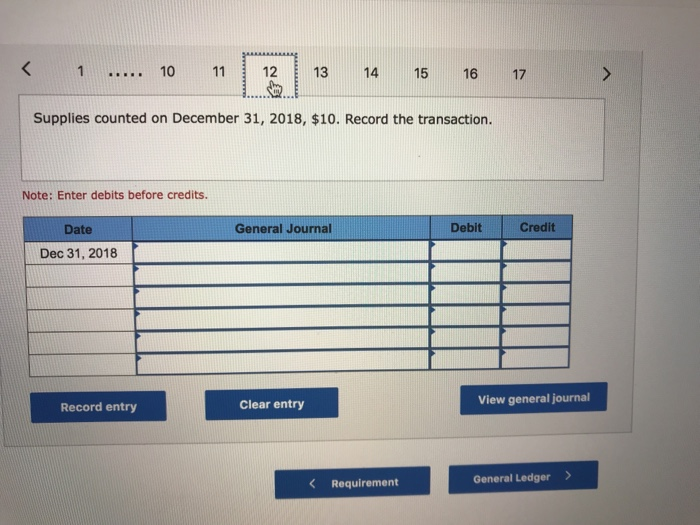

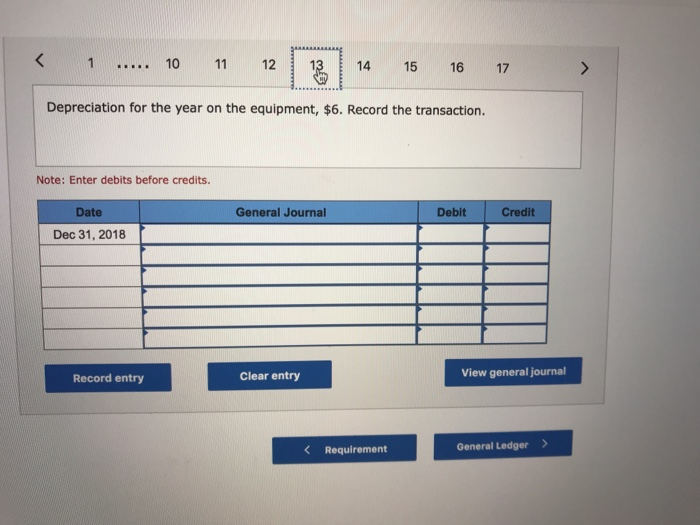

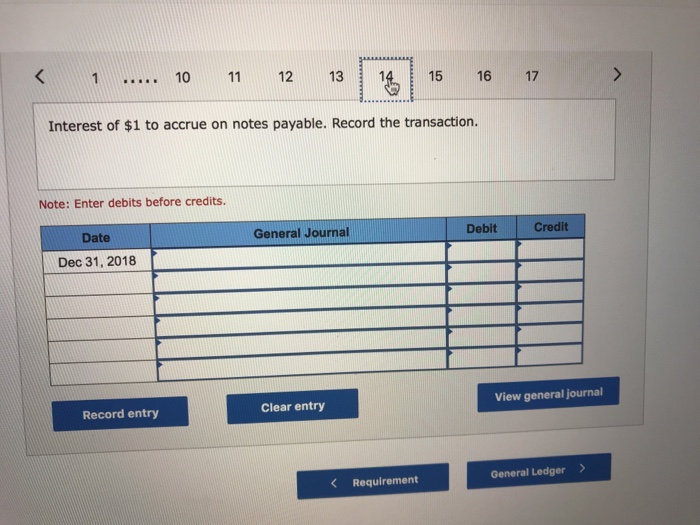

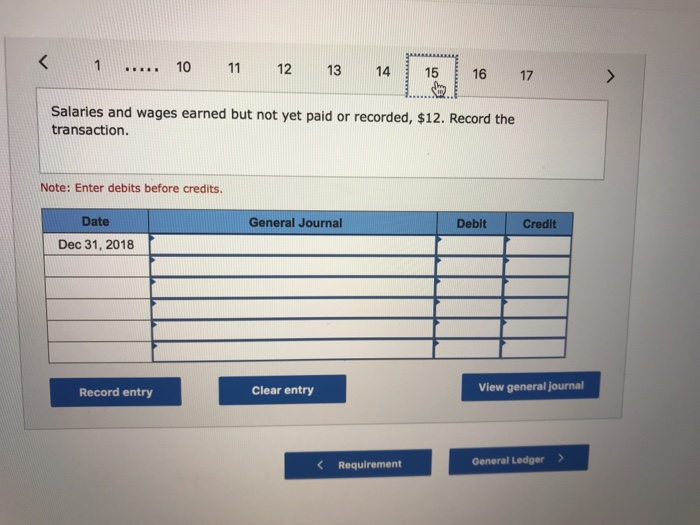

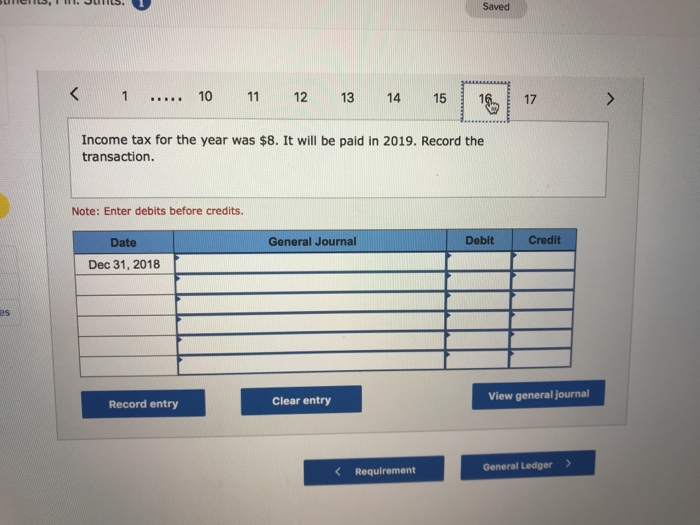

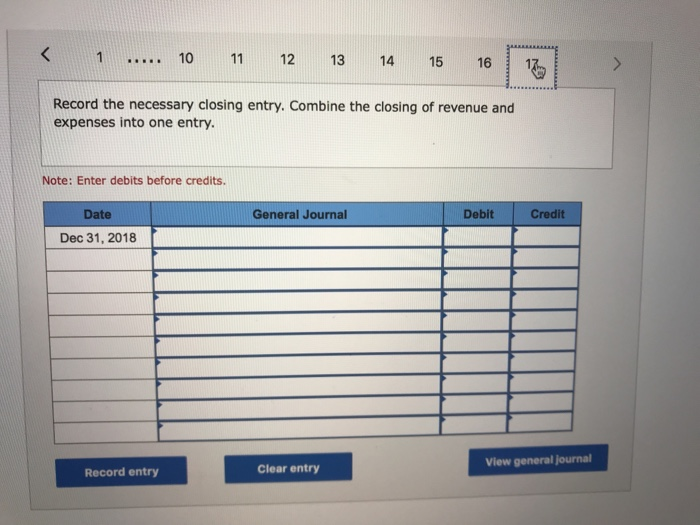

djustments, Fin. Stmts.6 Hel C4-2 From Recording Transactions (Including Adjusting Journal Entries) to Preparing Financial Statements and Closing Journal Entries (Chapters 2, 3, and 4) [LO 2-3, LO 3-3, LO 4-1, LO 4-2, LO 4-3, L 4-4, LO 4-5, LO 4-6) (General Ledger) Brothers Harry and Herman Hausyerday began operations of their machine shop (H &H Tool,Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1,2018, follows (the amounts are rounded to thousands of dollars t ed simplify) nt Titles Debit Credit Cash Accounts Receivable Supplies Land Equipment Accumulated Depreciation Software Accumulated Amortization Accounts Payable Notes Payable (short-term) Salaries and Wages Payable Interest Payable Income Tax Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Depreciation Expense Amortization Expense Incone Tax Expense Interest Expense Supplies Expense Totals $ 3 12 60 15 $ 6 71 $95 $95 17 Journal entry worksheet 17 Borrowed $12 cash on March 1 using a short-term note. Record the transaction. Note: Enter debits before credits Date General Journal Dotit Credit Mar 01, 2018 Clear entry View general journal Record entry KPrev4 of 4 Next Journal entry worksheet 17 pped Purchased land on March 2 for future building site; paid cash, $9. Record the transaction ook rint Note: Enter debits before credits. rences Date General Journal Debit Credit Mar 02, 2018 Record entry Clear entry View general journal KPrev 4 of 4 Next 17 Journal entry worksheet 2 4 5 6 7 17 Issued additional shares of common stock on April 3 for $23. Record the transaction Note: Enter debits before credits. General Journal Debit Credit Date Apr 03, 2018 View general journal Record entry Clear entry 10 12 13 14 15 16 17 Unrecorded amortization for the year on software, $5. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 View general journal Clear entry Record entry General Ledger> Requirement Supplies counted on December 31, 2018, $10. Record the transaction. Note: Enter debits before credits. Date General Journal Credit Dec 31, 2018 Clear entry View general journal Record entry Requirement General Ledger K1 10 11 12 1 10 121 14 15 16 17 1 Depreciation for the year on the equipment, $6. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 Record entry Clear entry View general journal K.10 1 12 131415 16 17 Interest of $1 to accrue on notes payable. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 Record entry Clear entry View general journal Requirement General Ledger> K1.... 10 11 12 13 14 15 16 17 Salaries and wages earned but not yet paid or recorded, $12. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 Record entry Clear entry View general journal Saved 1 .. 10 11 12 1314 15 1 17 Income tax for the year was $8. It will be paid in 2019. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 es Clear entry View general journal Record entry General Ledger>