Question

DLID Co., Ltd, a Hong Kong listed Property Company, has announced a rights offer to raise 1,000,000 new shares issued at a $10.05 subscription

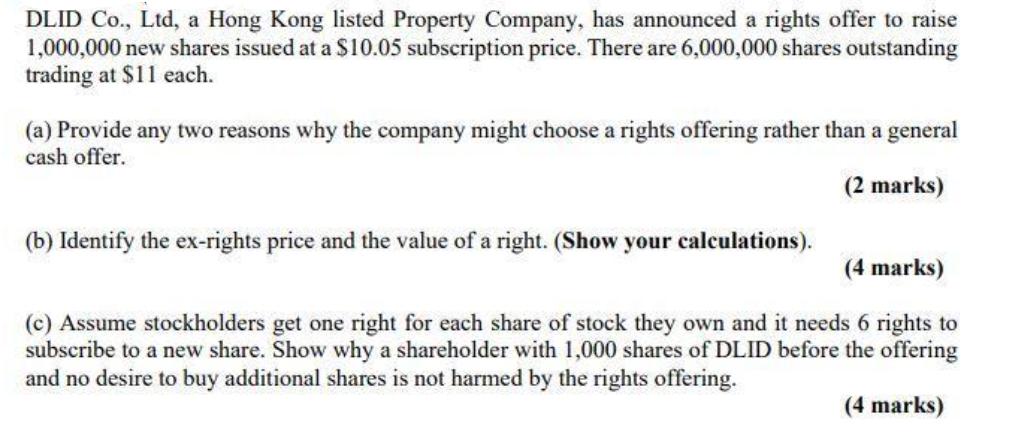

DLID Co., Ltd, a Hong Kong listed Property Company, has announced a rights offer to raise 1,000,000 new shares issued at a $10.05 subscription price. There are 6,000,000 shares outstanding trading at $11 each. (a) Provide any two reasons why the company might choose a rights offering rather than a general cash offer. (2 marks) (b) Identify the ex-rights price and the value of a right. (Show your calculations). (4 marks) (c) Assume stockholders get one right for each share of stock they own and it needs 6 rights to subscribe to a new share. Show why a shareholder with 1,000 shares of DLID before the offering and no desire to buy additional shares is not harmed by the rights offering. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Ro

7th Canadian Edition

007090653X, 978-0070906532, 978-0071339575

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App