Answered step by step

Verified Expert Solution

Question

1 Approved Answer

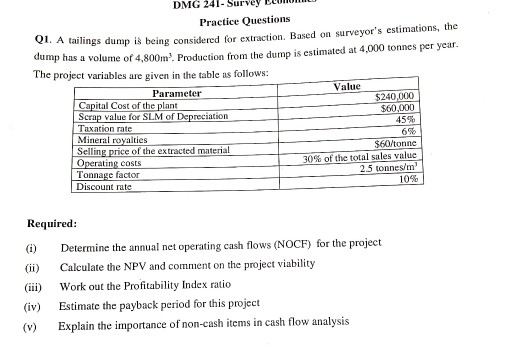

DMG 241- Survey LLUMINIO Practice Questions V. A tailings dump is being considered for extraction. Based on surveyor's estimations, the dump has a volume of

DMG 241- Survey LLUMINIO Practice Questions V. A tailings dump is being considered for extraction. Based on surveyor's estimations, the dump has a volume of 4,800m. Production from the dump is estimated at 4,000 tonnes per year. The project variables are given in the table as follows: Value Parameter Capital Cost of the plant $240.000 $60,000 Scrap value for SLM of Depreciation 45% Taxation rate 69 Mineral royalties Selling price of the extracted material $60/tonne Operating costs 30% of the total sales value Tonnage factor 2.5 tonnes/m Discount rate 10% Required: (1) (ii) (iii) (iv) (v) Determine the annual net operating cash flows (NOCF) for the project Calculate the NPV and comment on the project viability Work out the Profitability Index ratio Estimate the payback period for this project Explain the importance of non-cash items in cash flow analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started