Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do 1, 2, 3, 6 Chapter 12 Homework 1 of 8 -/2 = 1 View Policies Current Attempt in Progress Linkin Corporation is considering purchasing

do 1, 2, 3, 6

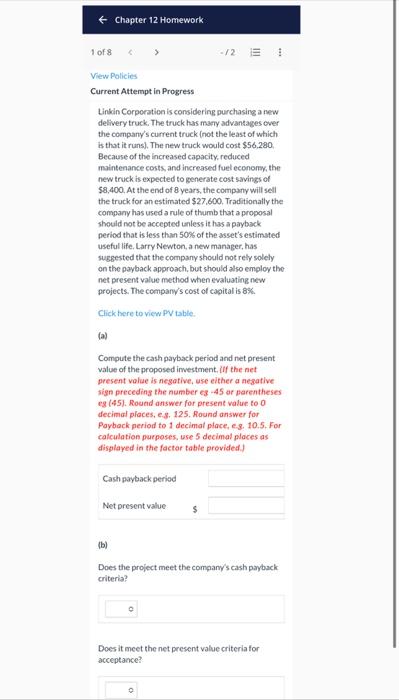

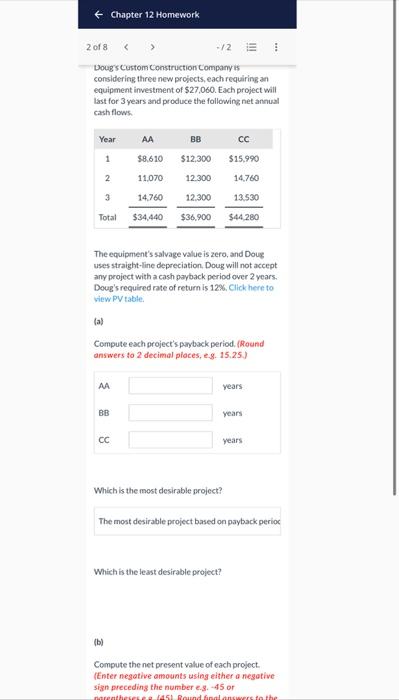

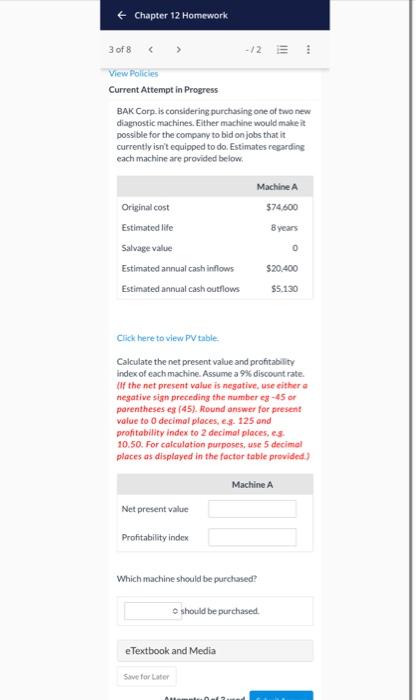

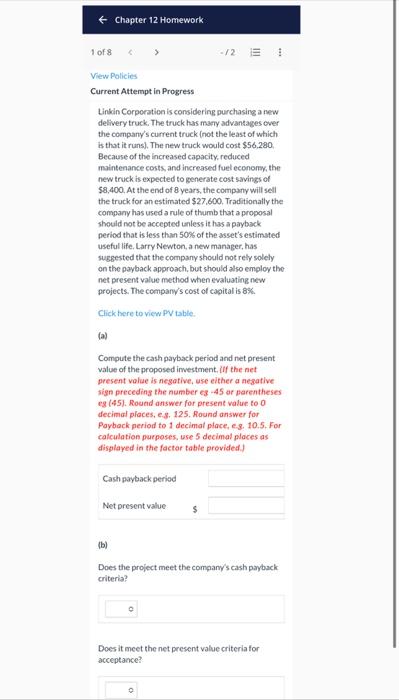

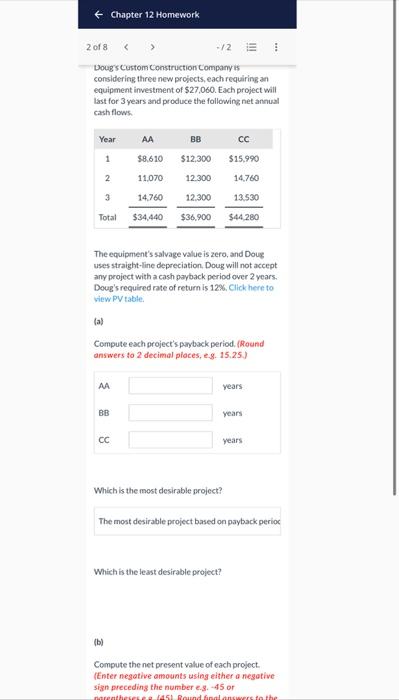

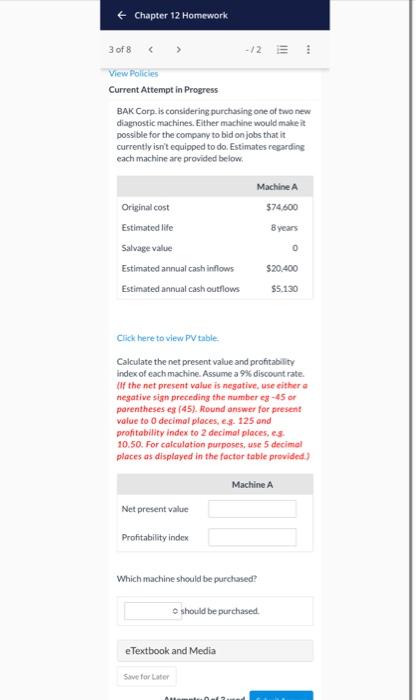

Chapter 12 Homework 1 of 8 -/2 = 1 View Policies Current Attempt in Progress Linkin Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost $56,280, Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,400. At the end of 8 years, the company will sell the truck for an estimated $27,600. Traditionally the company has used a rule of thumb that a proposal should not be accepted unless it has a payback period that is less than 50% of the asset's estimated useful life. Larry Newton, a new manager, has suggested that the company should not rely solely on the payback approach, but should also employ the net present value method when evaluating new projects. The company's cost of capital is 8%. Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125. Round answer for Payback period to 1 decimal place, e.g. 10.5. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Cash payback period Net present value (b) Does the project meet the company's cash payback criteria? Does it meet the net present value criteria for acceptance? Chapter 12 Homework 2 of 8 -12 1 View Policies Current Attempt in Progress BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Original cost $74,600 Estimated life Byears Salvage value 0 Estimated annual cash inflows $20,400 Estimated annual cash outflows $5.130 Click here to view PV table Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answer for present value to 0 decimal places, eg. 125 and profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Net present value Profitability index Which machine should be purchased? should be purchased eTextbook and Media Save for Later Aus Chapter 12 Homework 6 of 8 -/2 = 1 View Policies Current Attempt in Progress Vilas Company is considering a capital investment of $192,700 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $11.562 and $47,000, respectively. Vilas has a 12% cost of capital rate. which is the required rate of return on the investment. Click here to view PV table. (a) Compute the cash payback period. (Round answer to 1 decimal place, e.g. 10.5.) Cash payback period Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 10.52%.) Annual rate of return (b) Using the discounted cash flow technique, compute the net present value. (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answer for present value to 0 decimal places, eg. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started