Answered step by step

Verified Expert Solution

Question

1 Approved Answer

45) Which of the following correctly describes the term cost driver? A) the inflation rate that causes costs to rise B) the primary factor

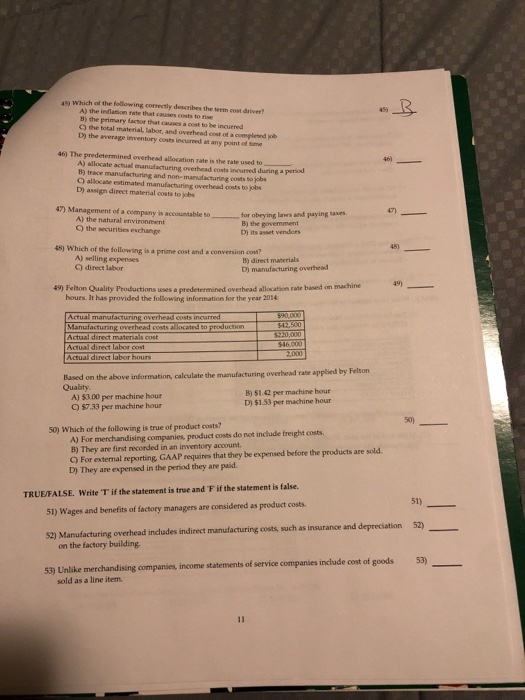

45) Which of the following correctly describes the term cost driver? A) the inflation rate that causes costs to rise B) the primary factor that causes a cost to be incurred C) the total material, labor, and overhead cost of a completed job D) the average inventory costs incurred at any point of time 46) The predetermined overhead allocation rate is the rate used to A) allocate actual manufacturing overhead costs incurred during a period B) trace manufacturing and non-manufacturing costs to jobs allocate estimated manufacturing overhead costs to jobs D) assign direct material costs to jobs 47) Management of a company is accountable to A) the natural environment the securities exchange 48) Which of the following is a prime cost and a conversion cost? A) selling expenses direct labor for obeying laws and paying taxes. B) the government D) its asset vendors 49) Felton Quality Productions uses a predetermined overhead allocation rate based on machine hours. It has provided the following information for the year 2014: Actual direct materials cost Actual direct labor cost Actual direct labor hours B) direct materials D) manufacturing overhead Actual manufacturing overhead costs incurred Manufacturing overhead costs allocated to production A) $3.00 per machine hour C) $7.33 per machine hour Based on the above information, calculate the manufacturing overhead rate applied by Felton Quality. $90,000 $42,500 $220,000 $46,000 2,000 B) $1.42 per machine hour D) $1.53 per machine hour 50) Which of the following is true of product costs? A) For merchandising companies, product costs do not include freight costs. B) They are first recorded in an inventory account. C) For external reporting, GAAP requires that they be expensed before the products are sold. D) They are expensed in the period they are paid. TRUE/FALSE. Write T if the statement is true and F if the statement is false. 51) Wages and benefits of factory managers are considered as product costs. 45) 11 B 46) 49) 53) Unlike merchandising companies, income statements of service companies include cost of goods sold as a line item. 50) 52) Manufacturing overhead includes indirect manufacturing costs, such as insurance and depreciation 52) on the factory building. 51) 53)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 45 Answer B the primary factor that causes a cost to be incurred Explanation Cost driver ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started