Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do 9 10 11 only Intro A corporate bond has 2 years to maturity, a coupon rate of 11%, a face value of $1,000 and

do 9 10 11 only

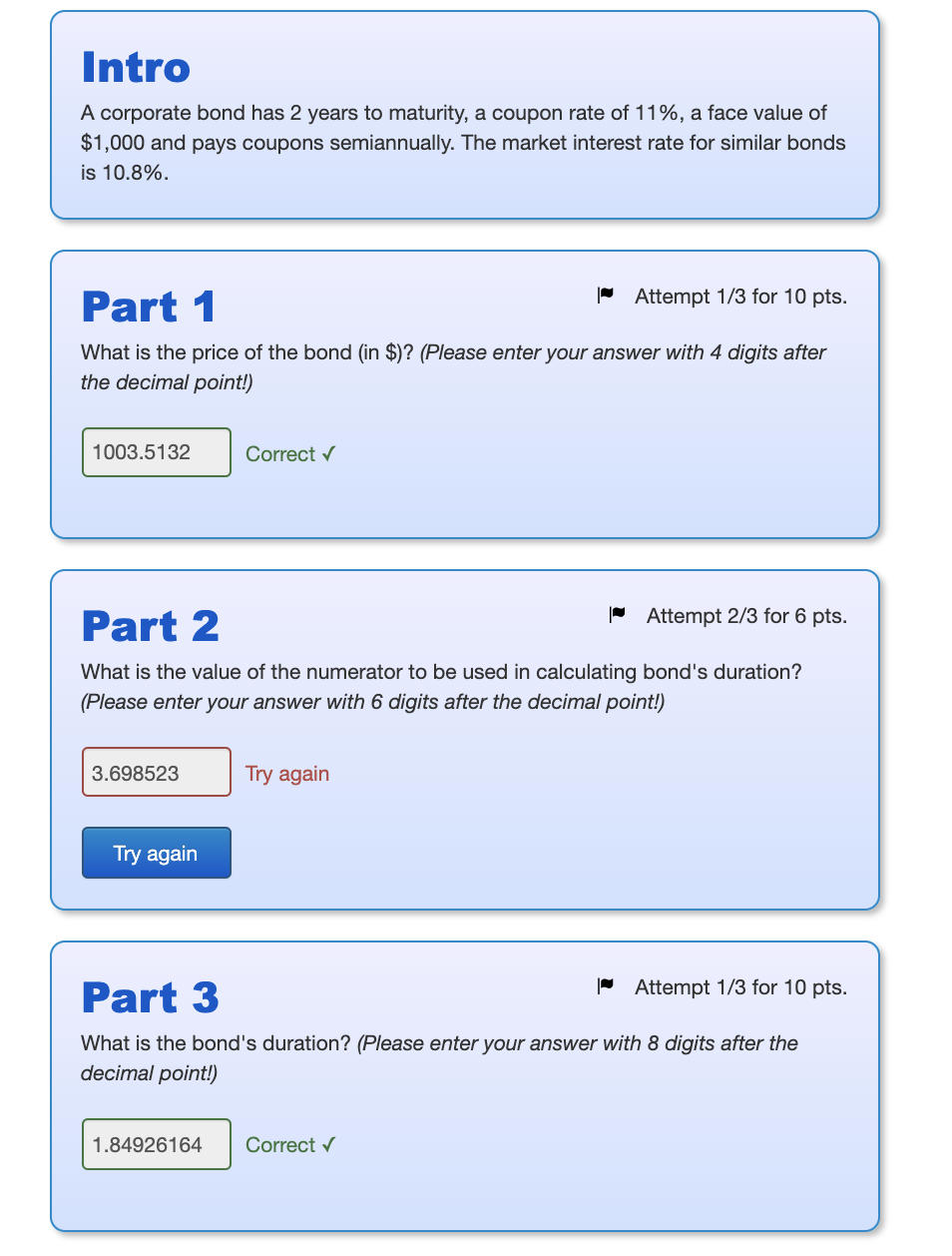

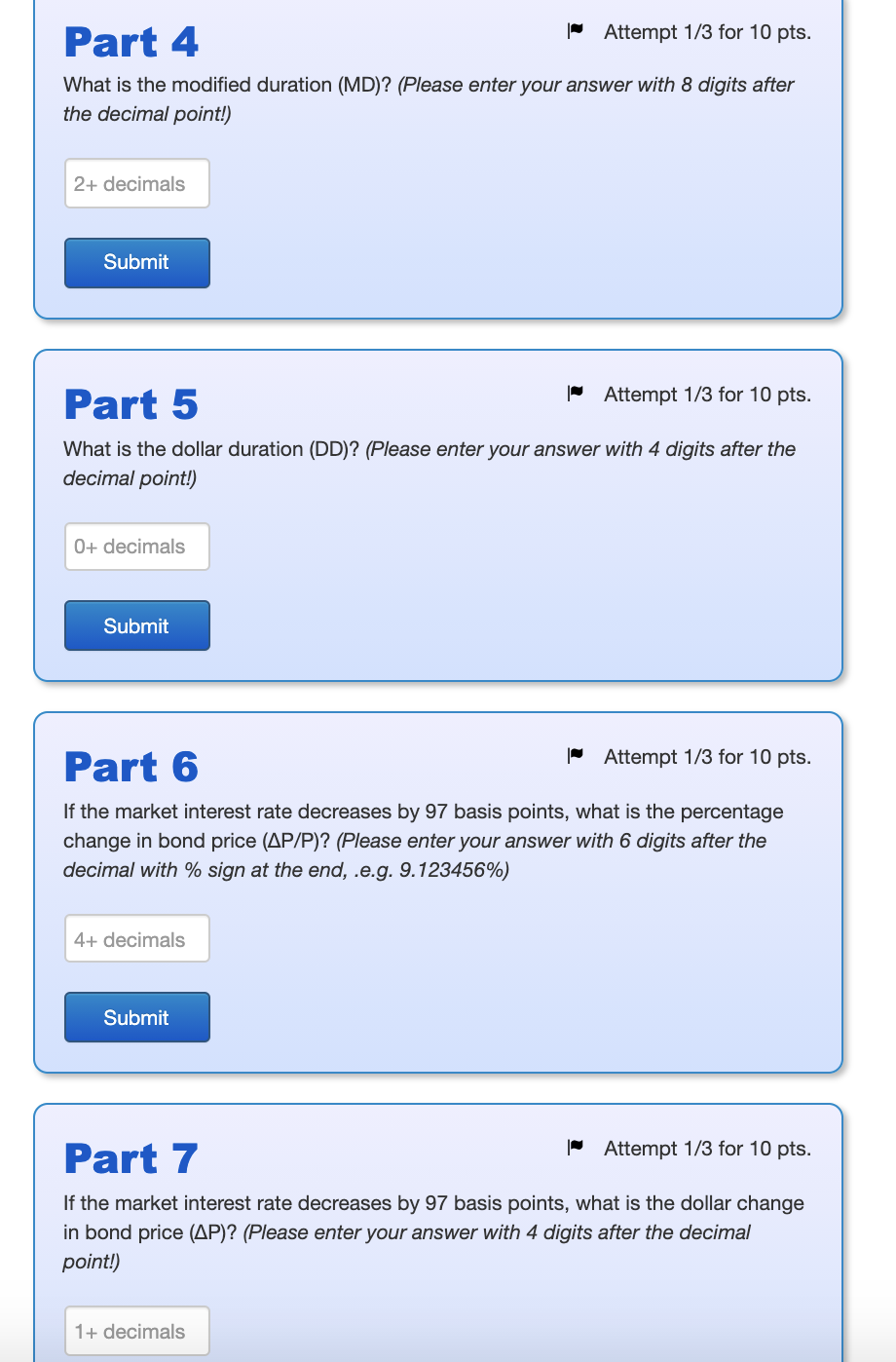

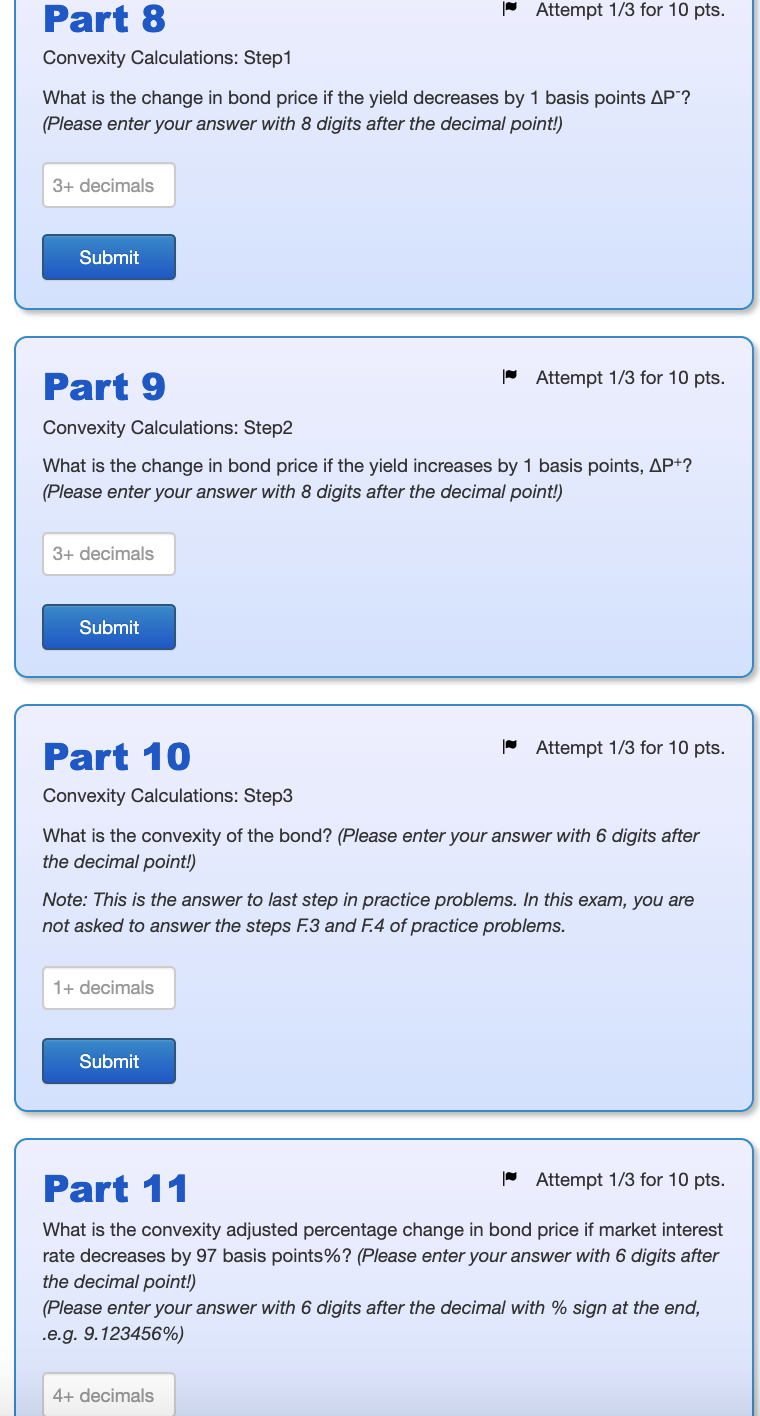

Intro A corporate bond has 2 years to maturity, a coupon rate of 11%, a face value of $1,000 and pays coupons semiannually. The market interest rate for similar bonds is 10.8%. Part 1 | Attempt 1/3 for 10 pts. What is the price of the bond (in $)? (Please enter your answer with 4 digits after the decimal point!) 1003.5132 Correct Part 2 Attempt 2/3 for 6 pts. What is the value of the numerator to be used in calculating bond's duration? (Please enter your answer with 6 digits after the decimal point!) 3.698523 Try again Try again Part 3 | Attempt 1/3 for 10 pts. What is the bond's duration? (Please enter your answer with 8 digits after the decimal point!) 1.84926164 Correct Part 4 - Attempt 1/3 for 10 pts. What is the modified duration (MD)? (Please enter your answer with 8 digits after the decimal point!) 2+ decimals Submit Part 5 Attempt 1/3 for 10 pts. What is the dollar duration (DD)? (Please enter your answer with 4 digits after the decimal point!) 0+ decimals Submit Part 6 "Attempt 1/3 for 10 pts. If the market interest rate decreases by 97 basis points, what is the percentage change in bond price (AP/P)? (Please enter your answer with 6 digits after the decimal with % sign at the end, .e.g. 9.123456%) 4+ decimals Submit Part 7 Attempt 1/3 for 10 pts. If the market interest rate decreases by 97 basis points, what is the dollar change in bond price (AP)? (Please enter your answer with 4 digits after the decimal point!) 1+ decimals Part 8 - Attempt 1/3 for 10 pts. Convexity Calculations: Step1 What is the change in bond price if the yield decreases by 1 basis points AP ? (Please enter your answer with 8 digits after the decimal point!) 3+ decimals Submit Part 9 | Attempt 1/3 for 10 pts. Convexity Calculations: Step2 What is the change in bond price if the yield increases by 1 basis points, AP+? (Please enter your answer with 8 digits after the decimal point!) 3+ decimals Submit Part 10 - Attempt 1/3 for 10 pts. Convexity Calculations: Step3 What is the convexity of the bond? (Please enter your answer with 6 digits after the decimal point!) Note: This is the answer to last step in practice problems. In this exam, you are not asked to answer the steps F.3 and F4 of practice problems. 1+ decimals Submit Attempt 1/3 for 10 pts. Part 11 What is the convexity adjusted percentage change in bond price if market interest rate decreases by 97 basis points%? (Please enter your answer with 6 digits after the decimal point!) (Please enter your answer with 6 digits after the decimal with % sign at the end, .e.g. 9.123456%) 4+ decimalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started