Answered step by step

Verified Expert Solution

Question

1 Approved Answer

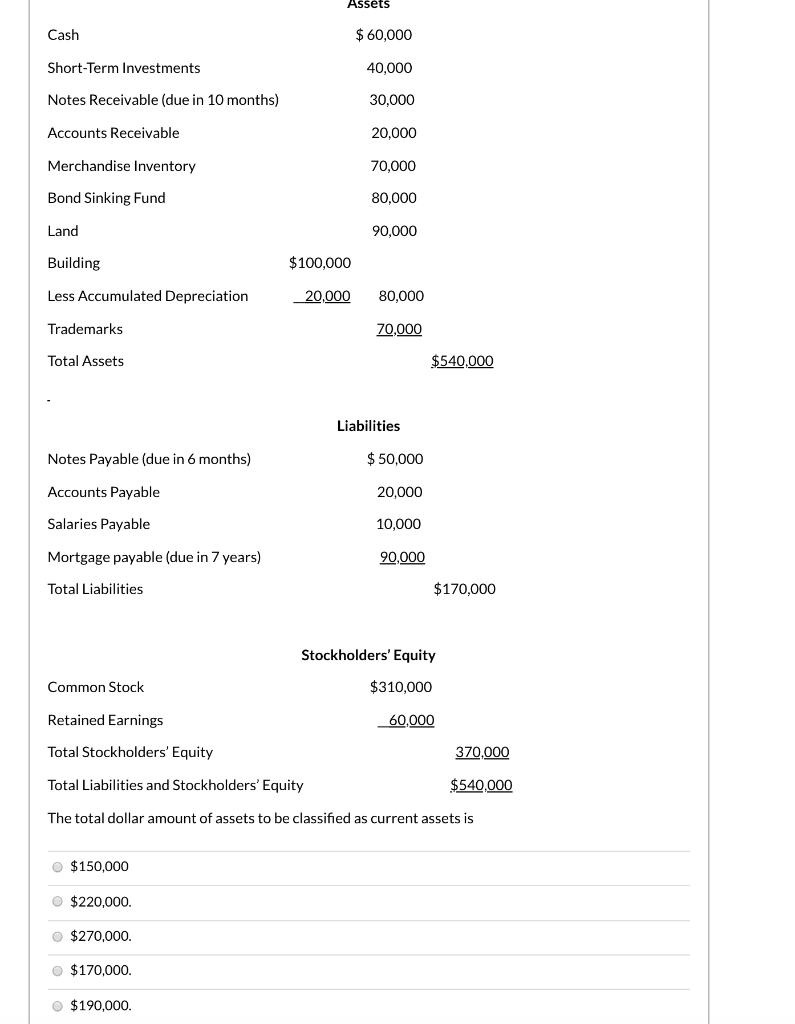

do all Assets Cash $ 60,000 Short-Term Investments 40,000 Notes Receivable (due in 10 months) 30,000 Accounts Receivable 20,000 Merchandise Inventory 70,000 Bond Sinking Fund

do all

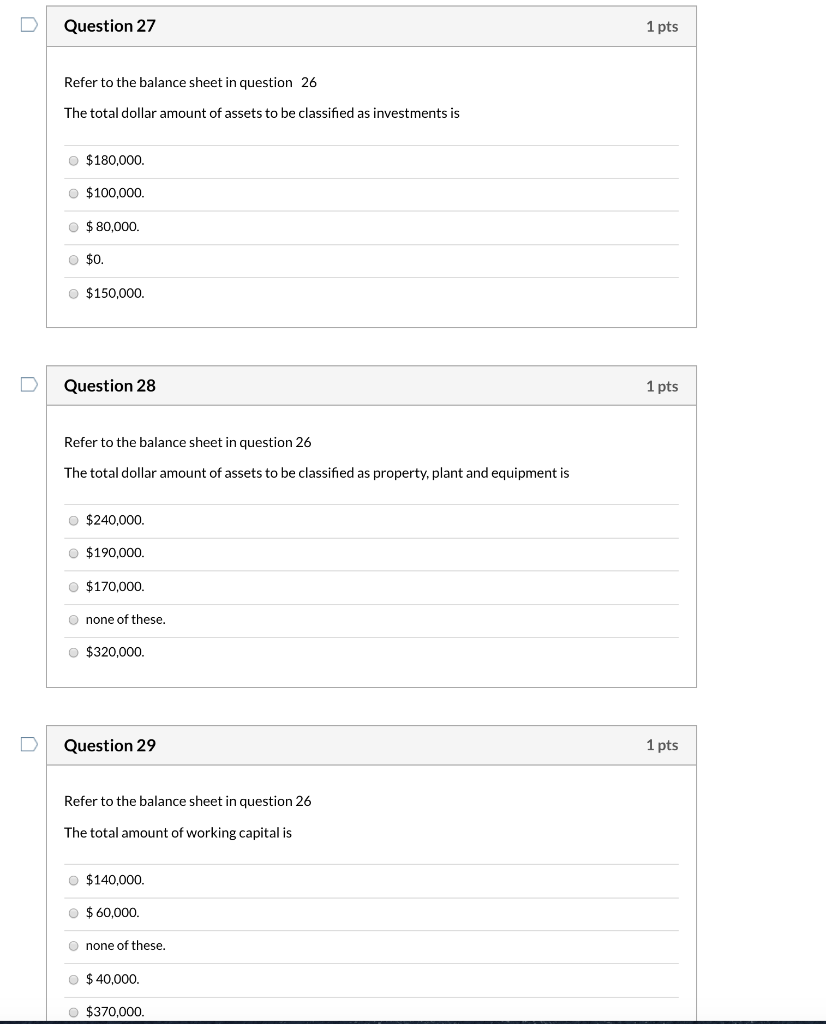

Assets Cash $ 60,000 Short-Term Investments 40,000 Notes Receivable (due in 10 months) 30,000 Accounts Receivable 20,000 Merchandise Inventory 70,000 Bond Sinking Fund 80,000 Land 90,000 Building $100,000 Less Accumulated Depreciation 20,000 80,000 Trademarks 70,000 Total Assets $540,000 Liabilities Notes Payable (due in 6 months) $50,000 Accounts Payable 20,000 Salaries Payable 10,000 Mortgage payable (due in 7 years) 90,000 Total Liabilities $170,000 Stockholders' Equity Common Stock $310,000 Retained Earnings 60,000 Total Stockholders' Equity 370,000 Total Liabilities and Stockholders' Equity $540,000 The total dollar amount of assets to be classified as current assets is $150,000 $220,000. $270,000 $170,000 $190,000 Question 27 1 pts Refer to the balance sheet in question 26 The total dollar amount of assets to be classified as investments is $180,000. $100,000 O $ 80,000. $0. $150,000. Question 28 1 pts Refer to the balance sheet in question 26 The total dollar amount of assets to be classified as property, plant and equipment is $240,000 O $190,000 O $170,000. O none of these. $320,000. D Question 29 1 pts Refer to the balance sheet in question 26 The total amount of working capital is $140,000 $ 60,000. O none of these. $ 40,000 $370,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started