Answered step by step

Verified Expert Solution

Question

1 Approved Answer

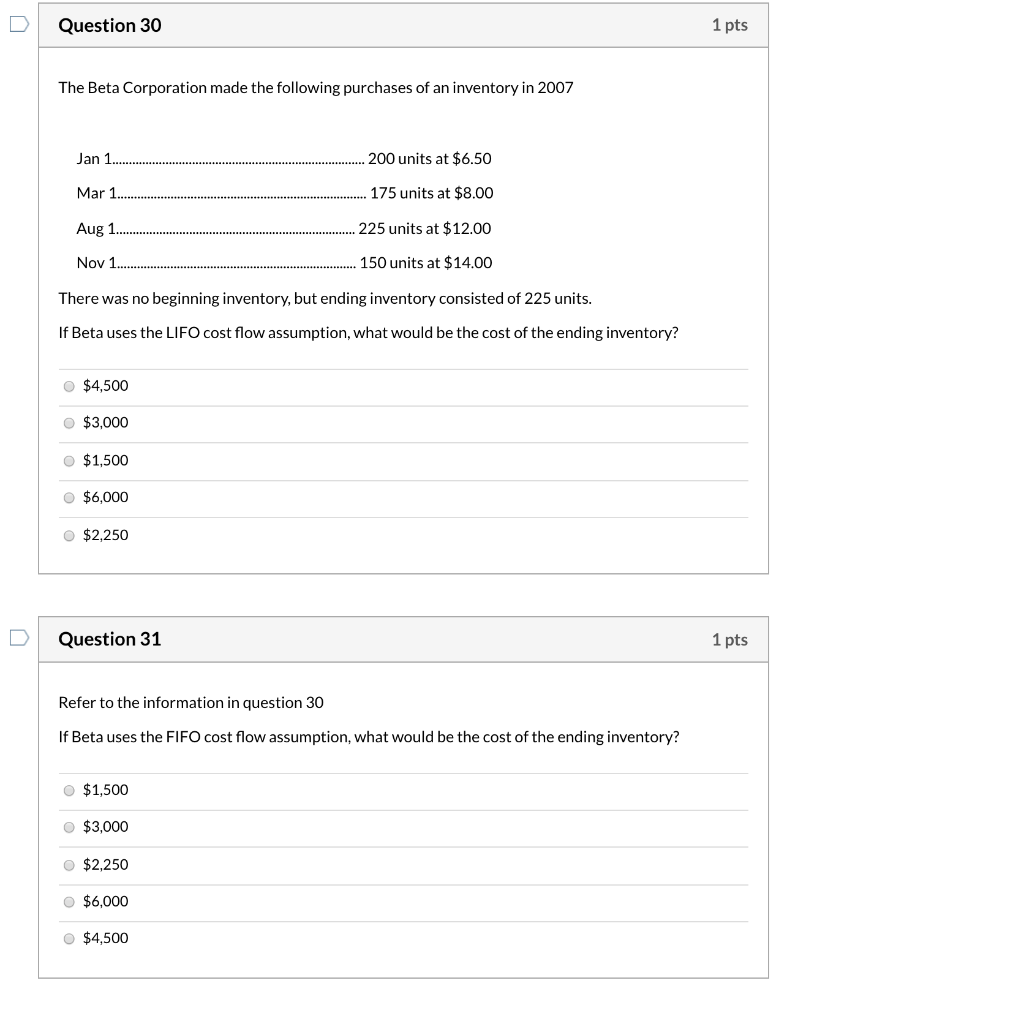

do all Question 30 1 pts The Beta Corporation made the following purchases of an inventory in 2007 Jan 1 200 units at $6.50 Mar

do all

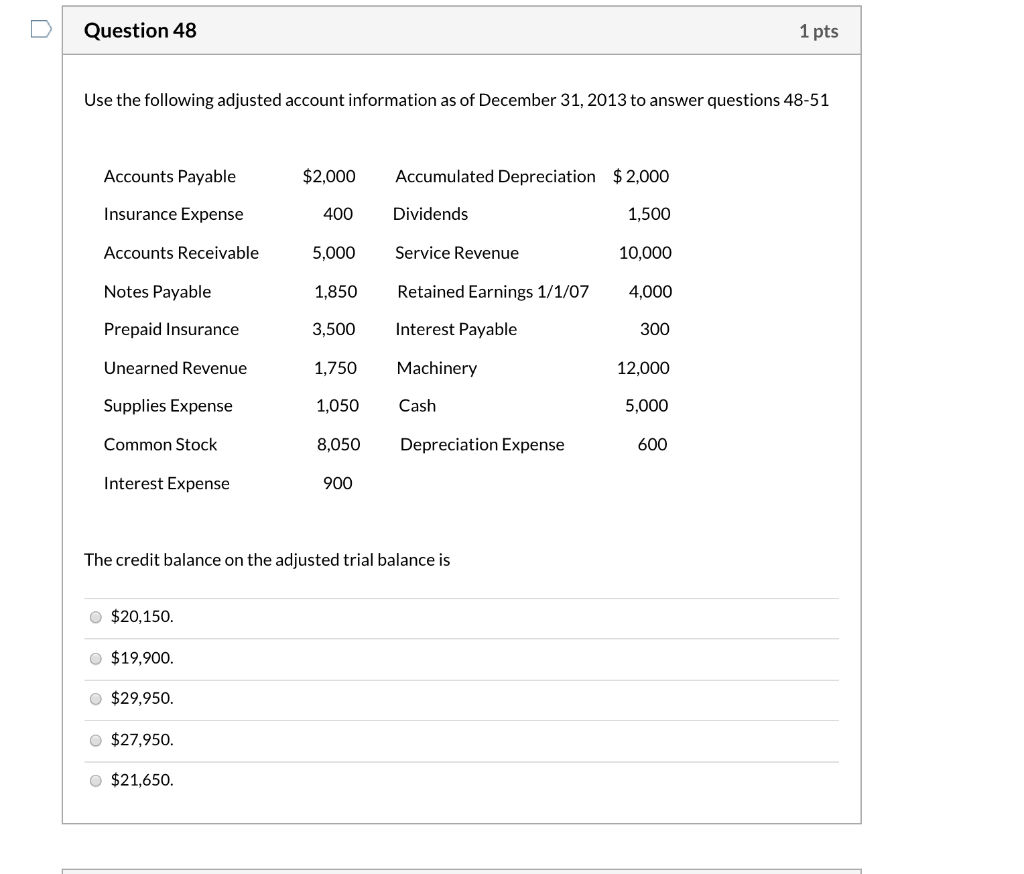

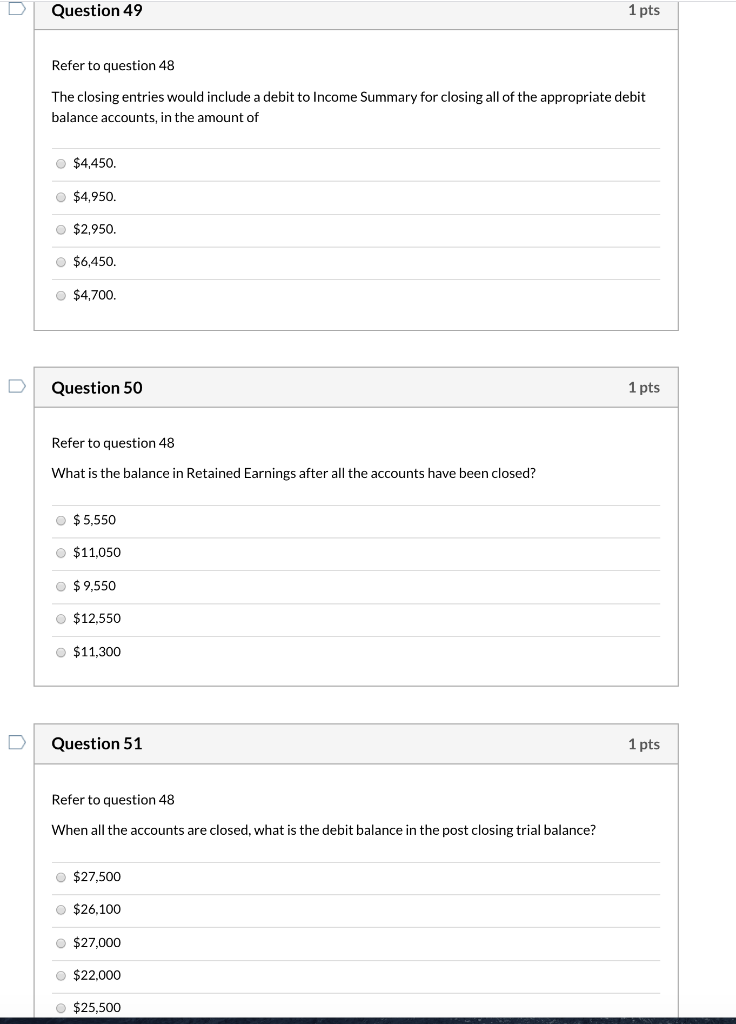

Question 30 1 pts The Beta Corporation made the following purchases of an inventory in 2007 Jan 1 200 units at $6.50 Mar 1.. 175 units at $8.00 Aug 1 225 units at $12.00 Nov 1 150 units at $14.00 There was no beginning inventory, but ending inventory consisted of 225 units. If Beta uses the LIFO cost flow assumption, what would be the cost of the ending inventory? $4,500 $3,000 $1,500 $6,000 $2,250 u Question 31 1 pts Refer to the information in question 30 If Beta uses the FIFO cost flow assumption, what would be the cost of the ending inventory? $1,500 $3,000 $2,250 $6,000 $4,500 Question 48 1 pts Use the following adjusted account information as of December 31, 2013 to answer questions 48-51 Accounts Payable $2,000 Accumulated Depreciation $2,000 Insurance Expense 400 Dividends 1,500 Accounts Receivable 5,000 Service Revenue 10,000 Notes Payable 1,850 Retained Earnings 1/1/07 4,000 Prepaid Insurance 3,500 Interest Payable 300 Unearned Revenue 1,750 Machinery 12,000 Supplies Expense 1,050 Cash 5,000 Common Stock 8,050 Depreciation Expense 600 Interest Expense 900 The credit balance on the adjusted trial balance is $20,150. $19,900. $29,950. $27,950. $21,650. Question 49 1 pts Refer to question 48 The closing entries would include a debit to Income Summary for closing all of the appropriate debit balance accounts, in the amount of $4,450. $4,950. $2,950. $6,450. $4,700. Question 50 1 pts Refer to question 48 What is the balance in Retained Earnings after all the accounts have been closed? $ 5,550 $11,050 $ 9,550 $12.550 $11,300 Question 51 1 pts Refer to question 48 When all the accounts are closed, what is the debit balance in the post closing trial balance? $27,500 $26,100 $27,000 $22.000 $25,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started