Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO ALL WORK IN EXCEL AND SHOW THE FORMULAS USED IN EXCEL begin{tabular}{|c|c|} hline Sales growth & 20% hline Tax rate & 21%

DO ALL WORK IN EXCEL AND SHOW THE FORMULAS USED IN EXCEL

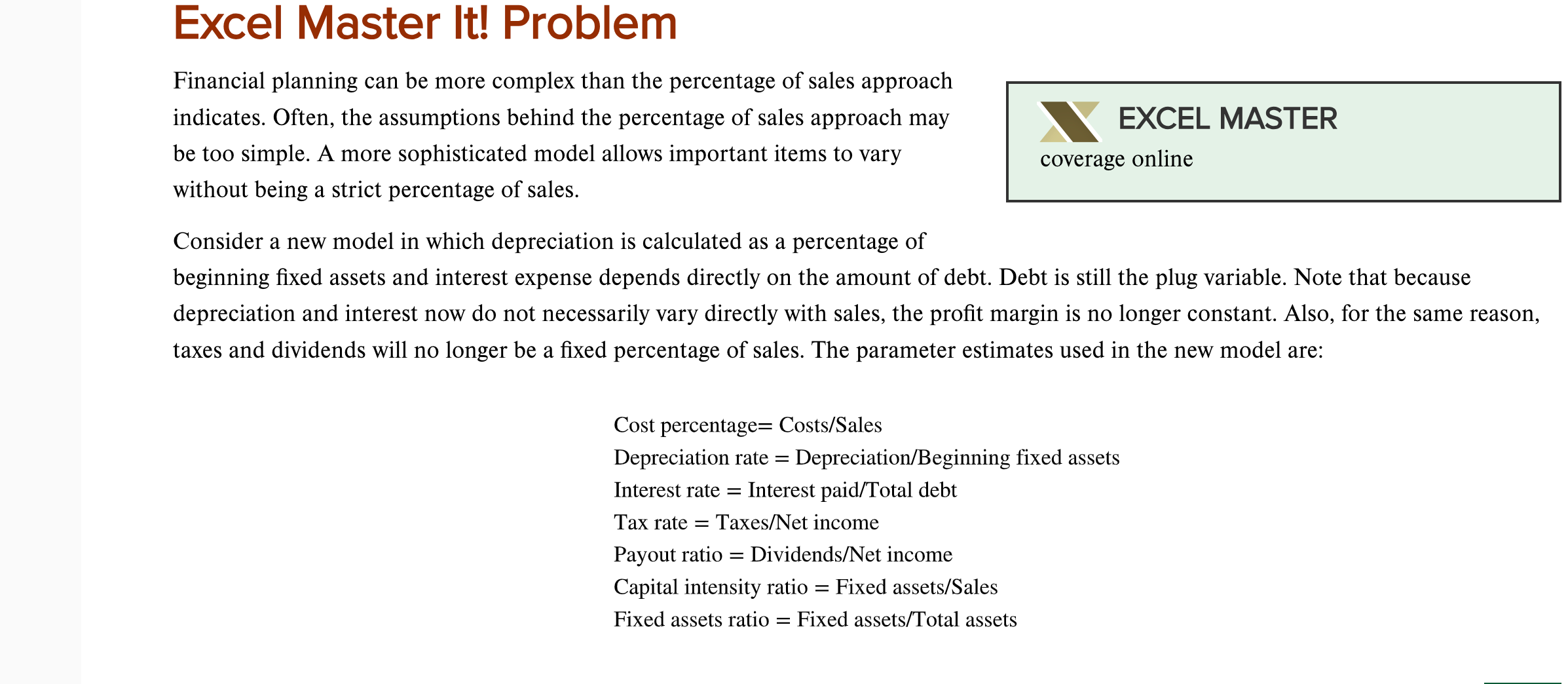

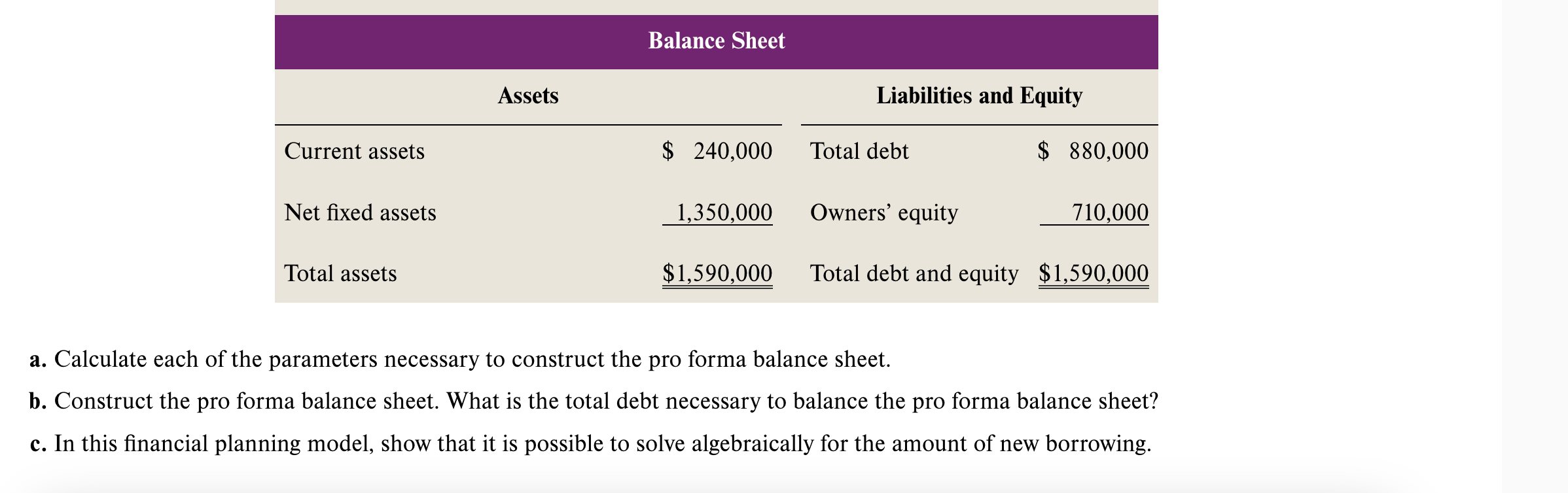

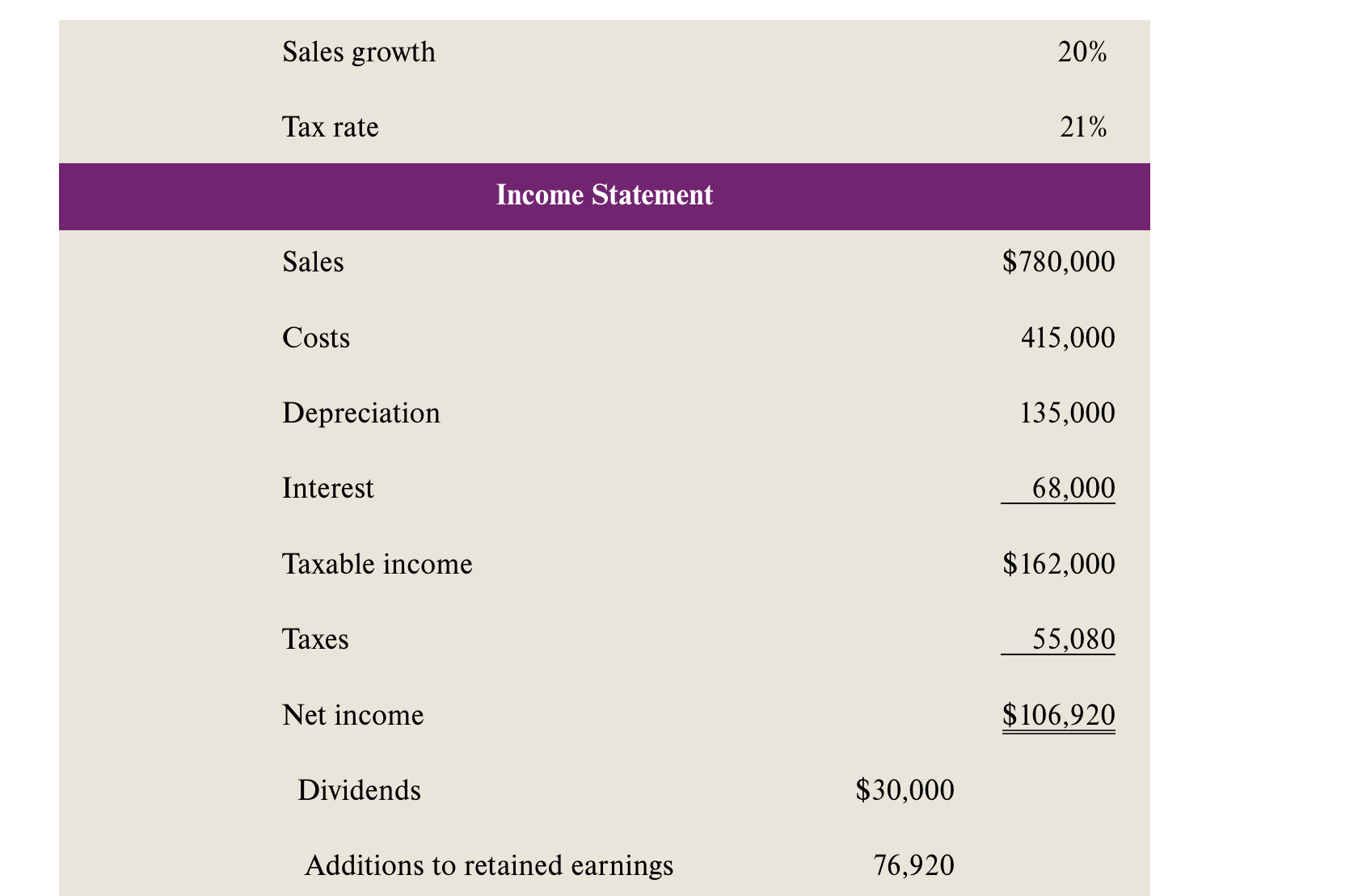

\begin{tabular}{|c|c|} \hline Sales growth & 20% \\ \hline Tax rate & 21% \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline Sales & $780,000 \\ \hline Costs & 415,000 \\ \hline Depreciation & 135,000 \\ \hline Interest & 68,000 \\ \hline Taxable income & $162,000 \\ \hline Taxes & 55,080 \\ \hline Net income & $106,920 \\ \hline Dividends & \\ \hline Additions to retained earnings & \\ \hline \end{tabular} a. Calculate each of the parameters necessary to construct the pro forma balance sheet. b. Construct the pro forma balance sheet. What is the total debt necessary to balance the pro forma balance sheet? c. In this financial planning model, show that it is possible to solve algebraically for the amount of new borrowing. Financial planning can be more complex than the percentage of sales approach indicates. Often, the assumptions behind the percentage of sales approach may be too simple. A more sophisticated model allows important items to vary without being a strict percentage of sales. Consider a new model in which depreciation is calculated as a percentage of beginning fixed assets and interest expense depends directly on the amount of debt. Debt is still the plug variable. Note that because depreciation and interest now do not necessarily vary directly with sales, the profit margin is no longer constant. Also, for the same reason, taxes and dividends will no longer be a fixed percentage of sales. The parameter estimates used in the new model are: Costpercentage=Costs/SalesDepreciationrate=Depreciation/BeginningfixedassetsInterestrate=Interestpaid/TotaldebtTaxrate=Taxes/NetincomePayoutratio=Dividends/NetincomeCapitalintensityratio=Fixedassets/SalesFixedassetsratio=Fixedassets/Totalassets The model parameters can be determined by whatever methods the company deems appropriate. For example, they might be based on average values for the last several years, industry standards, subjective estimates, or even company targets. Alternatively, sophisticated statistical techniques can be used to estimate them. The Yasmin Company is preparing its pro forma financial statements for the next year using this model. The abbreviated financial statements are presented below

\begin{tabular}{|c|c|} \hline Sales growth & 20% \\ \hline Tax rate & 21% \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline Sales & $780,000 \\ \hline Costs & 415,000 \\ \hline Depreciation & 135,000 \\ \hline Interest & 68,000 \\ \hline Taxable income & $162,000 \\ \hline Taxes & 55,080 \\ \hline Net income & $106,920 \\ \hline Dividends & \\ \hline Additions to retained earnings & \\ \hline \end{tabular} a. Calculate each of the parameters necessary to construct the pro forma balance sheet. b. Construct the pro forma balance sheet. What is the total debt necessary to balance the pro forma balance sheet? c. In this financial planning model, show that it is possible to solve algebraically for the amount of new borrowing. Financial planning can be more complex than the percentage of sales approach indicates. Often, the assumptions behind the percentage of sales approach may be too simple. A more sophisticated model allows important items to vary without being a strict percentage of sales. Consider a new model in which depreciation is calculated as a percentage of beginning fixed assets and interest expense depends directly on the amount of debt. Debt is still the plug variable. Note that because depreciation and interest now do not necessarily vary directly with sales, the profit margin is no longer constant. Also, for the same reason, taxes and dividends will no longer be a fixed percentage of sales. The parameter estimates used in the new model are: Costpercentage=Costs/SalesDepreciationrate=Depreciation/BeginningfixedassetsInterestrate=Interestpaid/TotaldebtTaxrate=Taxes/NetincomePayoutratio=Dividends/NetincomeCapitalintensityratio=Fixedassets/SalesFixedassetsratio=Fixedassets/Totalassets The model parameters can be determined by whatever methods the company deems appropriate. For example, they might be based on average values for the last several years, industry standards, subjective estimates, or even company targets. Alternatively, sophisticated statistical techniques can be used to estimate them. The Yasmin Company is preparing its pro forma financial statements for the next year using this model. The abbreviated financial statements are presented below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started