Do answer step by step .Read carefully .Answer must be correct if answer is ok I will give you 2 upvotes. please don,t use excel file. please answer g,h part. Answer must g,h part.

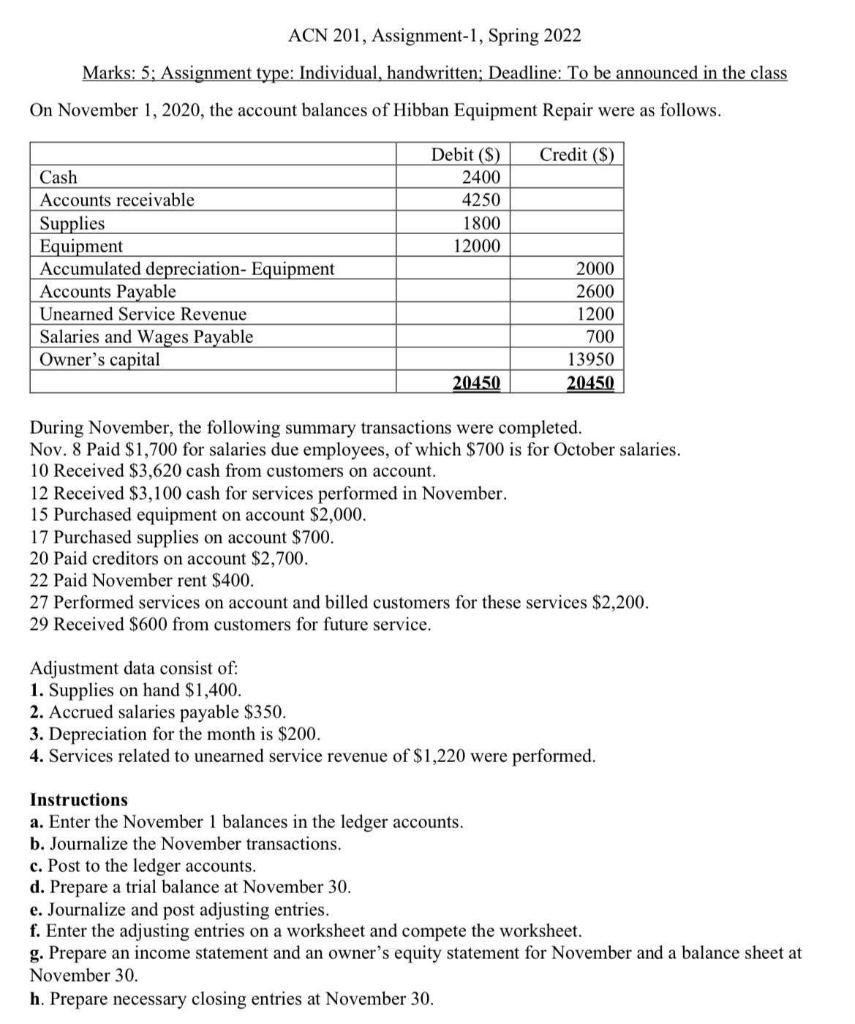

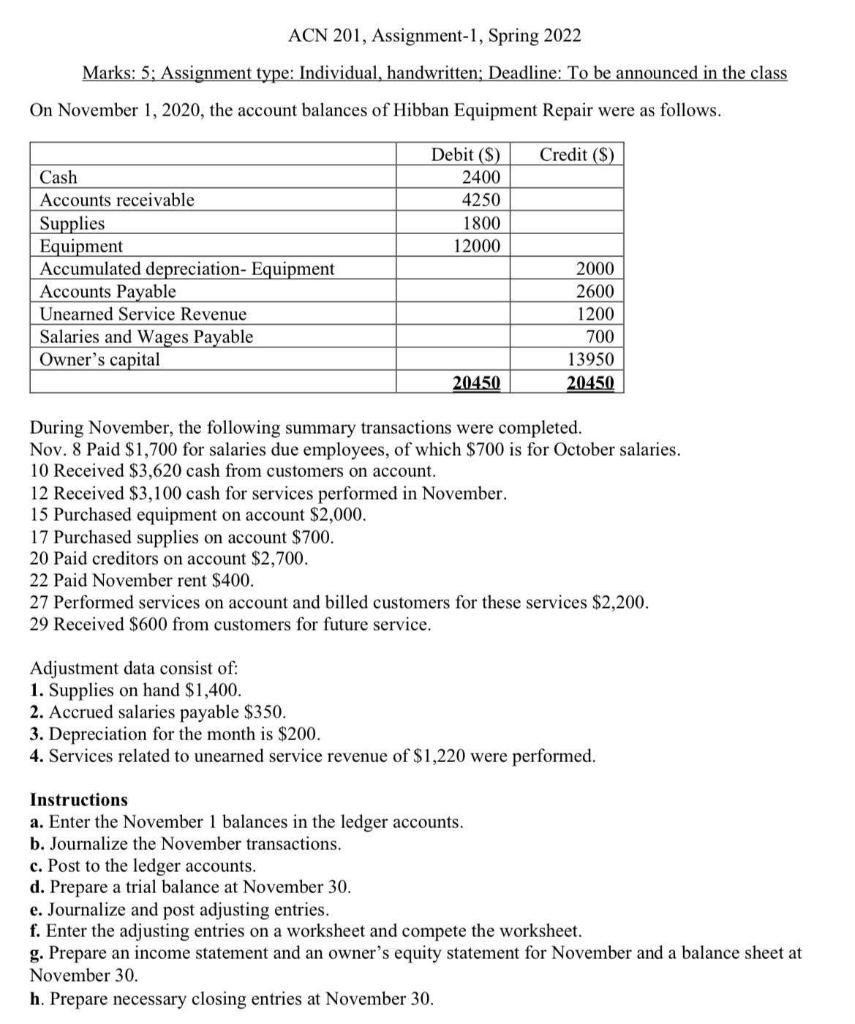

ACN 201, Assignment-1, Spring 2022 Marks: 5; Assignment type: Individual, handwritten; Deadline: To be announced in the class On November 1, 2020, the account balances of Hibban Equipment Repair were as follows. Credit (S) Debit (S) 2400 4250 1800 12000 Cash Accounts receivable Supplies Equipment Accumulated depreciation- Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Owner's capital 2000 2600 1200 700 13950 20450 20450 During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries. 10 Received $3,620 cash from customers on account. 12 Received $3,100 cash for services performed in November 15 Purchased equipment on account $2,000. 17 Purchased supplies on account $700. 20 Paid creditors on account $2,700. 22 Paid November rent $400. 27 Performed services on account and billed customers for these services $2,200. 29 Received $600 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,400. 2. Accrued salaries payable $350. 3. Depreciation for the month is $200. 4. Services related to unearned service revenue of $1,220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts. b. Journalize the November transactions. c. Post to the ledger accounts. d. Prepare a trial balance at November 30. e. Journalize and post adjusting entries. f. Enter the adjusting entries on a worksheet and compete the worksheet. g. Prepare an income statement and an owner's equity statement for November and a balance sheet at November 30. h. Prepare necessary closing entries at November 30. ACN 201, Assignment-1, Spring 2022 Marks: 5; Assignment type: Individual, handwritten; Deadline: To be announced in the class On November 1, 2020, the account balances of Hibban Equipment Repair were as follows. Credit (S) Debit (S) 2400 4250 1800 12000 Cash Accounts receivable Supplies Equipment Accumulated depreciation- Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Owner's capital 2000 2600 1200 700 13950 20450 20450 During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries. 10 Received $3,620 cash from customers on account. 12 Received $3,100 cash for services performed in November 15 Purchased equipment on account $2,000. 17 Purchased supplies on account $700. 20 Paid creditors on account $2,700. 22 Paid November rent $400. 27 Performed services on account and billed customers for these services $2,200. 29 Received $600 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,400. 2. Accrued salaries payable $350. 3. Depreciation for the month is $200. 4. Services related to unearned service revenue of $1,220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts. b. Journalize the November transactions. c. Post to the ledger accounts. d. Prepare a trial balance at November 30. e. Journalize and post adjusting entries. f. Enter the adjusting entries on a worksheet and compete the worksheet. g. Prepare an income statement and an owner's equity statement for November and a balance sheet at November 30. h. Prepare necessary closing entries at November 30