Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do exactly like the example answer provided below. if done the other way or didnt include any steps or table. i will dislike it. example

Do exactly like the example answer provided below. if done the other way or didnt include any steps or table. i will dislike it.

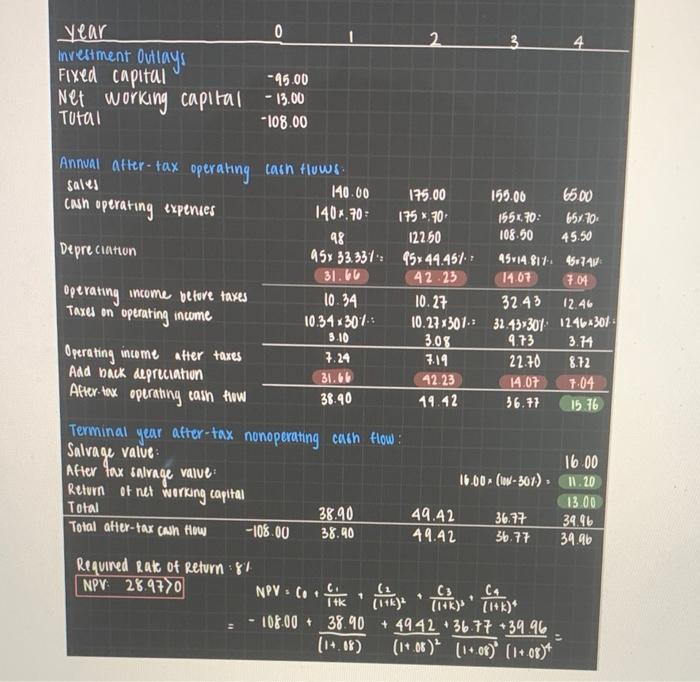

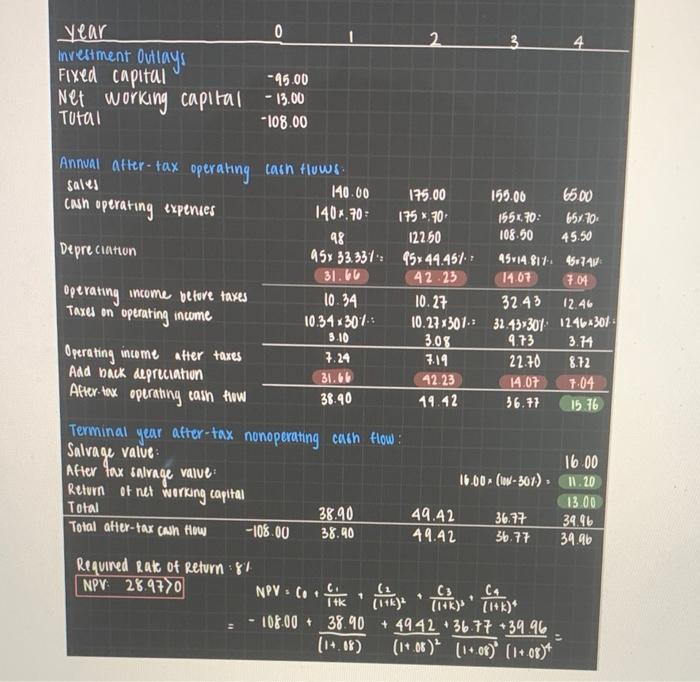

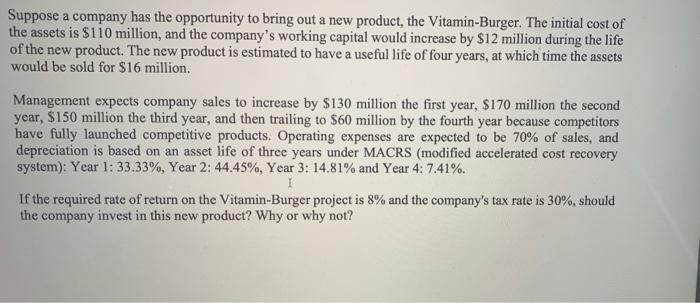

Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $95 million, and the company's working capital would increase by $13 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $16 million. Management expects company sales to increase by $140 million the first year, $175 million the second year, $155 million the third year, and then trailing to $65 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 70% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system). Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%.If the required rate of return on the Vitamin-Burger project is 8% and the company's tax rate is 30%, should the company invest in this new product? 3 year 0 mrestment Oullays Fixed capital -45.00 Net working capital -13.00 Tural *108.00 Annual after- tax operating cash flows sales 140.00 175.00 155.00 65.00 cash operating expenses 1404.70 175 70 155670: 65/70 98 12250 108.50 45.50 Depreciation 45x 53.331; 9544.45%. 45114811 574 31.6 42.23 14.07 7.04 Operating income before taxes 10.34 10.27 32 43 12.46 Taxes on operating income 10.34.307: 10.27-301. 32.43-30 12462301 3.10 3.08 4.73 3.11 Operating income after taxes 7.24 7.19 22.70 8.12 And back depreciation 31.66 42.23 14.07 7.04 After-tax operating cash how 3840 14.42 36.77 15.16 Terminal year after-tax nonoperating cash flow : Salvage valve 16.00 valve 16.00-(ww-301) IL 20 Return of net working capital 13.00 Total 38.90 49.42 36.77 34.96 Total after-tax cash flow -108.00 38.90 49.42 36.77 39.96 After fax salvage Required Rate of Return 87 NPV 28.9770 NPV.CO. Pike home the little - 108.00 38.90 + 4942 36.77 39.96 (14.48) (1408) [1+08) (1+08)* Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $110 million, and the company's working capital would increase by $12 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $16 million. Management expects company sales to increase by $130 million the first year, $170 million the second year, $150 million the third year, and then trailing to $60 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 70% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system): Year 1:33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%. 1 If the required rate of return on the Vitamin-Burger project is 8% and the company's tax rate is 30%, should the company invest in this new product? Why or why not example problem.

our answer must be like the answer below. include all the table and steps.

question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started