Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do exactly like the example. do it correctly and explain the answer. Please do all the steps (exactly like in done in example). 12 What

Do exactly like the example. do it correctly and explain the answer.

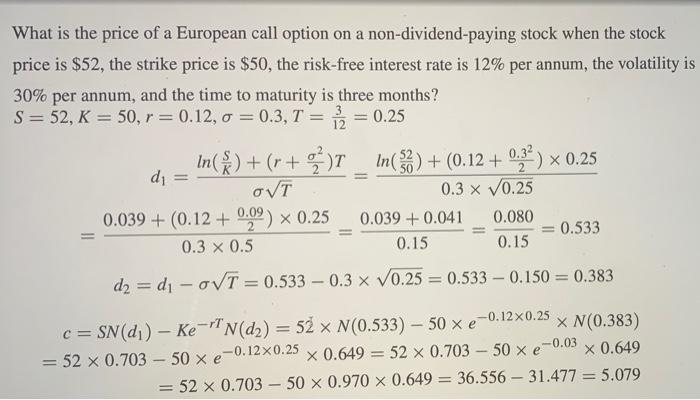

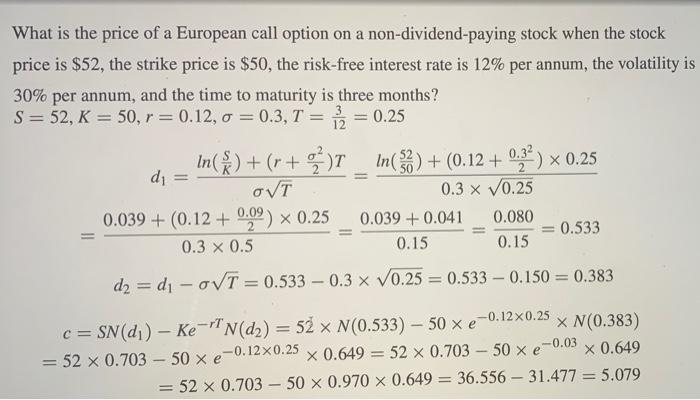

12 What is the price of a European call option on a non-dividend-paying stock when the stock price is $52, the strike price is $50, the risk-free interest rate is 12% per annum, the volatility is 30% per annum, and the time to maturity is three months ? S = 52, K = 50, r=0.12,0 = 0.3, T = = 0.25 In(x) +(r+2) In( 32) + (0.12 +0,32) * 0.25 di OVT 0.3 x 70.25 0.039 + (0.12 + 0,09) * 0.25 0.039 + 0.041 0.080 = 0.533 0.3 x 0.5 0.15 0.15 d2 = d -OVT = 0.533 0.3 x 70.25 = 0.533 0.150 = 0.383 c = SN(di) Ke-T n(d2) = 52 x N(0.533) 50 x e-0.12x0.25 x N(0.383) = 52 x 0.703 50 x e-0.12X0.25 x 0.649 = 52 x 0.703 - 50 x e-0.03 X 0.649 52 x 0.703 50 X 0.970 x 0.649 = 36.556 - 31.477 = 5.079 Problem 5: What is the price of a European call option on a non-dividend-paying stock when the stock price is $51, the strike price is $50, the risk-free interest rate is 10% per annum, the volatility is 30% per annum, and the time to maturity is three months

Please do all the steps (exactly like in done in example).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started