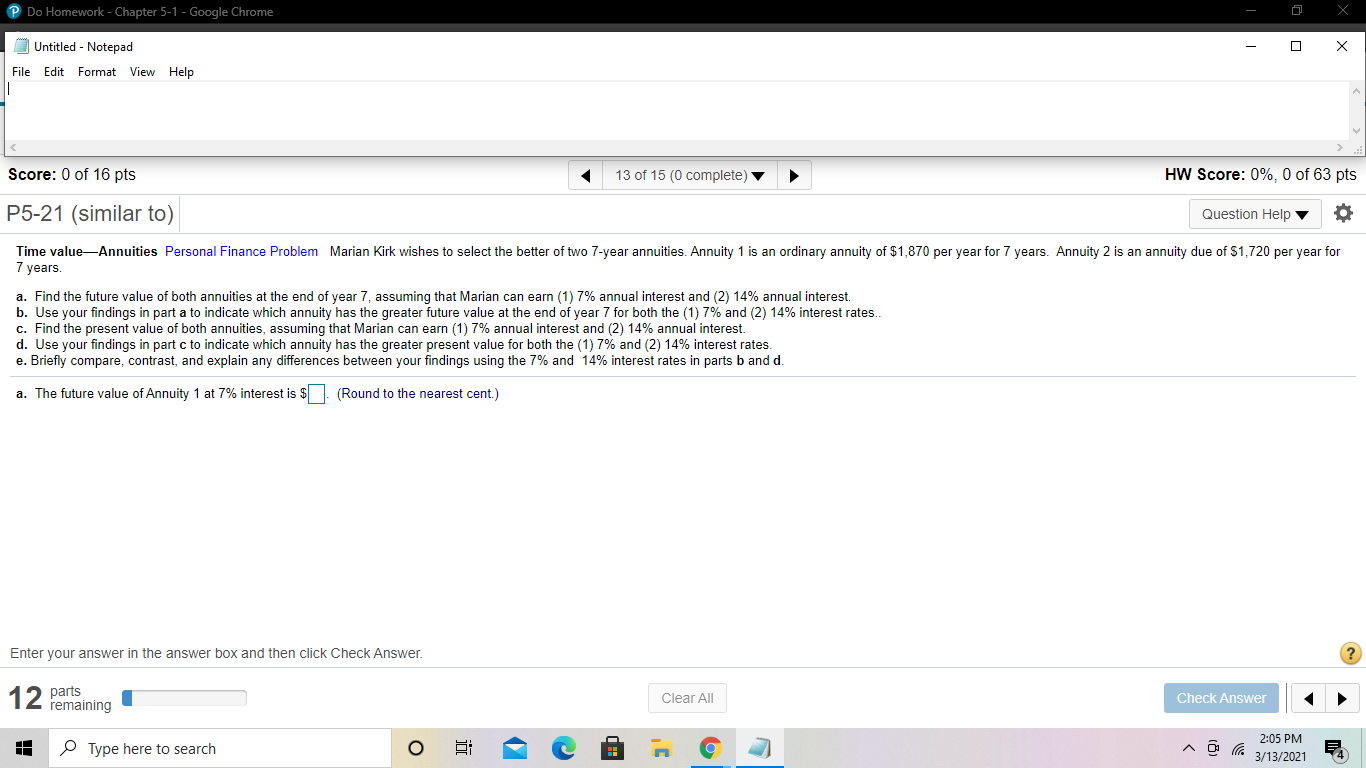

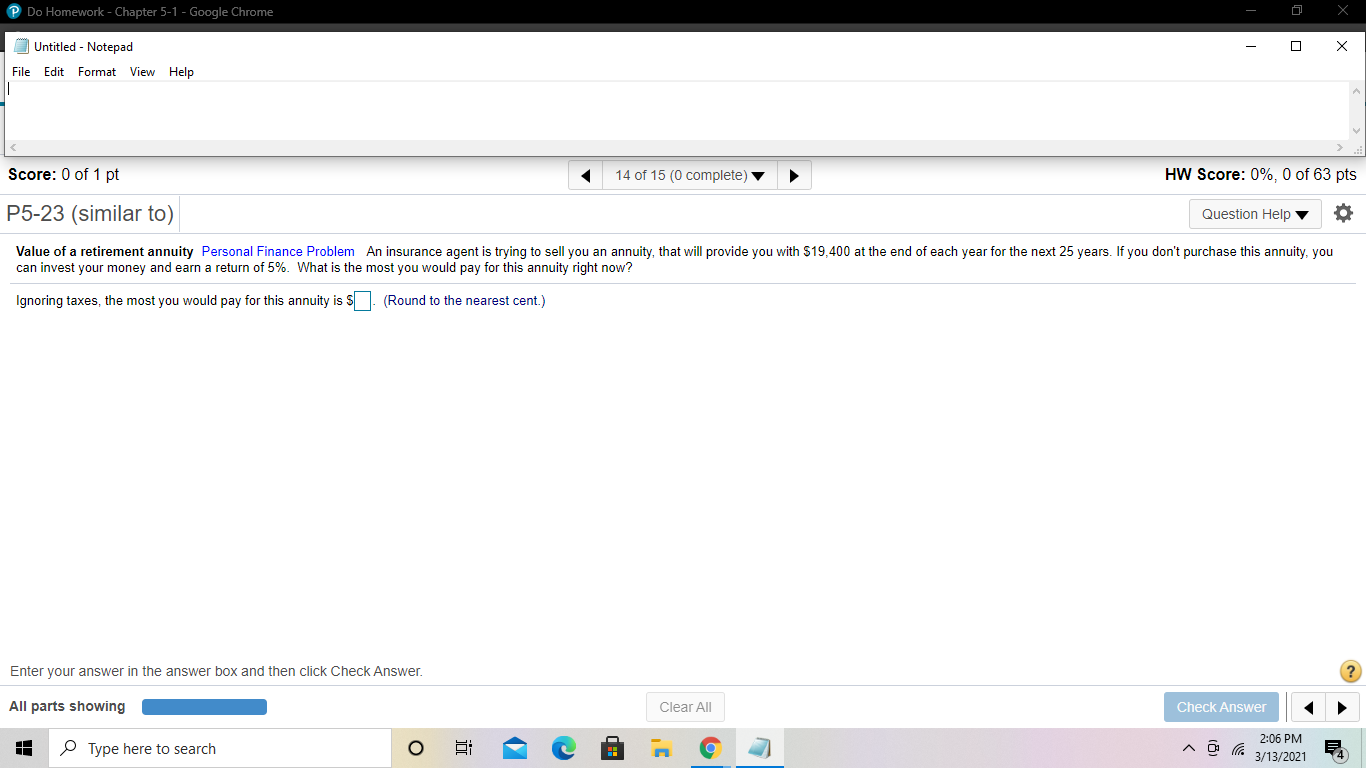

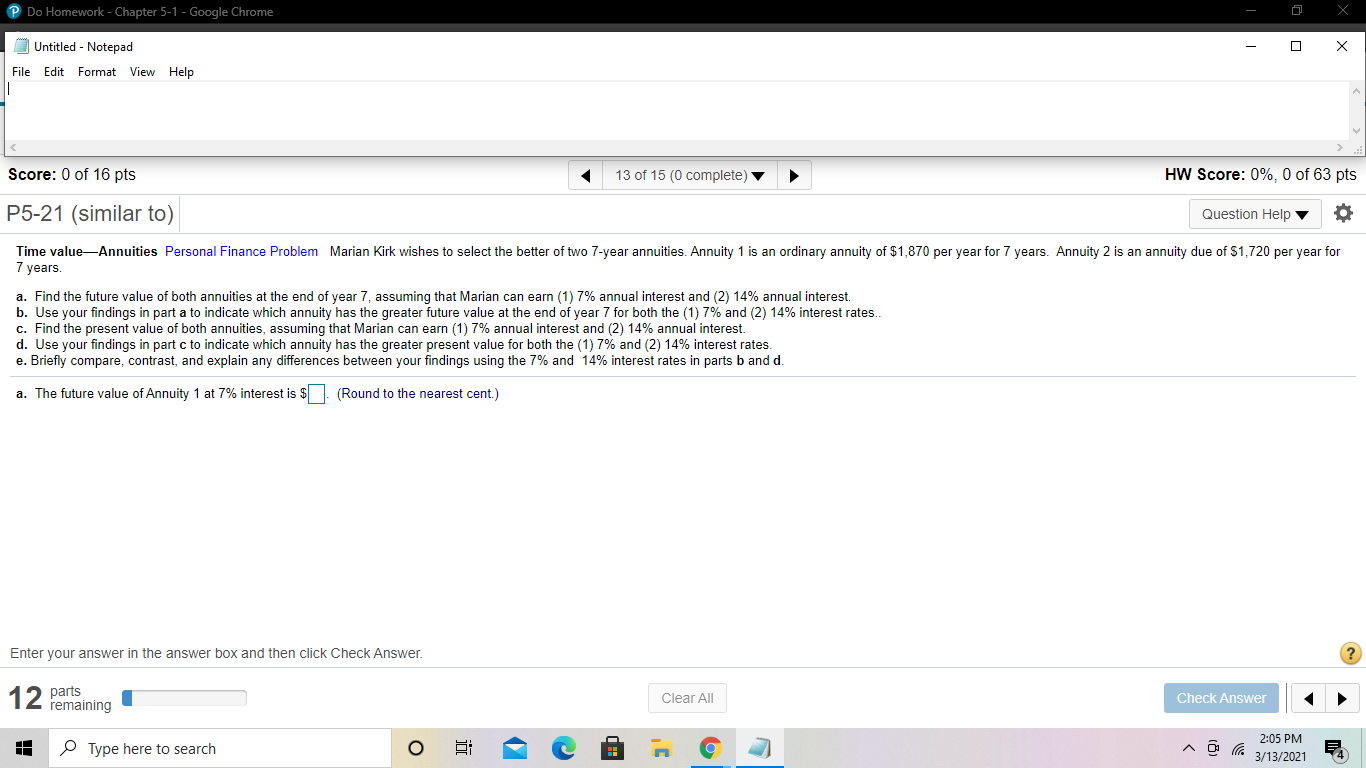

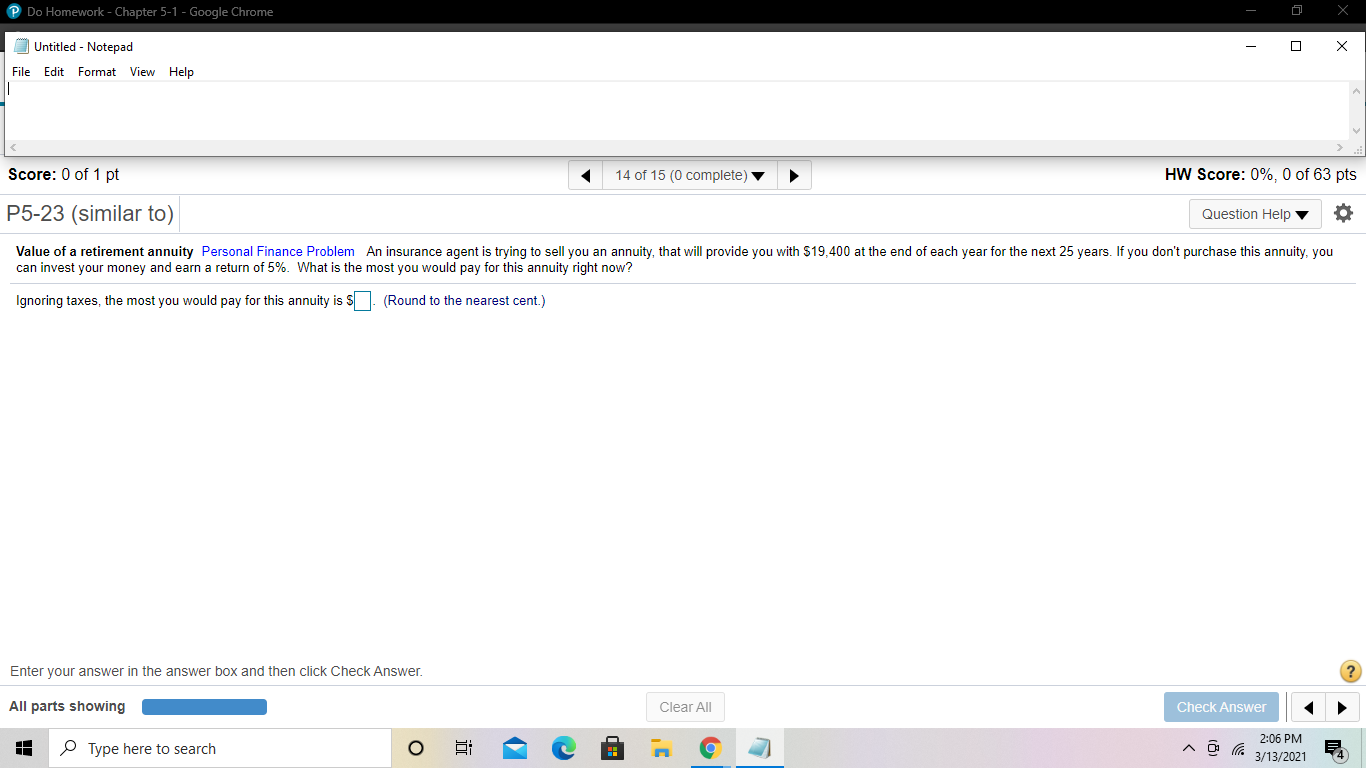

Do Homework - Chapter 5-1 - Google Chrome o Untitled - Notepad File Edit Format View Help Score: 0 of 16 pts 13 of 15 (0 complete) HW Score: 0%, 0 of 63 pts P5-21 (similar to) Question Help o Time valueAnnuities Personal Finance Problem Marian Kirk wishes to select the better of two 7-year annuities. Annuity 1 is an ordinary annuity of $1,870 per year for 7 years. Annuity 2 is an annuity due of $1,720 per year for 7 years. a. Find the future value of both annuities at the end of year 7, assuming that Marian can earn (1) 7% annual interest and (2) 14% annual interest. b. Use your findings in part a to indicate which annuity has the greater future value at the end of year 7 for both the (1) 7% and (2) 14% interest rates.. c. Find the present value of both annuities, assuming that Marian can earn (1) 7% annual interest and (2) 14% annual interest. d. Use your findings in part c to indicate which annuity has the greater present value for both the (1) 7% and (2) 14% interest rates. e. Briefly compare, contrast, and explain any differences between your findings using the 7% and 14% interest rates in parts b and d. a. The future value of Annuity 1 at 7% interest is $ (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. 12 parts Clear All Check Answer remaining o Type here to search O j e 2:05 PM 3/13/2021 Do Homework - Chapter 5-1 - Google Chrome o Untitled - Notepad File Edit Format View Help Score: 0 of 1 pt 14 of 15 (0 complete) HW Score: 0%, 0 of 63 pts P5-23 (similar to) Question Help Value of a retirement annuity Personal Finance Problem An insurance agent is trying to sell you an annuity, that will provide you with $19,400 at the end of each year for the next 25 years. If you don't purchase this annuity, you can invest your money and earn a return of 5%. What is the most you would pay for this annuity right now? Ignoring taxes, the most you would pay for this annuity is $. (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. All parts showing Clear All Check Answer 1: j Type here to search c 2:06 PM 3/13/2021