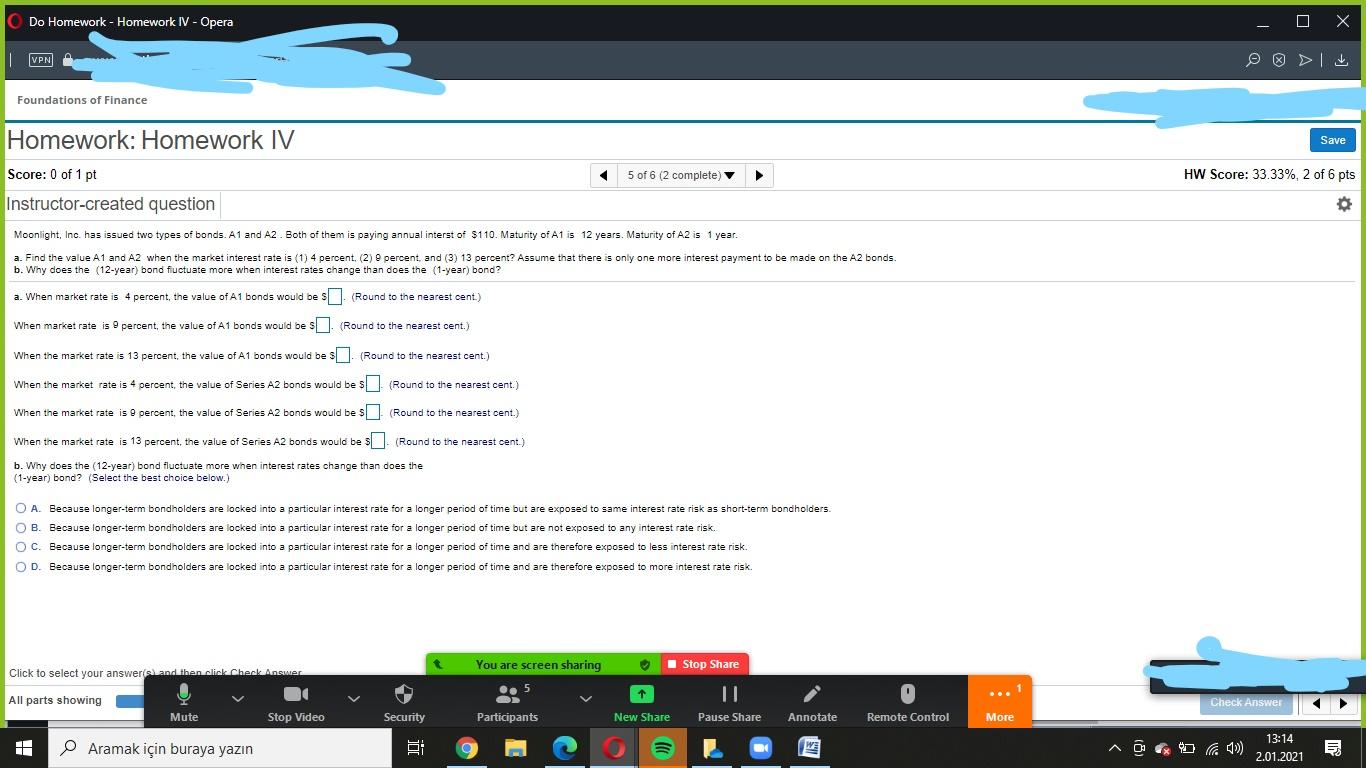

Do Homework - Homework IV - Opera X VPN > Foundations of Finance Homework: Homework IV Save Score: 0 of 1 pt 5 of 6 (2 complete) HW Score: 33.33%, 2 of 6 pts Instructor-created question Moonlight, Inc. has issued two types of bonds. A1 and A2. Both of them is paying annual interst of $110. Maturity of A1 is 12 years. Maturity of A2 is 1 year. a. Find the value A1 and A2 when the market interest rate is (1) 4 percent (2) 9 percent, and (3) 13 percent? Assume that there is only one more interest payment to be made on the A2 bonds. b. Why does the (12-year) bond fluctuate more when interest rates change than does the (1-year) bond? a. When market rate is 4 percent, the value of A1 bonds would be s. (Round to the nearest cent) When market rate is 9 percent, the value of A1 bonds would be 8. (Round to the nearest cent.) When the market rate is 13 percent, the value of A1 bonds would be s. (Round to the nearest cent.) When the market rate is 4 percent, the value of Series A2 bonds would be $ (Round to the nearest cent.) When the market rate is 9 percent, the value of Series A2 bonds would be $ (Round to the nearest cent.) When the market rate is 13 percent, the value of Series A2 bonds would be s - (Round to the nearest cent.) ) b. Why does the (12-year) bond fluctuate more when interest rates change than does the (1-year) bond? (Select the best choice below. O A. Because longer-term bondholders are locked into a particular interest rate for a longer period of time but are exposed to same interest rate risk as short-term bondholders. O B. Because longer-term bondholders are locked into a particular interest rate for a longer period of time but are not exposed to any interest rate risk. OC. Because longer-term bondholders are locked into a particular interest rate for a longer period of time and are therefore exposed to less interest rate risk. OD. Because longer-term bondholders are locked into a particular interest rate for a longer period of time and are therefore exposed to more interest rate risk t You are screen sharing Stop Share Click to select your answer and then click Check Answer 5 All parts showing 0 Check Answer Mute Stop Video Security Participants New Share Pause Share Annotate Remote Control More 13:14 1 1 Aramak iin buraya yazn wa Aula a ) 2.01.2021