Answered step by step

Verified Expert Solution

Question

1 Approved Answer

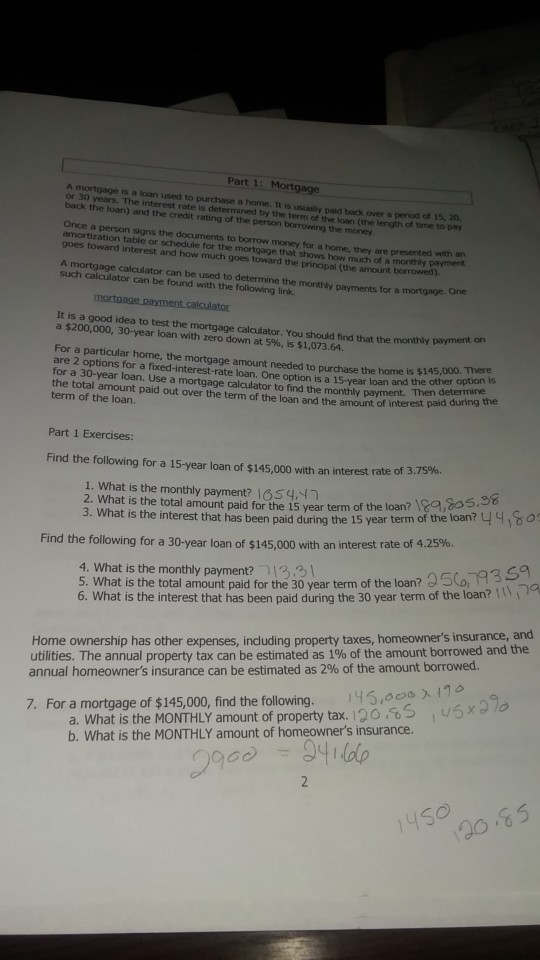

do I have it right Part 1: Mortgage A mortgage is a loan used to purchase a home. It is bedover a period of 1,20

do I have it right

Part 1: Mortgage A mortgage is a loan used to purchase a home. It is bedover a period of 1,20 or 30 years. The interest rate is determined by the term of the l e ngth of time to pay back the loan) and the credit rating of the person borrowing the money Once a person signs the documents to borrow money for a home the presented we amortization table or schedule for the mortgage that show how much of a monthly payme goes toward interest and how much goes toward the principal (the amount borrowed) A mortgage calculator can be used to determine the monthly payments for a mortgage such calculator can be found with the following link mortgage payment calculator It is a good idea to test the mortgage calculator. You should find that the monthly payment a $200,000, 30-year loan with zero down at 5%, is $1,073.64. For a particular home, the mortgage amount needed to purchase the home is $145,000 are 2 options for a fixed-interest-rate loan. One option is a 15-year loan and the other for a 30-year loan. Use a mortgage calculator to find the monthly payment. Then acte the total amount paid out over the term of the loan and the amount of interest pard term of the loan. to purchase the home is $145,000. There year loan and the other option is y payment. Then determine Part 1 Exercises: Find the following for a 15-year loan of $145.000 with an interest rate of 3.75%. 1. What is the monthly payment? 1654.47 2. What is the total amount paid for the 15 vear term of the loan? 3. What is the interest that has been paid during the 15 year term of the loan year term of the loan? 49.805.98 41 Find the following for a 30-year loan of $145,000 with an interest rate of 4.25%. 4. What is the monthly payment? 13.31 5. What is the total amount paid for the 30 year term of the loan? 5 b. What is the interest that has been paid during the 30 year term of the loan? loan? 256,79359 he loan? 11,79 Home ownership has other expenses, including property taxes, homeowner's insurance, and utilities. The annual property tax can be estimated as 1% of the amount borrowed and the annual homeowner's insurance can be estimated as 2% of the amount borrowed. U5XDIO 7. For a mortgage of $145,000, find the following. 145,000 a. What is the MONTHLY amount of property tax. 120.85 b. What is the MONTHLY amount of homeowner's insurance. = 241.166 1450 20.85Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started