Answered step by step

Verified Expert Solution

Question

1 Approved Answer

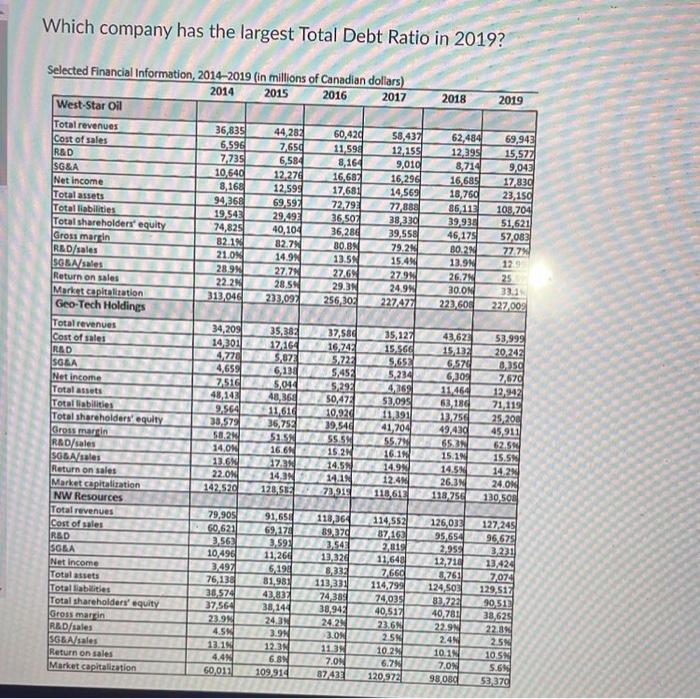

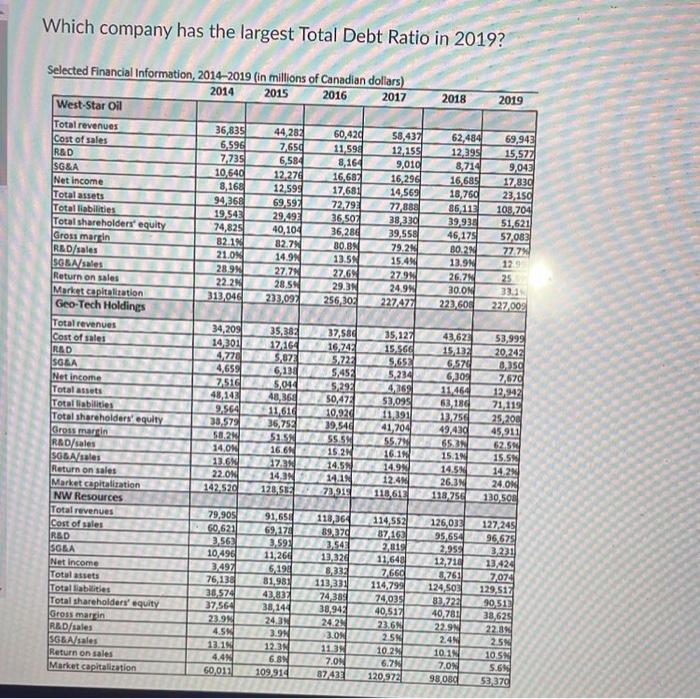

do it nowww Which company has the largest Total Debt Ratio in 2019? Selected Financial Information, 2014-2019 (in millions of Canadian dollars) 2014 2015 2016

do it nowww

Which company has the largest Total Debt Ratio in 2019? Selected Financial Information, 2014-2019 (in millions of Canadian dollars) 2014 2015 2016 2017 2018 2019 West-Star Oil Total revenues Cost of sales R&D SG&A Net income Total assets Total liabilities Total shareholders' equity Gross margin R&D/sales SGBA/sales Return on sales Market capitalization Geo-Tech Holdings Total revenues Cost of sales RAD SG&A Net income Total assets Total liabilities Total shareholders' equity Gross margin R&D/sales SG&A/sales Return on sales Market capitalization NW Resources Total revenues Cost of sales R&D SG&A Net income Total assets Total liabilities Total shareholders' equity Gross margin R&D/sales SG&A/sales Return on sales Market capitalization 36,835 44,282 60,420 6,596 7,650 11,598 7,735 6,584 8,164 10,640 12,276 16,687 8,168 12,599 17,681 94,368 69,597 72,79 19,543 29,493 36,507 74,825 40,104 36,286 82.1% 82.7% 80.8% 21.0% 14.9% 13.5% 28.9% 27.7% 27,6% 22.2% 28.5% 29.3 313,046 233,092 256,302 34,209 35,382 37,580 14,301 17164 16,742 4,778 5,873 5,722 4,659 6,13 5.452 7.516 5,044 5,292 48,368 50,472 11,616 10,920 36,752 39,546 51.5 55.59 16.6 15 2 17.34 14.5% 14.3 14.1% 128,582 73,919 91,658 118,364 69,178 89.370 3.592 3,54 13,326 8,33 113,331 74,389 38,942 24.29 3.0 11.3 48,143 9,564 33,579 58.29 14,0 13.6% 22.0% 142.520 79,905 60,621 3,563 10,496 3497 76,138 38,574 37,564 23.9% 4.5% 13.1% 4.4% 60,011 11,26 6,198 81,981 43,832 38,144 24.3% 3.9 12.3 6.8% 109.914 7.0% 87 433 58,437 62,484 69,943 12,155 12,395 15,577 9,010 8,714 9,043 16,296 16,685 17,830 14,569 18,760 23,150 77,888 86,113 108,704 38,330 39.938 51,621 39,558 46,175 57,083 79.2% 80.2% 77.7% 15.4% 13.9% 12.9 27.9% 26.7% 25 24.9% 30.0 33.1% 227.477 223,608 227,009 35,127 43,623 53,999 15.566 15,132 20,242 5.653 6.570 8.350 5,234 6,30% 7,670 4,36% 11,464 12,942 $3,095 63,186 71,119 11,391 13,756 25,208 41,704 49,430 45,911 55.7% 65.3 62.5% 16.1% 15.1% 15.5% 14.9% 14.5 14.2% 12.4 26.3% 24.0 118,613 118.756 130.508 114,552 126,033 127,245 87,163 95,654 96,675 2,819 2,959 3.231 11,648 12,718 13,424 7,660 8761 7,074 114,799 124,503 129,517 74,035 83,722 90,513 40,517 40,781 38,625 23.6% 22.9 22.8% 2.5% 2.5% 10.2% 10.5% 6.7 5.6% 120,972 53.370 2.4% 10.1% 7.0% 98,080

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started