Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do it on a piece of paper with proper handwriting. do all the steps, ut must be exactly like an example problem provided below. if

Do it on a piece of paper with proper handwriting. do all the steps, ut must be exactly like an example problem provided below. if done incorrectly or miss a step. i will be preety honest in the feedback and thumps down will be given.

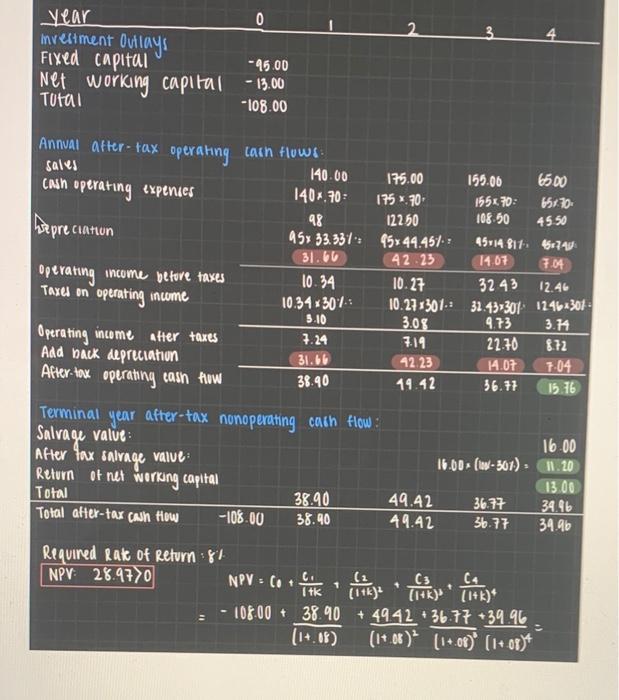

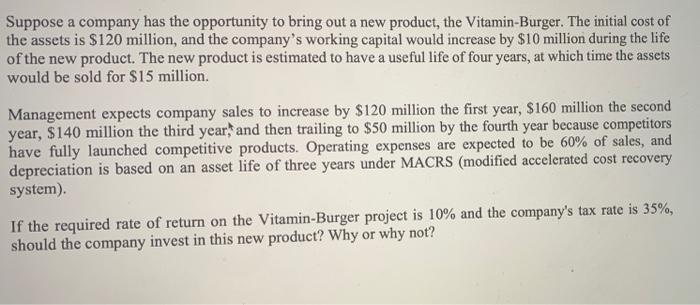

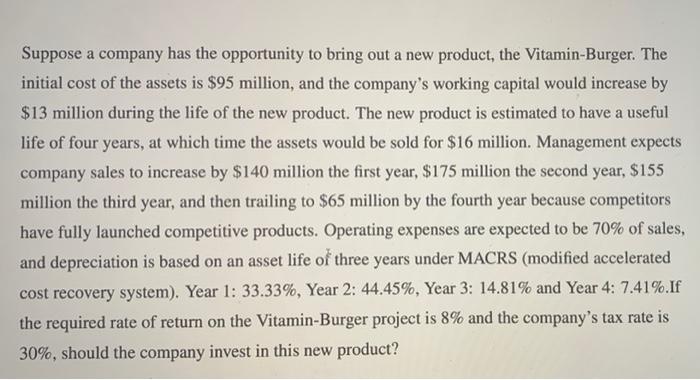

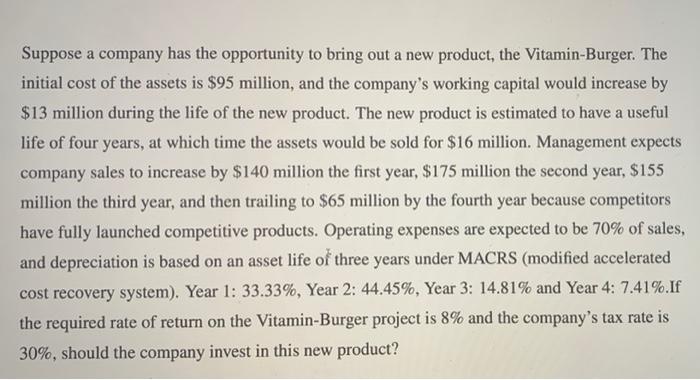

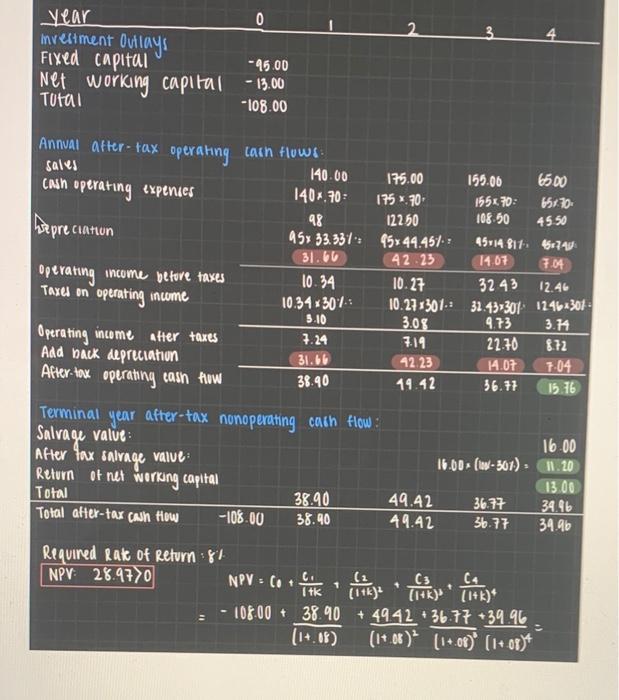

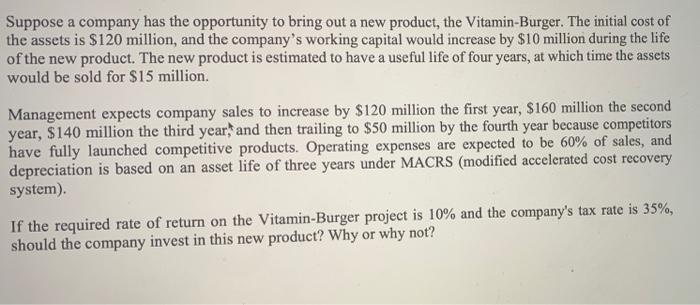

Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $95 million, and the company's working capital would increase by $13 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $16 million. Management expects company sales to increase by $140 million the first year, $175 million the second year, $155 million the third year, and then trailing to $65 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 70% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system). Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%. If the required rate of return on the Vitamin-Burger project is 8% and the company's tax rate is 30%, should the company invest in this new product? Year 0 Ireltment Outlays Fixed capital -45.00 Net working capital - 13.00 TUFAI -108.00 Annval after-tax operating cash flows sales 140.00 175.00 155.06 6500 Cash operating expenses 1404.70 175 70 155270: 6670 12250 108.50 45.50 Depreciation 95% 33.331 452 44.451 : 45714 811 574 31.66 42.23 14.07 7.04 operating income before taxes 10.34 10.27 32 43 12.45 Taxel on operating income 10.34*307 10.27301.: 32.433301 12462301 - 5:10 3.08 4.73 3.11 Operating income after taxes 7.24 7.19 22.70 872 Add back depreciation 31.66 42.23 14.07 7:04 After-tax operating cash how 38.90 19.42 36.17 Terminal year after-tax nonoperating cash flow : Salvage value 16.00 After tax salvage value 16.00-(ww-301) - 11.20 Return of net working capital 13.00 Total 38.90 49.42 36.77 34 9b Total after-tax con fiou -108.00 38.40 49.42 36.77 34.96 15.16 Required Rate of Return: 81 NPV 28.9770 NPV = co the care C4 Channel (14k)(1+k)* - 108.00 + 38.90 + 4942 3677 +39.96 (14.08) (11.08) (14.00) (1+.01)* Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $120 million, and the company's working capital would increase by $10 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $15 million. Management expects company sales to increase by $120 million the first year, $160 million the second year, $140 million the third year, and then trailing to $50 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 60% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system) If the required rate of return on the Vitamin-Burger project is 10% and the company's tax rate is 35%, should the company invest in this new product? Why or why not Eaxmple problem.

Actual problem

This is my second time asking the same question. please do it correctly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started