Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fog Lifter Coffee Roasting Company of Benicia, California roasts two unique blends of coffee beans: Fog Lifter and Midnight Oil. These unique blends are

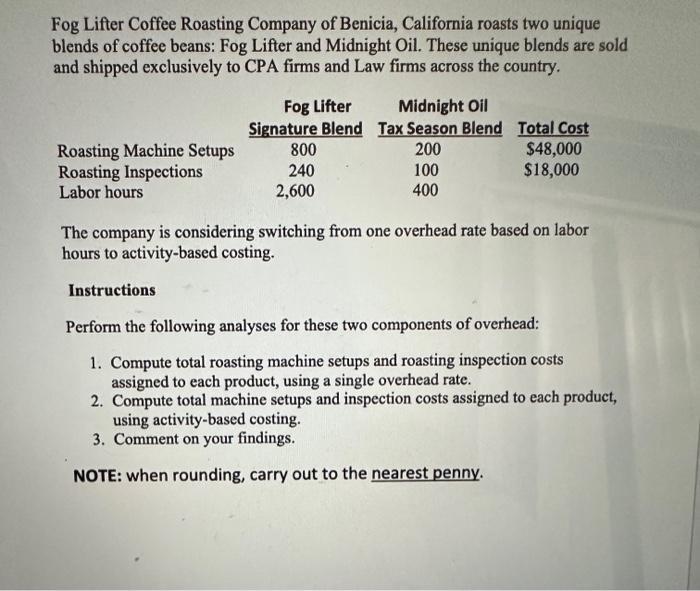

Fog Lifter Coffee Roasting Company of Benicia, California roasts two unique blends of coffee beans: Fog Lifter and Midnight Oil. These unique blends are sold and shipped exclusively to CPA firms and Law firms across the country. Roasting Machine Setups Roasting Inspections Labor hours Fog Lifter Midnight Oil Signature Blend Tax Season Blend 200 800 240 2,600 100 400 Total Cost $48,000 $18,000 The company is considering switching from one overhead rate based on labor hours to activity-based costing. Instructions Perform the following analyses for these two components of overhead: 1. Compute total roasting machine setups and roasting inspection costs assigned to each product, using a single overhead rate. 2. Compute total machine setups and inspection costs assigned to each product, using activity-based costing. 3. Comment on your findings. NOTE: when rounding, carry out to the nearest penny.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute total roasting machine setups and roasting inspection costs assigned to each product using a single overhead rate Total labor hours Fog Lifter 2600 labor hours Midnight Oil 200 labor hours O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started