Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do not include Microsoft, google and apple Image transcription text Final Grade Weight This assignment is worth 15% of your final grade Instructions Each student

Do not include Microsoft, google and apple

Image transcription text

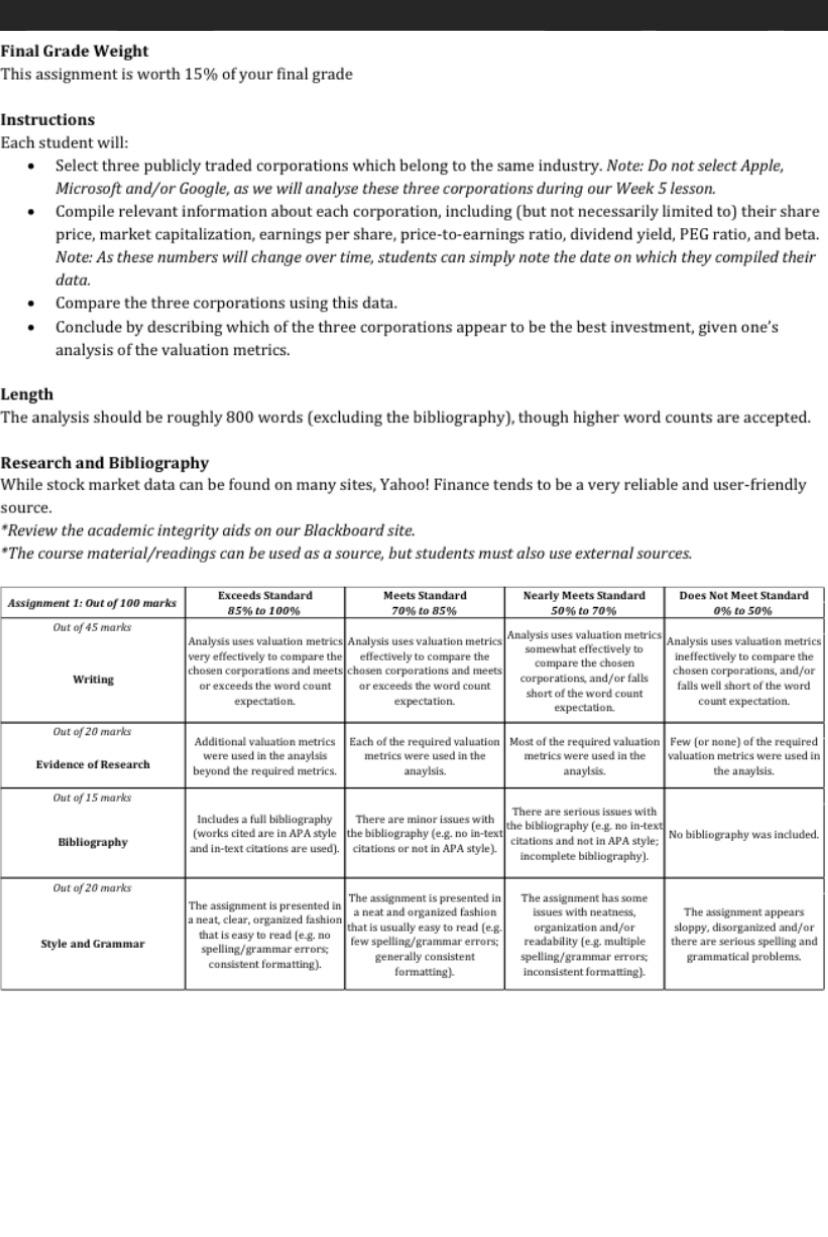

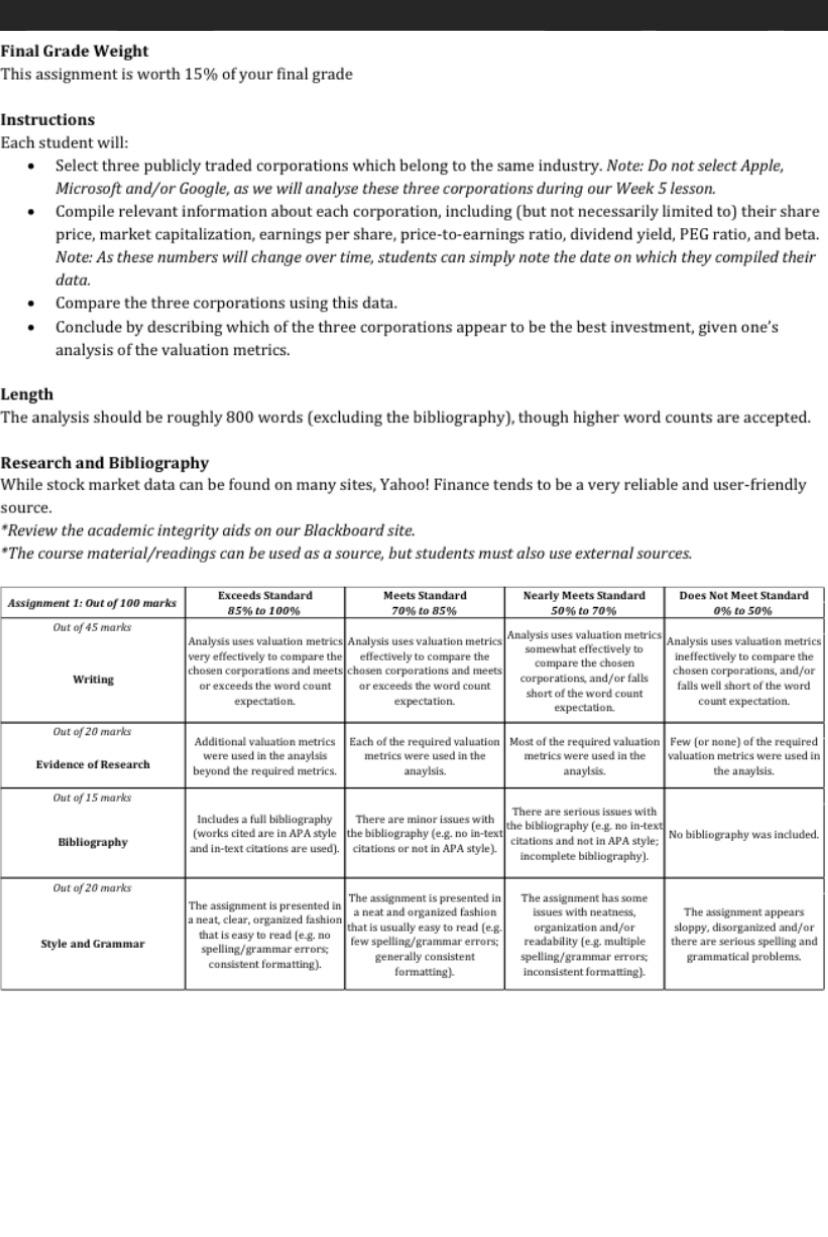

Final Grade Weight This assignment is worth 15% of your final grade Instructions Each student will:

Select three publicly traded corporations which belong to the same industry. Note: Do not select Apple,

Final Grade Weight This assignment is worth 15% of your final grade Instructions Each student will: Select three publicly traded corporations which belong to the same industry. Note: Do not select Apple, Microsoft and/or Google, as we will analyse these three corporations during our Week 5 lesson. Compile relevant information about each corporation, including (but not necessarily limited to) their share price, market capitalization, earnings per share, price-to-earnings ratio, dividend yield, PEG ratio, and beta. Note: As these numbers will change over time, students can simply note the date on which they compiled their data. Compare the three corporations using this data. Conclude by describing which of the three corporations appear to be the best investment, given one's analysis of the valuation metrics. Length The analysis should be roughly 800 words (excluding the bibliography), though higher word counts are accepted. Research and Bibliography While stock market data can be found on many sites, Yahoo! Finance tends to be a very reliable and user-friendly source. *Review the academic integrity aids on our Blackboard site. *The course material/readings can be used as a source, but students must also use external sources. Assignment 1: Out of 100 marks Out of 45 marks Writing Out of 20 marks Evidence of Research Out of 15 marks Bibliography Out of 20 marks Style and Grammar Exceeds Standard 85% to 100% Meets Standard 70% to 85% Nearly Meets Standard 50% to 70% Does Not Meet Standard 0% to 50% Analysis uses valuation metrics Analysis uses valuation metrics Analysis uses valuation metrics Analysis uses valuation metrics very effectively to compare the effectively to compare the chosen corporations and meets chosen corporations and meets or exceeds the word count expectation Additional valuation metrics were used in the anaylsis beyond the required metrics. Includes a full bibliography (works cited are in APA style and in-text citations are used). The assignment is presented in a neat, clear, organized fashion that is easy to read (e.g. no spelling/grammar errors; consistent formatting). or exceeds the word count expectation. Each of the required valuation metrics were used in the anaylsis. There are minor issues with the bibliography (e.g. no in-text citations or not in APA style). The assignment is presented in a neat and organized fashion that is usually easy to read (e.g few spelling/grammar errors; generally consistent formatting). somewhat effectively to compare the chosen corporations, and/or falls short of the word count expectation. ineffectively to compare the chosen corporations, and/or falls well short of the word count expectation. Most of the required valuation Few (or none) of the required metrics were used in the valuation metrics were used in the anaylsis. anaylsis. There are serious issues with the bibliography (e.g. no in-text citations and not in APA style: incomplete bibliography). The assignment has some issues with neatness, organization and/or readability (e.g. multiple spelling/grammar errors; inconsistent formatting). No bibliography was included. The assignment appears sloppy, disorganized and/or there are serious spelling and grammatical problems.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started