Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do only part b please. Question 2 (60 marks). A garment manufacturer is to develop a new fashion brand with a range of clothes to

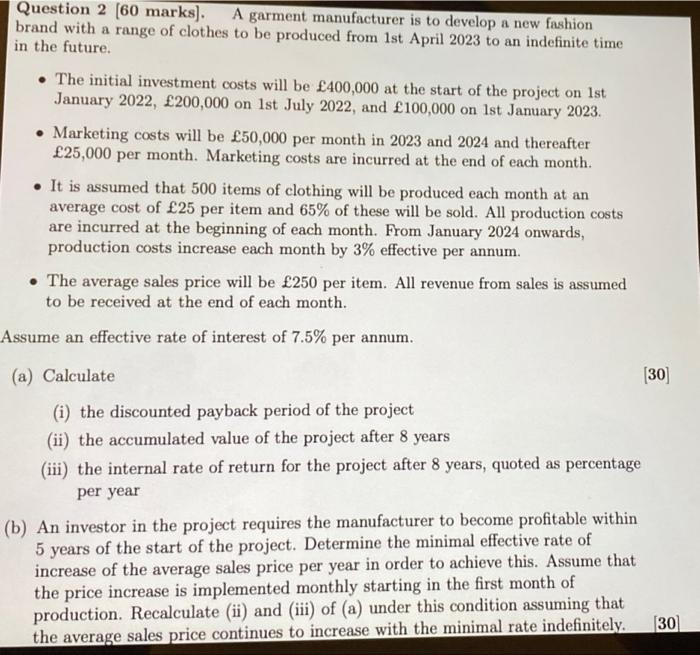

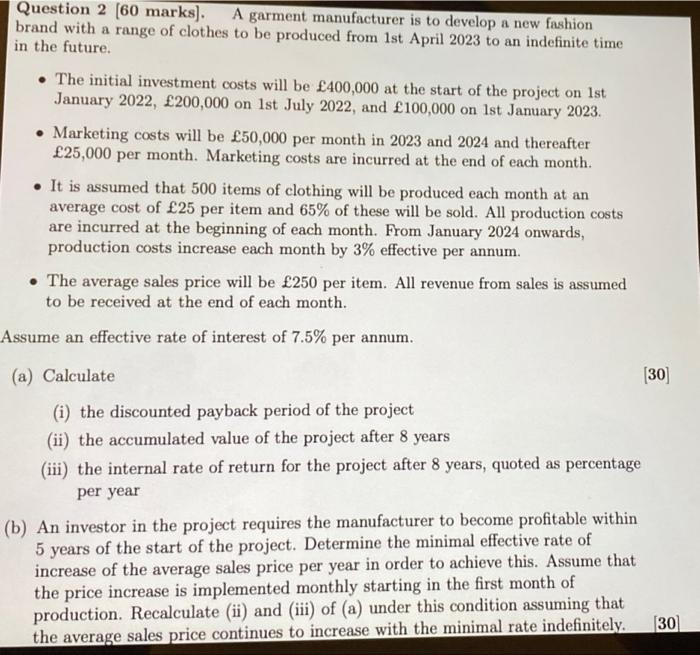

Do only part b please. Question 2 (60 marks). A garment manufacturer is to develop a new fashion brand with a range of clothes to be produced from 1st April 2023 to an indefinite time in the future. The initial investment costs will be 400,000 at the start of the project on 1st January 2022, 200,000 on 1st July 2022, and 100,000 on 1st January 2023. Marketing costs will be 50,000 per month in 2023 and 2024 and thereafter 25,000 per month. Marketing costs are incurred at the end of each month. . It is assumed that 500 items of clothing will be produced each month at an average cost of 25 per item and 65% of these will be sold. All production costs are incurred at the beginning of each month. From January 2024 onwards, production costs increase each month by 3% effective per annum. The average sales price will be 250 per item. All revenue from sales is assumed to be received at the end of each month. Assume an effective rate of interest of 7.5% per annum. (a) Calculate (30) (i) the discounted payback period of the project (ii) the accumulated value of the project after 8 years (iii) the internal rate of return for the project after 8 years, quoted as percentage per year (b) An investor in the project requires the manufacturer to become profitable within 5 years of the start of the project. Determine the minimal effective rate of increase of the average sales price per year in order to achieve this. Assume that the price increase is implemented monthly starting in the first month of production. Recalculate (ii) and (iii) of (a) under this condition assuming that (30) the average sales price continues to increase with the minimal rate indefinitely. Question 2 (60 marks). A garment manufacturer is to develop a new fashion brand with a range of clothes to be produced from 1st April 2023 to an indefinite time in the future. The initial investment costs will be 400,000 at the start of the project on 1st January 2022, 200,000 on 1st July 2022, and 100,000 on 1st January 2023. Marketing costs will be 50,000 per month in 2023 and 2024 and thereafter 25,000 per month. Marketing costs are incurred at the end of each month. . It is assumed that 500 items of clothing will be produced each month at an average cost of 25 per item and 65% of these will be sold. All production costs are incurred at the beginning of each month. From January 2024 onwards, production costs increase each month by 3% effective per annum. The average sales price will be 250 per item. All revenue from sales is assumed to be received at the end of each month. Assume an effective rate of interest of 7.5% per annum. (a) Calculate (30) (i) the discounted payback period of the project (ii) the accumulated value of the project after 8 years (iii) the internal rate of return for the project after 8 years, quoted as percentage per year (b) An investor in the project requires the manufacturer to become profitable within 5 years of the start of the project. Determine the minimal effective rate of increase of the average sales price per year in order to achieve this. Assume that the price increase is implemented monthly starting in the first month of production. Recalculate (ii) and (iii) of (a) under this condition assuming that (30) the average sales price continues to increase with the minimal rate indefinitely

Do only part b please. Question 2 (60 marks). A garment manufacturer is to develop a new fashion brand with a range of clothes to be produced from 1st April 2023 to an indefinite time in the future. The initial investment costs will be 400,000 at the start of the project on 1st January 2022, 200,000 on 1st July 2022, and 100,000 on 1st January 2023. Marketing costs will be 50,000 per month in 2023 and 2024 and thereafter 25,000 per month. Marketing costs are incurred at the end of each month. . It is assumed that 500 items of clothing will be produced each month at an average cost of 25 per item and 65% of these will be sold. All production costs are incurred at the beginning of each month. From January 2024 onwards, production costs increase each month by 3% effective per annum. The average sales price will be 250 per item. All revenue from sales is assumed to be received at the end of each month. Assume an effective rate of interest of 7.5% per annum. (a) Calculate (30) (i) the discounted payback period of the project (ii) the accumulated value of the project after 8 years (iii) the internal rate of return for the project after 8 years, quoted as percentage per year (b) An investor in the project requires the manufacturer to become profitable within 5 years of the start of the project. Determine the minimal effective rate of increase of the average sales price per year in order to achieve this. Assume that the price increase is implemented monthly starting in the first month of production. Recalculate (ii) and (iii) of (a) under this condition assuming that (30) the average sales price continues to increase with the minimal rate indefinitely. Question 2 (60 marks). A garment manufacturer is to develop a new fashion brand with a range of clothes to be produced from 1st April 2023 to an indefinite time in the future. The initial investment costs will be 400,000 at the start of the project on 1st January 2022, 200,000 on 1st July 2022, and 100,000 on 1st January 2023. Marketing costs will be 50,000 per month in 2023 and 2024 and thereafter 25,000 per month. Marketing costs are incurred at the end of each month. . It is assumed that 500 items of clothing will be produced each month at an average cost of 25 per item and 65% of these will be sold. All production costs are incurred at the beginning of each month. From January 2024 onwards, production costs increase each month by 3% effective per annum. The average sales price will be 250 per item. All revenue from sales is assumed to be received at the end of each month. Assume an effective rate of interest of 7.5% per annum. (a) Calculate (30) (i) the discounted payback period of the project (ii) the accumulated value of the project after 8 years (iii) the internal rate of return for the project after 8 years, quoted as percentage per year (b) An investor in the project requires the manufacturer to become profitable within 5 years of the start of the project. Determine the minimal effective rate of increase of the average sales price per year in order to achieve this. Assume that the price increase is implemented monthly starting in the first month of production. Recalculate (ii) and (iii) of (a) under this condition assuming that (30) the average sales price continues to increase with the minimal rate indefinitely

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started