Answered step by step

Verified Expert Solution

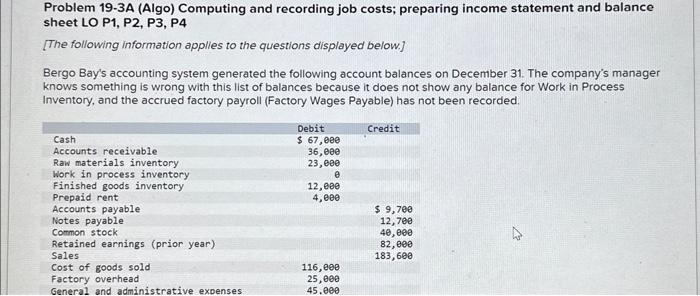

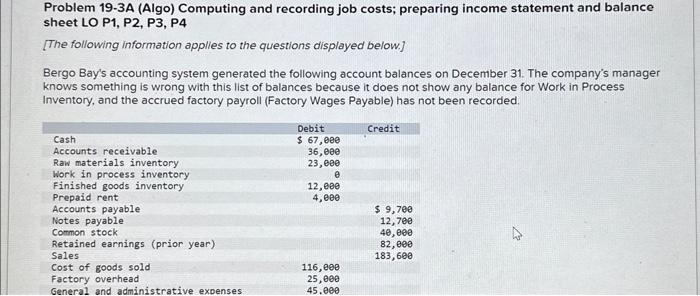

Question

1 Approved Answer

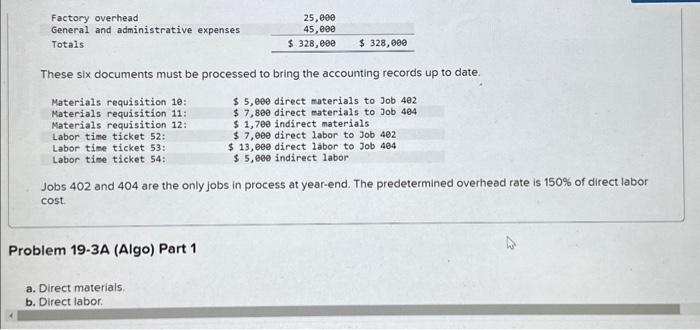

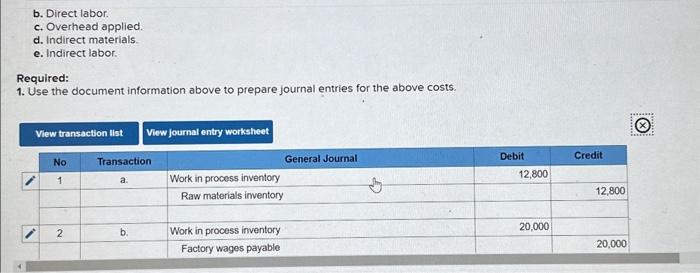

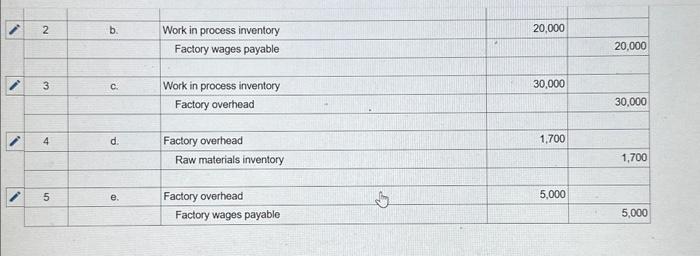

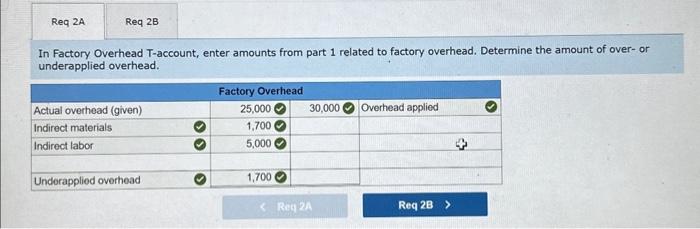

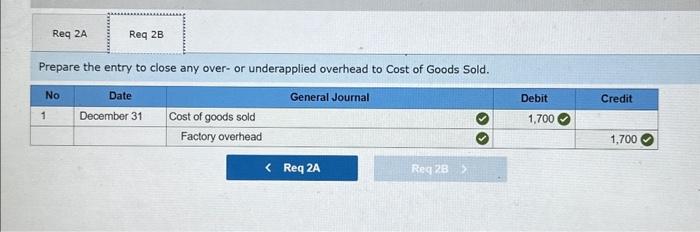

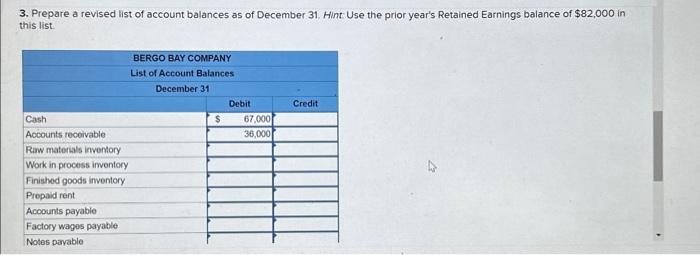

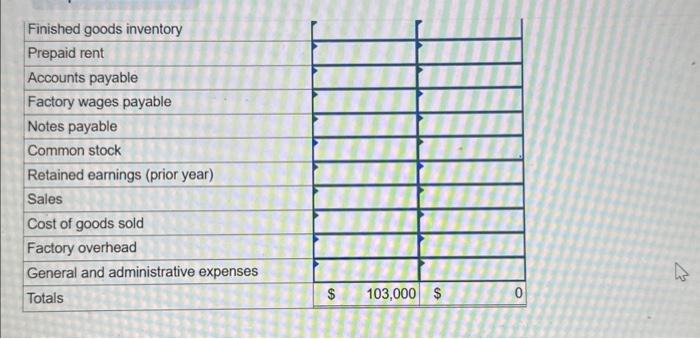

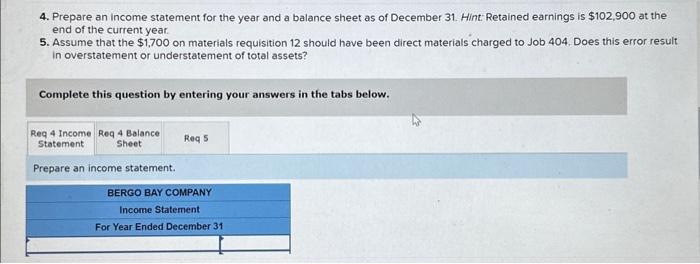

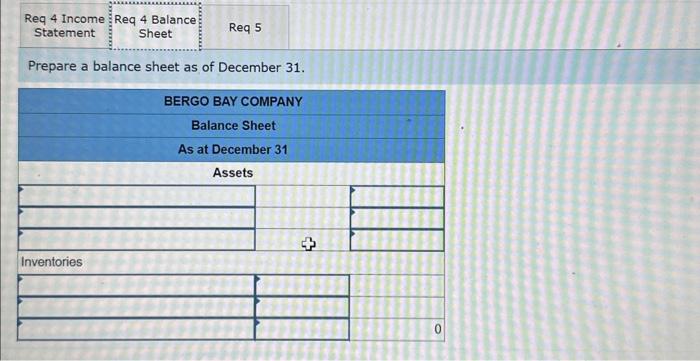

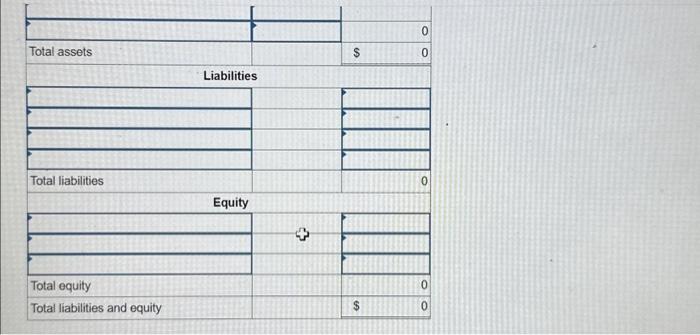

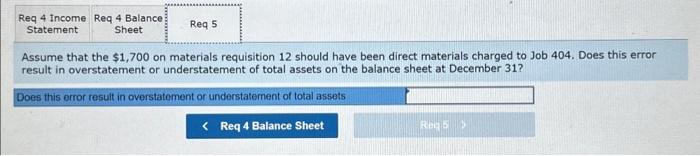

do part 3,4 and 5. please. repare the entry to close any over- or underapplied overhead to Cost of Goods Sold. 3. Prepare a revised

do part 3,4 and 5. please.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started