do part B!

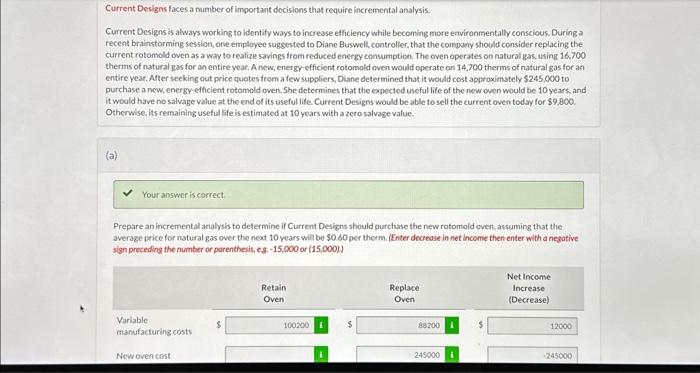

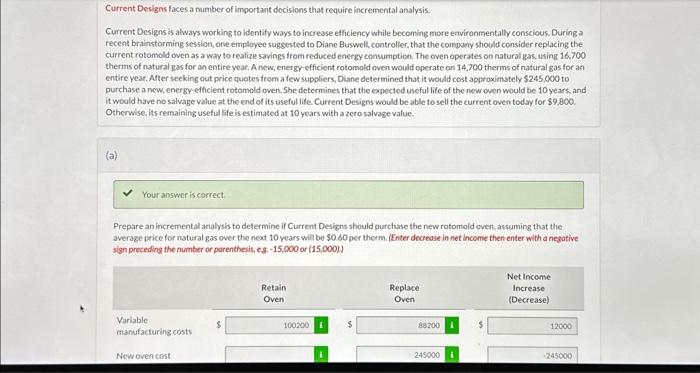

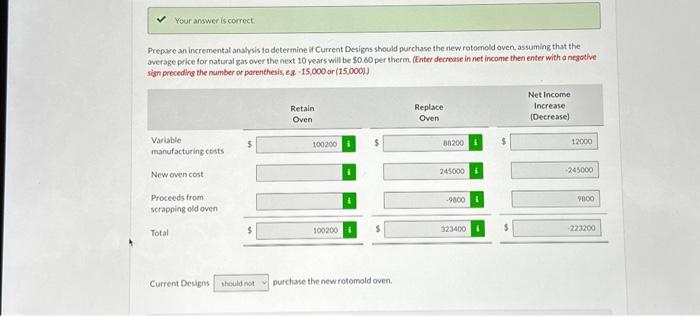

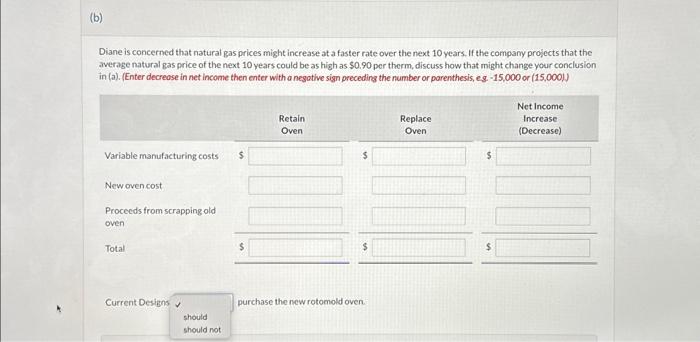

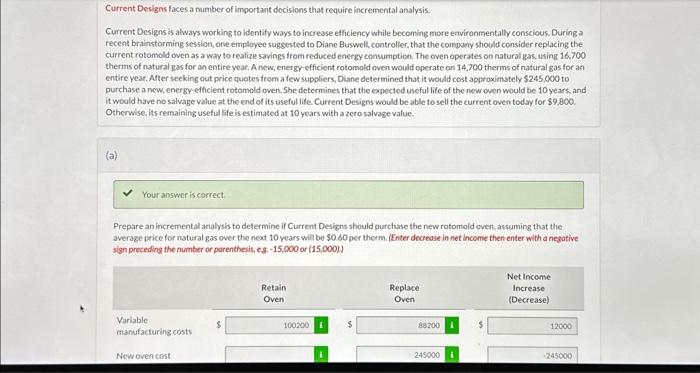

Your answer is correct. Prepare an incremental anulvsis to determine if Current Designs should purchase the new rotomold oven, assuming that the average price for natural gas over the next 10 years will be 50.60 per therm. (Enter decrease in net income then enter with a negotive sign preceding the number or parenthesis, es-15,000 or (15,000) Current Designs purchase the new rotomold oven. Diane is concerned that natural gas prices might increase at a faster rate over the next 10 years, If the compamy projects that the awerage natural gas price of the next 10 years could be as high as \\( \\$ 0.90 \\) per therm, discuss how that might change your conclusion in (a). (Enter decrease in net income then enter with a negotive sign preceding the number or parenthesis, eg. - 15,000 or (15,000), Current Designs faces a number of important decisions that require incremental analysis: Current Designs is always working to identify wass to increase efficiency while becoming more ertvironmentally conscious. During a recent brainstorming session, one employee suggested to Diane Buswell, controller, that the company should consider replacing the current rotomold oven as a way to realize savings from reduced energy consumpticn. The oven operates on natural gas, using 16,700 therms of natural gas for an entire year. A new, energy efficient rotomold oven would operate on 14,700 therms of natural gas for an entire year. Atter seeking out price quotes from a few suppliers, Diane determined that it would cost approximately \\( \\$ 245,000 \\) to purchase a new, energy-efficient rotomold oven. She determines that the expected useful life of the new oven would be 10 years, and it would have no salvage value at the end of its useful life. Current Designs would be able to sell the current oven today for \\( \\$ 9,800 \\). Otherwise, its remaining useful life is estimated at 10 years with a zero salvage value. (a) Your answer is correct Prepare an incremental analysis to determine if Current Designs should purchase the new rotomold oven, assuming that the average price for natural gas over the noct 10 years will be 50.60 per therm. (Enter decrease in net income then enter with a negotive sign preceding the number or parenthesis, es - 15,000 or \\( (15,000)) \\)