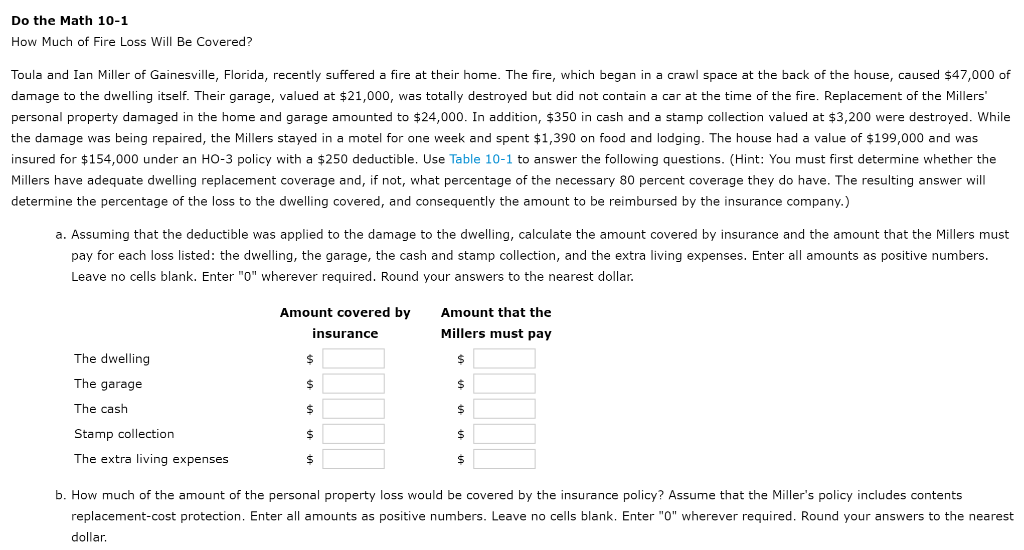

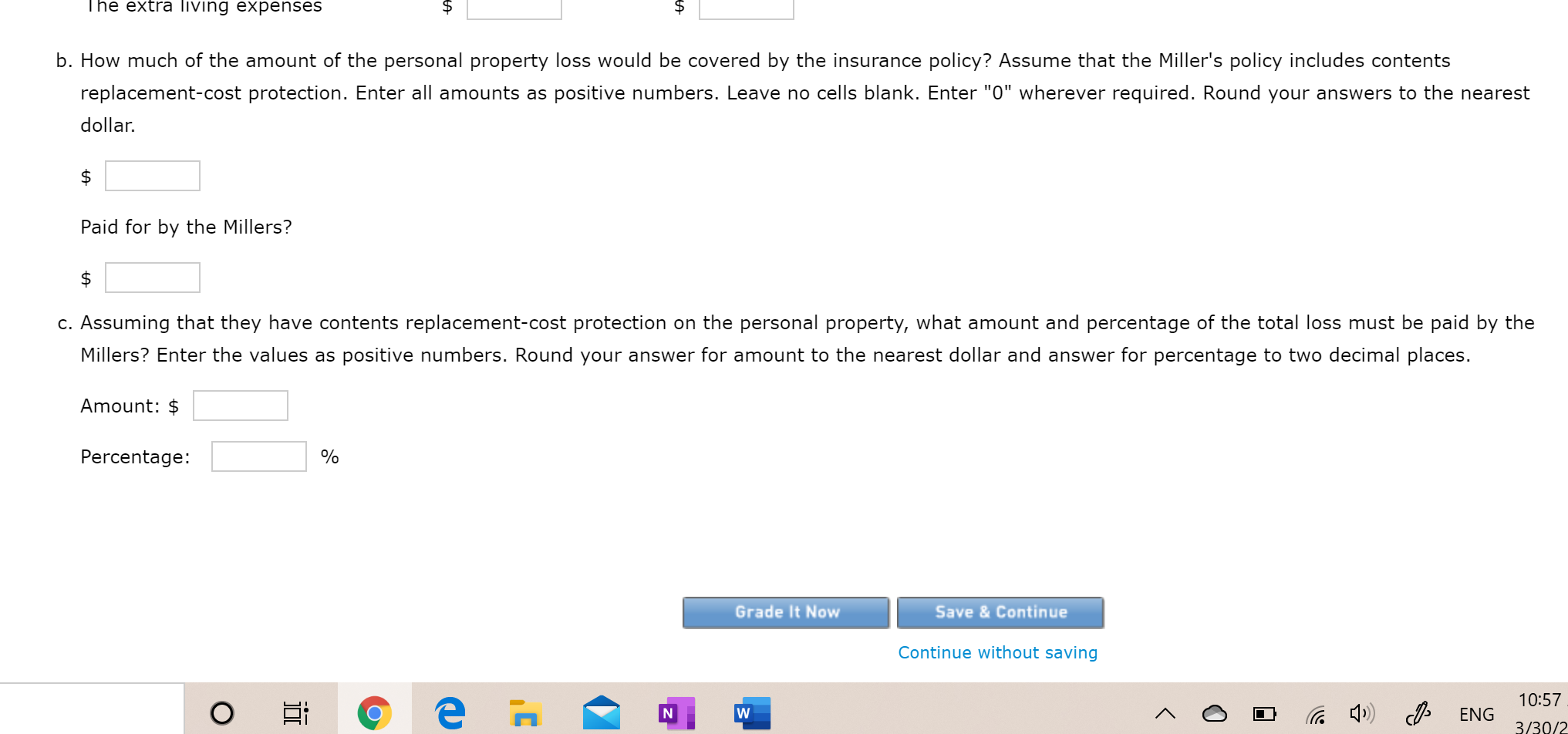

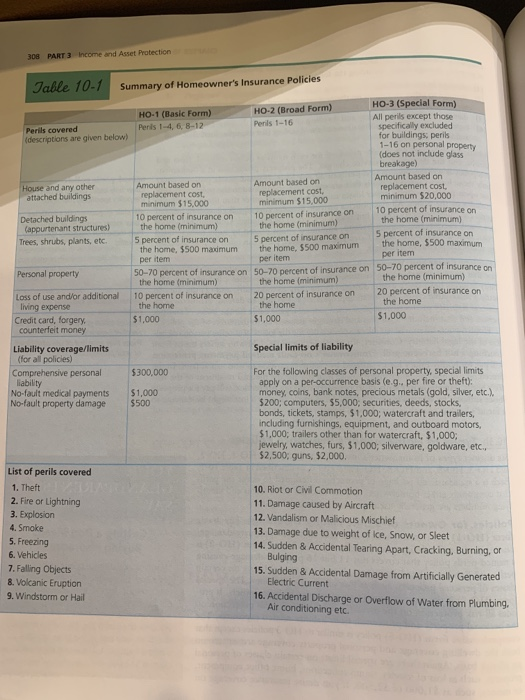

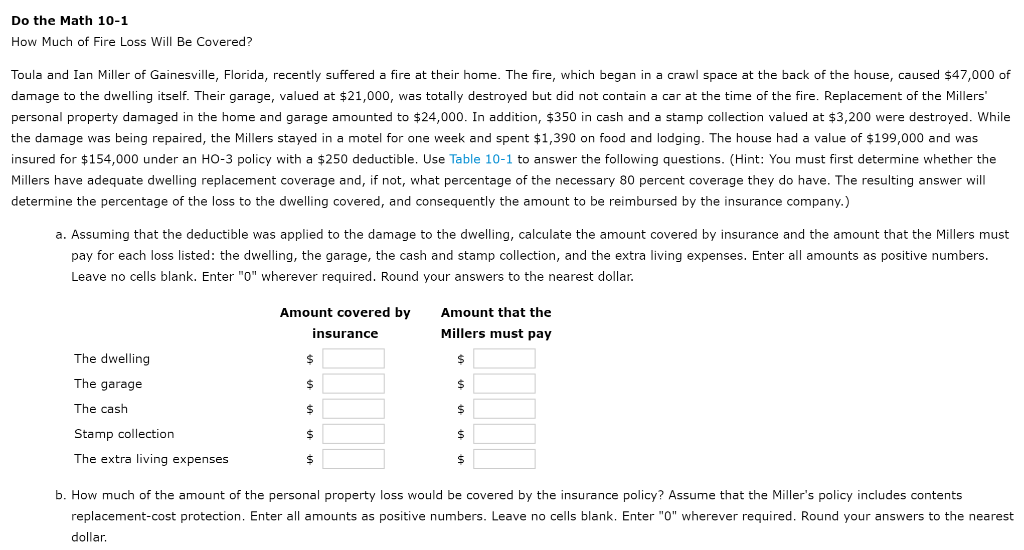

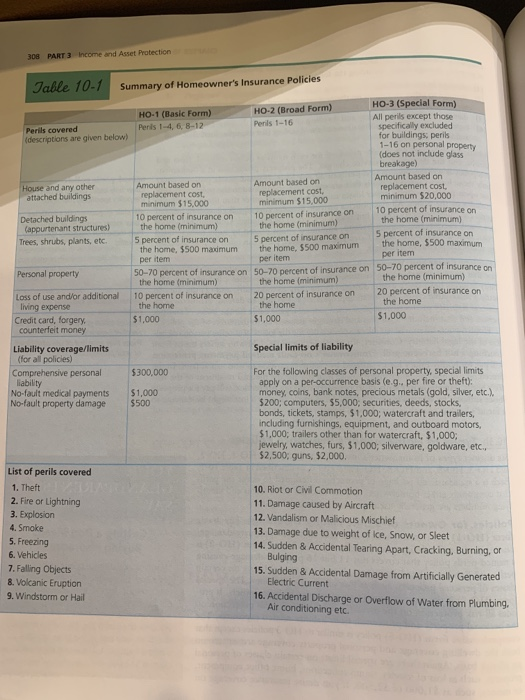

Do the Math 10-1 How Much of Fire Loss Will Be Covered? Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $47,000 of damage to the dwelling itself. Their garage, valued at $21,000, was totally destroyed but did not contain a car at the time of the fire. Replacement of the Millers' personal property damaged in the home and garage amounted to $24,000. In addition, $350 in cash and a stamp collection valued at $3,200 were destroyed. While the damage was being repaired, the Millers stayed in a motel for one week and spent $1,390 on food and lodging. The house had a value of $199,000 and was insured for $154,000 under an HO-3 policy with a $250 deductible. Use Table 10-1 to answer the following questions. (Hint: You must first determine whether the Millers have adequate dwelling replacement coverage and, if not, what percentage of the necessary 80 percent coverage they do have. The resulting answer will determine the percentage of the loss to the dwelling covered, and consequently the amount to be reimbursed by the insurance company.) a. Assuming that the deductible was applied to the damage to the dwelling, calculate the amount covered by insurance and the amount that the Millers must pay for each loss listed: the dwelling, the garage, the cash and stamp collection, and the extra living expenses. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. Amount covered by insurance Amount that the Millers must pay The dwelling The garage The cash Stamp collection The extra living expenses b. How much of the amount of the personal property loss would be covered by the insurance policy? Assume that the Miller's policy includes contents replacement-cost protection. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. The extra living expenses " b. How much of the amount of the personal property loss would be covered by the insurance policy? Assume that the Miller's policy includes contents replacement-cost protection. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. $ Paid for by the Millers? $ c. Assuming that they have contents replacement-cost protection on the personal property, what amount and percentage of the total loss must be paid by the Millers? Enter the values as positive numbers. Round your answer for amount to the nearest dollar and answer for percentage to two decimal places. Amount: $ Percentage: % Grade It Now Save & Continue Continue without saving 10:57 O e um ^ O o ra 4) OS ENG 3/30/2 308 PART 3 Income and Asset Protection Table 10-1 Summary of Homeowner's Insurance Policies HO-3 (Special Form) HO-1 (Basic Form) HO-2 (Broad Form) All perils except those Perils covered Peris 1-4, 6, 8-12 Perils 1-16 specifically excluded (descriptions are given below) for buildings perils 1-16 on personal property (does not include glass breakage) Amount based on House and any other Amount based on Amount based on replacement cost, attached buildings replacement cost replacement cost, minimum $20.000 minimum $15,000 minimum $15.000 Detached buildings 10 percent of insurance on 10 percent of insurance on 10 percent of insurance on Cappurtenant structures) the home (minimum) the home (minimum) the home (minimum) Trees, shrubs, plants, etc. 5 percent of insurance on 5 percent of insurance on 5 percent of insurance on the home $500 maximum the home, $500 maximum the home, 5500 maximum per item per item per item Personal property 50-70 percent of insurance on 50-70 percent of Insurance on 50-70 percent of insurance on the home (minimum) the home (minimum) the home (minimum) Loss of use and/or additional 10 percent of insurance on 20 percent of insurance on 20 percent of insurance on living expense the home the home the home Credit card, forgery. $1,000 $1,000 $1,000 counterfeit money Special limits of liability Liability coverage/limits for all policies) Comprehensive personal liability No-fault medical payments No-fault property damage $300,000 $1,000 $500 For the following classes of personal property, special limits apply on a per-occurrence basis (e.g. per fire or theft): money, coins, bank notes, precious metals (gold, silver, etc.) $200: computers, $5,000, securities, deeds, stocks, bonds, tickets, stamps, $1,000; watercraft and trailers, including furnishings, equipment, and outboard motors, $1,000; trailers other than for watercraft, $1,000; jewelry, watches, furs, $1,000; silverware, goldware, etc., $2,500: guns, $2,000. List of perils covered 1. Theft 2. Fire or Lightning 3. Explosion 4. Smoke 5. Freezing 6. Vehicles 7. Falling Objects 8. Volcanic Eruption 9. Windstorm or Hail 10. Riot or Civil Commotion 11. Damage caused by Aircraft 12. Vandalism or Malicious Mischief 13. Damage due to weight of ice, Snow, or Sleet 14. Sudden & Accidental Tearing Apart, Cracking, Burning, or Bulging 15. Sudden & Accidental Damage from Artificially Generated Electric Current 16. Accidental Discharge or Overflow of Water from Plumbing, Air conditioning etc. Do the Math 10-1 How Much of Fire Loss Will Be Covered? Toula and Ian Miller of Gainesville, Florida, recently suffered a fire at their home. The fire, which began in a crawl space at the back of the house, caused $47,000 of damage to the dwelling itself. Their garage, valued at $21,000, was totally destroyed but did not contain a car at the time of the fire. Replacement of the Millers' personal property damaged in the home and garage amounted to $24,000. In addition, $350 in cash and a stamp collection valued at $3,200 were destroyed. While the damage was being repaired, the Millers stayed in a motel for one week and spent $1,390 on food and lodging. The house had a value of $199,000 and was insured for $154,000 under an HO-3 policy with a $250 deductible. Use Table 10-1 to answer the following questions. (Hint: You must first determine whether the Millers have adequate dwelling replacement coverage and, if not, what percentage of the necessary 80 percent coverage they do have. The resulting answer will determine the percentage of the loss to the dwelling covered, and consequently the amount to be reimbursed by the insurance company.) a. Assuming that the deductible was applied to the damage to the dwelling, calculate the amount covered by insurance and the amount that the Millers must pay for each loss listed: the dwelling, the garage, the cash and stamp collection, and the extra living expenses. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. Amount covered by insurance Amount that the Millers must pay The dwelling The garage The cash Stamp collection The extra living expenses b. How much of the amount of the personal property loss would be covered by the insurance policy? Assume that the Miller's policy includes contents replacement-cost protection. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. The extra living expenses " b. How much of the amount of the personal property loss would be covered by the insurance policy? Assume that the Miller's policy includes contents replacement-cost protection. Enter all amounts as positive numbers. Leave no cells blank. Enter "0" wherever required. Round your answers to the nearest dollar. $ Paid for by the Millers? $ c. Assuming that they have contents replacement-cost protection on the personal property, what amount and percentage of the total loss must be paid by the Millers? Enter the values as positive numbers. Round your answer for amount to the nearest dollar and answer for percentage to two decimal places. Amount: $ Percentage: % Grade It Now Save & Continue Continue without saving 10:57 O e um ^ O o ra 4) OS ENG 3/30/2 308 PART 3 Income and Asset Protection Table 10-1 Summary of Homeowner's Insurance Policies HO-3 (Special Form) HO-1 (Basic Form) HO-2 (Broad Form) All perils except those Perils covered Peris 1-4, 6, 8-12 Perils 1-16 specifically excluded (descriptions are given below) for buildings perils 1-16 on personal property (does not include glass breakage) Amount based on House and any other Amount based on Amount based on replacement cost, attached buildings replacement cost replacement cost, minimum $20.000 minimum $15,000 minimum $15.000 Detached buildings 10 percent of insurance on 10 percent of insurance on 10 percent of insurance on Cappurtenant structures) the home (minimum) the home (minimum) the home (minimum) Trees, shrubs, plants, etc. 5 percent of insurance on 5 percent of insurance on 5 percent of insurance on the home $500 maximum the home, $500 maximum the home, 5500 maximum per item per item per item Personal property 50-70 percent of insurance on 50-70 percent of Insurance on 50-70 percent of insurance on the home (minimum) the home (minimum) the home (minimum) Loss of use and/or additional 10 percent of insurance on 20 percent of insurance on 20 percent of insurance on living expense the home the home the home Credit card, forgery. $1,000 $1,000 $1,000 counterfeit money Special limits of liability Liability coverage/limits for all policies) Comprehensive personal liability No-fault medical payments No-fault property damage $300,000 $1,000 $500 For the following classes of personal property, special limits apply on a per-occurrence basis (e.g. per fire or theft): money, coins, bank notes, precious metals (gold, silver, etc.) $200: computers, $5,000, securities, deeds, stocks, bonds, tickets, stamps, $1,000; watercraft and trailers, including furnishings, equipment, and outboard motors, $1,000; trailers other than for watercraft, $1,000; jewelry, watches, furs, $1,000; silverware, goldware, etc., $2,500: guns, $2,000. List of perils covered 1. Theft 2. Fire or Lightning 3. Explosion 4. Smoke 5. Freezing 6. Vehicles 7. Falling Objects 8. Volcanic Eruption 9. Windstorm or Hail 10. Riot or Civil Commotion 11. Damage caused by Aircraft 12. Vandalism or Malicious Mischief 13. Damage due to weight of ice, Snow, or Sleet 14. Sudden & Accidental Tearing Apart, Cracking, Burning, or Bulging 15. Sudden & Accidental Damage from Artificially Generated Electric Current 16. Accidental Discharge or Overflow of Water from Plumbing, Air conditioning etc