Do the Math 14-3

Market Price

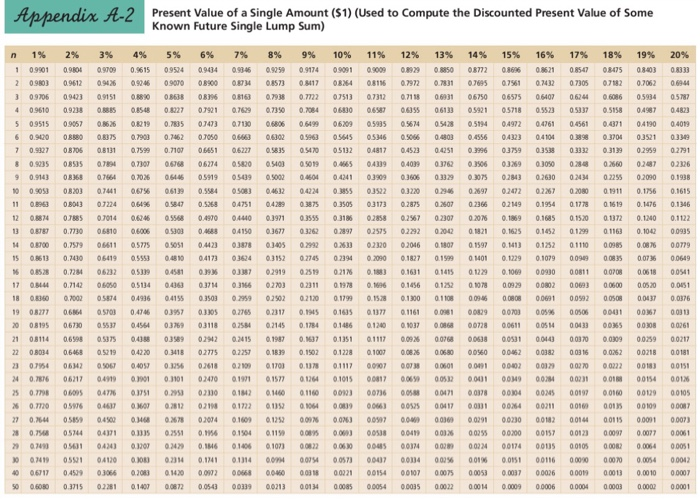

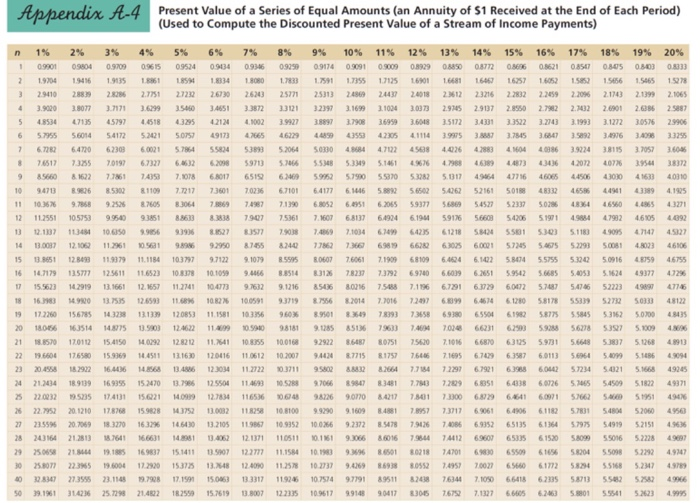

What is the market price of a $1,000, 7 percent bond paying a semiannual coupon if comparable market interest rates rise to 12 percent and the bond matures in 14 years? Round your answer to the nearest dollar. (Hint: Use Appendix A-2 and Appendix A-4.) Round 'Present value of a Single Amount' and 'Present value of a Series of Equal Amounts' in intermediate calculations to four decimal places.

$ ____

Anhendix A.2 Present Value of a Single Amount (S1) (Used to compute the Discounted Present Value of Some Known Future Single Lump Sum) 0.15.30 n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 09901 OURO 9709 0.961509574 09434 09366 959 09174 09091 090090.8929 9850 0877208696 0.862108547 034750800308333 2 098030961209426 0.92.46 0.9070 08900 0.8734 0.857) 0.81170 8264 0.8116 0.7972 0.7831 0.7695 0.7561 0.7432 07305 07182 0.7062 06944 309706 09493 09151 1 0 3638 08796 0815307933 0.7722 07513 07312 07113 06931 06750 06575 05407 062406086 05934 05782 0.961009238 BBS 0.8548 0.8027 071 070 07390 0.7084 06:00 0.6587 0.6355 0613305921 05718 05523 053 05158 0499704823 5 09515 09057 01626 02190,235 07473 0713006806 05499 0620905935 05674 05428 5194 04972 0.4761 04561 0.4371 0419004019 6 0.9429 088 0875 0.29030.7462 07050 w 6302 05203 0.5645 0.5346 0.5056 0.003 0.45560423 04104 0 2 0 019 7 0.9327 0.87060811 0.7599 07107 0.6651 0.6227 0.5835 0510 05132 04817 0.4523 0.4251 0.3996 03759 0.3538 03332 0.3139 0.2959 0.2791 8 0.9235 08535 0.7894 07307 09768 06274 0.5820 0.540) 0.5019 0.4665 04339 0.4099 0.376) 1906 039 03050 0.28 0.560 020 0226 9091430380764020606146 0.5919 05-09 0,5002 0.4604 0.434103909 0.3606 0339 0307 0M) 02610 0 0 229 02090 0.1938 1000 08203 0744100% 0.6139 0.5584 OSOR) 04632 04224 03355 3522 03220029.06 0297 0207202357 0200001911 0.1756 0.1615 11 089 0801302224064% 1847 008 04751 04790 0 0503173 02875 0.2507 02366 02149 0.1954 0.1778 0.1619 0.1476 0.1346 12 084 085 07014 06246 008 0.4970 04440 1921 0.3555 03185 0.2858 0.2567 0.2307 0.2076 0.1869 0.1685 0.1372 0.1240 0.1122 13 08780 0.7730 06:10 06006 0.5303 0.4688 0415003627 03262 02897 02575 0.2292 020 021 01635 0.1452 01299 011630.1042 0.0935 14 0900 0.7579 0411 05775 9051 0.4423 378 3.405 02992 O 023200204601807 01597 141) 0.1752 0.1110 00985 0.0026 00779 15061) 02410 06419 0.5553 0.4810 04173 0.3624 0.3152 02745 0.2394 0.2090 0.1827 0.1999 0.1401 0.1229 0.1079 0099 00 0026 0.0649 16 08528 0.7284 06232 0533904581 0.9% 0.338702919 0.19 0.21 0.1883 0.1631 0.1415 0.12290.1069 0.0930 00811 0.0708 0.0618 0.0511 17 01 0.7142 00 05134 0.4 0.37 31 270302311 0.1978 0.16 0.1456 01282 0.1978 0.092900802 0003 0 0600 0050 00851 18 0.8360 0.7002 0.587404936 0.4155 0.3503 0.299 0.2502 02120 0.1799 0.1578 0.1300 0 .1108 00946 0.0008 0.0691 00992 0.0508 0.0437 0.0376 19 08277 0.6364 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0 .1945 0.1635 0.1377 0.1161 0.0981 0.0329 0.0703 0.05% 0 0506 000100 0 0013 2008195 06710 0 4554 0.3759 0.3118 25 2145 0.1784 0.1486 0.1240 0.101 000 000 0061100514 0043300 0000261 21 0.8114 0.6598 0.5375 0.4358 0.3589 02942 0 .2415 0.1987 0.1637 0.1351 0.1117 0.0926 0.0768 0.0538 0.0531 0.0143 00370 00 0025900217 22 08034 064680219 0422004413 02723 02 0180 .1502 01228 0.1007 00826 00680 0056000462 0.0382 0.0316 0. 02 00218 00181 23 0.2954 0642 OSO. 040 0.1256 0.2018 02199 0170) 0.17 01117 097 0033 0001 0002 00129 00270 0.0222 0.018300151 24 0.7816 06217 04190 001 0.1101 02470 191 1577 01264 0101500817 00690 0052 041 009 00231 0011 00154 0011 0.7798 06:00 0.4776 0.3751 0.2953 0.2330 01842 0.1460 0.11600 ) 0076 00588 00471 00128 00104 0015 00197 00160 00129 00105 0.7720 0506 0469 MOJ 0.2012 02180172 01 00119 006) 00125 00111 0011 004 00211 00169 001S00109 00087 27 0.764 0.5859 0.4502 0.3468 0.2678 0.2094 0.1609 0.125 0.01% 0.0%) 0.0597 0.00 0 0369 0.0291 0.0230 0.0182 00144 0.0115 0.0091 0.0073 23 0.78 05744 04171 35 02551 016 01504119 000 000 0018 0041) 001 00290020000157 0012300097 0.0077 00051 29 0.74905031 044) 0.207 0.1429 0.16 0.1406 0.107300022 0.0639 0085 00344 00289 002200174 00135 00105 0.0002 0.0064 0.0051 02419 051041200 ) 2014 0.1941 011144 009 00573 0047 004 003 0010011 00116 00000000000054 00042 80 0617 04529 03066 0.2083 0.142000W2 0 668 00180 0031800221 00154 00107 00075 00053 0.0037 00026 00019 00013 0.0010 00007 50 0.6030 0.3715 0.2281 0.1407 0.0172 0.0543 0.0339 0.0213 0.0134 0.0085 0.0054 0.0035 0.0022 0.0014 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001 00601 00900 010 Appendix A-4 Present Value of a series of Equal Amounts (an Annuity of S1 Received at the End of Each Period) (Used to Compute the Discounted Present Value of a Stream of Income Payments) n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% S 59 1.18 79204 104 105 104 10 5 7355171256801668 166 1657 16052155215056 155 157 2010 2 2 751 20 20 20 20 20 20 2018 21 22 26 2110 209 21065 0 0 37171 2546 052 01 297 16921004 2003 292 2907 2927 2102 2001 2027 15 5797 518 2.7908 3.608251720 2 0 1993 3127230529906 5.6014 5.6172 5201 SO 90 S 359 640 62309 5204560 4722 1963.24 315 325 67327 662 597) S SS 5.33 0 0 3 27 .761 7405 7.1078 1 65196 5 52 57980 SU USO 10 0713 826 530211097717 710 70216 67101 4177 61466 50 2161 01 1 41 11 10 9 7605 06 0 7 71 26.0951 6.2005 54527 5237 4 250 12 112551 105753 0540915 790 75361 71607 792 1) 1 1 10.00 956 9396 127 157 2018 2435971034 504 55001 5.30 5.1180 4.9095 47141 140 .0037 12.100 11.2361 9 9 2950 818588077827366 6.989 5.7345 54675 52293 SOBI 15 .8651 128493 119379 11.1184 10.37797122 3.5595 0607 76061 5.575553242 5.0916 45 1610712 125 12.5611 11652310378101059 46 514 316 78237 5.9543 5.6685 5.4053 5.1624 596 1291911661125 112741 0673 9.76329.1216 8536 8.0216 7503 6,0472 5.7087 5.474652223 4714 186 9 13755 200 1 102 10319 956 .2014 7.2016 6.1280 58178 553) 4112 1 122 16 1208530 019 58775 5.3162 20 1 4 S 50 22 11 98181 905 3506 567785327 5. 109 21 17010 M2 200 201 2026 25430 Z 59731 56 510 22 664 176501599 1 20416 117 000 87715 7.10 60113 5. 5.2009 27 57234 5621 2004 909 69 520 041 7066 5.2005 5 20 25 14015021 20 16 269. 00 8.01 7301 22795220121017870815282 021 0.1009209.1609 27 2016 2017 10 776 28 24164 213313 .7611 661 081 02 20371 1105110161 3660167 7 4412 GHS61520 29 75008 216 .185 1697 15:1411 507 12.2777 11.1584 10.199 8 30218 74701 6950961065.2204 55 5.7282 4942 303 .8077 22. 35 9.6004172320 153735 3.8 12.4050 11.5 1027379499 0 74957 70027 65660 617 5829 5.27 80 247 27.399 23.1148 3798 1719 15.046) 33317 119245 10.757497791 89511 824 7634 7.105066418 623055.8713 5502575824006 50 .131 142 25.72971.482 82990 5.619 1.2007 122375109617 9914890411 330 767 7.13 6.463 5201 59541 52234 7201