do the permananet and temporary differences for 2016-2020.

do 19-8

do temporary and permanent difference for 2016-2020

do 19-8

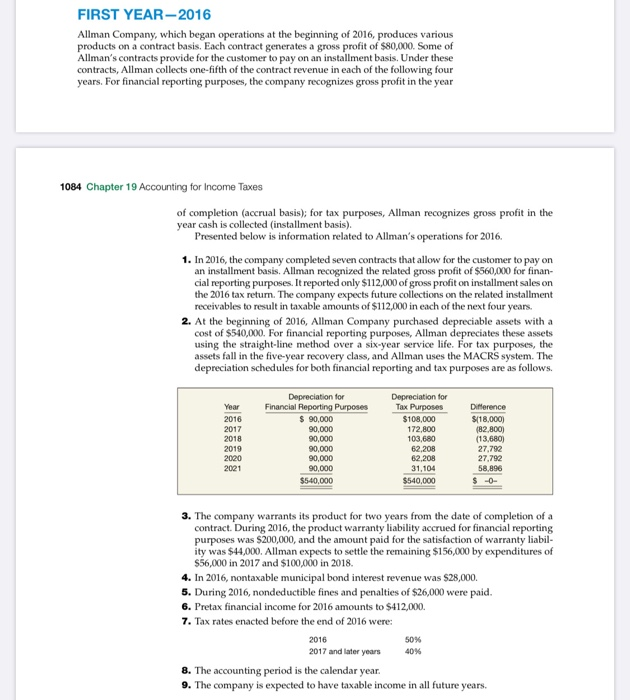

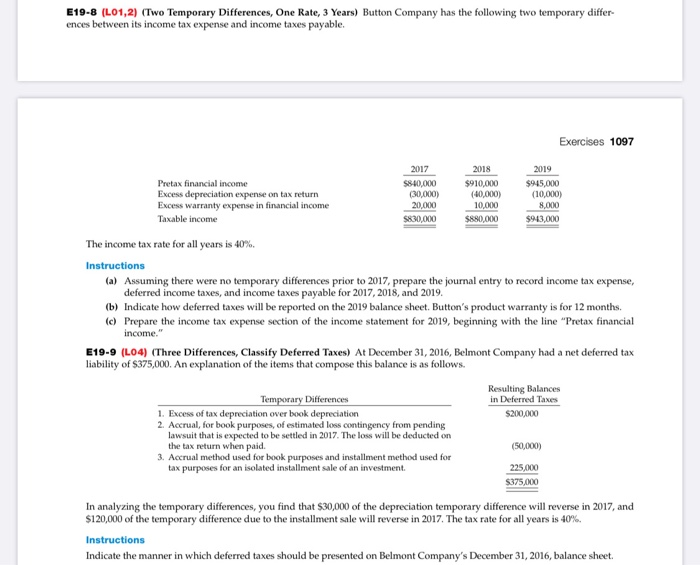

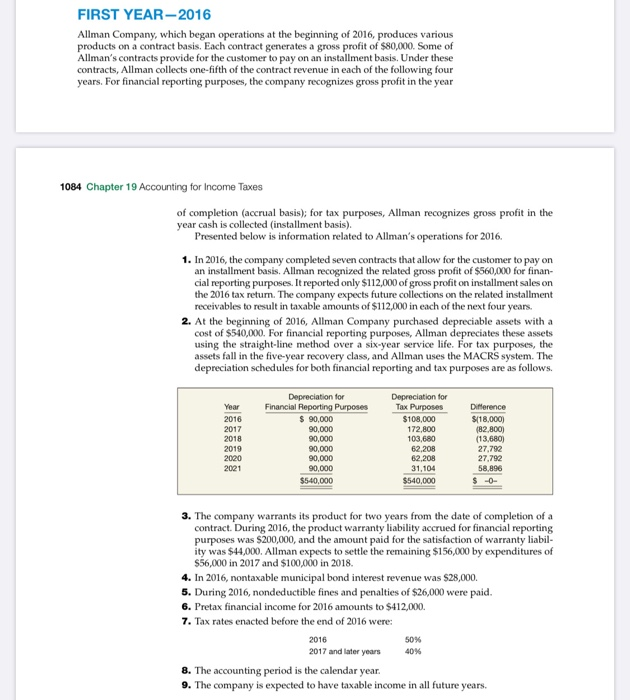

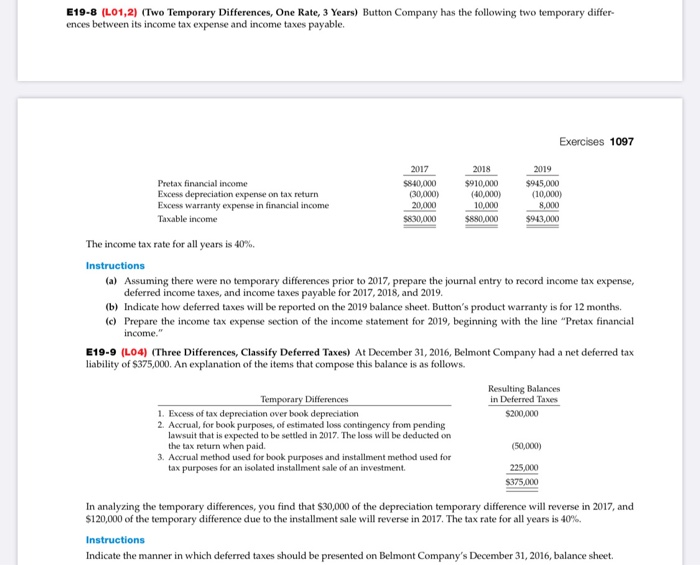

FIRST YEAR-2016 Allman Company, which began operations at the beginning of 2016, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of Allman's contracts provide for the customer to pay on an installment basis. Under these contracts, Allman collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year 1084 Chapter 19 Accounting for Income Taxes of completion (accrual basis); for tax purposes, Allman recognizes gross profit in the year cash is collected installment basis). Presented below is information related to Allman's operations for 2016. 1. In 2016, the company completed seven contracts that allow for the customer to pay on an installment basis. Allman recognized the related gross profit of $560,000 for finan- cial reporting purposes. It reported only $112,000 of gross profit on installment sales on the 2016 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of $112,000 in each of the next four years. 2. At the beginning of 2016, Allman Company purchased depreciable assets with a cost of $540,000. For financial reporting purposes, Allman depreciates these assets using the straight-line method over a six-year service life. For tax purposes, the assets fall in the five-year recovery class, and Allman uses the MACRS system. The depreciation schedules for both financial reporting and tax purposes are as follows. Year 2016 2017 2018 Depreciation for Financial Reporting Purposes $ 90,000 90,000 90,000 90.000 90.000 90.000 $540,000 Depreciation for Tax Purposes $108.000 172,800 103,680 62.208 62,208 31,104 $540,000 Difference $(18.000 (82,800) (13.680) 27.792 27,792 58.896 $ -0- 2019 2020 2021 3. The company warrants its product for two years from the date of completion of a contract. During 2016, the product warranty liability accrued for financial reporting purposes was $200,000, and the amount paid for the satisfaction of warranty liabil- ity was $44,000. Allman expects to settle the remaining $156,000 by expenditures of $56,000 in 2017 and $100,000 in 2018. 4. In 2016, nontaxable municipal bond interest revenue was $28,000. 5. During 2016, nondeductible fines and penalties of $26,000 were paid. 6. Pretax financial income for 2016 amounts to $412,000. 7. Tax rates enacted before the end of 2016 were: 2016 50% 2017 and later years 40% 8. The accounting period is the calendar year. 9. The company is expected to have taxable income in all future years. E19-8 (L01, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the following two temporary differ ences between its income tax expense and income taxes payable. Exercises 1097 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income 2017 $80.000 (30.000) 20,000 5830.000 2018 $910,000 (40,000) 10.000 $80,000 2019 $945.000 (10.000) 8,000 $943,000 The income tax rate for all years is 40%. Instructions (a) Assuming there were no temporary differences prior to 2017, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. (b) Indicate how deferred taxes will be reported on the 2019 balance sheet. Button's product warranty is for 12 months (c) Prepare the income tax expense section of the income statement for 2019, beginning with the line "Pretax financial income." E19-9 (L04) (Three Differences, Classify Deferred Taxes) At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. Resulting Balances in Deferred Taxes $200,000 Temporary Differences 1. Excess of tax depreciation over book depreciation 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2017. The loss will be deducted on the tax return when paid. 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment (50,000) 225,000 $375.00 In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2017, and $120,000 of the temporary difference due to the installment sale will reverse in 2017. The tax rate for all years is 40%. Instructions Indicate the manner in which deferred taxes should be presented on Belmont Company's December 31, 2016, balance sheet FIRST YEAR-2016 Allman Company, which began operations at the beginning of 2016, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of Allman's contracts provide for the customer to pay on an installment basis. Under these contracts, Allman collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year 1084 Chapter 19 Accounting for Income Taxes of completion (accrual basis); for tax purposes, Allman recognizes gross profit in the year cash is collected installment basis). Presented below is information related to Allman's operations for 2016. 1. In 2016, the company completed seven contracts that allow for the customer to pay on an installment basis. Allman recognized the related gross profit of $560,000 for finan- cial reporting purposes. It reported only $112,000 of gross profit on installment sales on the 2016 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of $112,000 in each of the next four years. 2. At the beginning of 2016, Allman Company purchased depreciable assets with a cost of $540,000. For financial reporting purposes, Allman depreciates these assets using the straight-line method over a six-year service life. For tax purposes, the assets fall in the five-year recovery class, and Allman uses the MACRS system. The depreciation schedules for both financial reporting and tax purposes are as follows. Year 2016 2017 2018 Depreciation for Financial Reporting Purposes $ 90,000 90,000 90,000 90.000 90.000 90.000 $540,000 Depreciation for Tax Purposes $108.000 172,800 103,680 62.208 62,208 31,104 $540,000 Difference $(18.000 (82,800) (13.680) 27.792 27,792 58.896 $ -0- 2019 2020 2021 3. The company warrants its product for two years from the date of completion of a contract. During 2016, the product warranty liability accrued for financial reporting purposes was $200,000, and the amount paid for the satisfaction of warranty liabil- ity was $44,000. Allman expects to settle the remaining $156,000 by expenditures of $56,000 in 2017 and $100,000 in 2018. 4. In 2016, nontaxable municipal bond interest revenue was $28,000. 5. During 2016, nondeductible fines and penalties of $26,000 were paid. 6. Pretax financial income for 2016 amounts to $412,000. 7. Tax rates enacted before the end of 2016 were: 2016 50% 2017 and later years 40% 8. The accounting period is the calendar year. 9. The company is expected to have taxable income in all future years. E19-8 (L01, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the following two temporary differ ences between its income tax expense and income taxes payable. Exercises 1097 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income 2017 $80.000 (30.000) 20,000 5830.000 2018 $910,000 (40,000) 10.000 $80,000 2019 $945.000 (10.000) 8,000 $943,000 The income tax rate for all years is 40%. Instructions (a) Assuming there were no temporary differences prior to 2017, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. (b) Indicate how deferred taxes will be reported on the 2019 balance sheet. Button's product warranty is for 12 months (c) Prepare the income tax expense section of the income statement for 2019, beginning with the line "Pretax financial income." E19-9 (L04) (Three Differences, Classify Deferred Taxes) At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. Resulting Balances in Deferred Taxes $200,000 Temporary Differences 1. Excess of tax depreciation over book depreciation 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2017. The loss will be deducted on the tax return when paid. 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment (50,000) 225,000 $375.00 In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2017, and $120,000 of the temporary difference due to the installment sale will reverse in 2017. The tax rate for all years is 40%. Instructions Indicate the manner in which deferred taxes should be presented on Belmont Company's December 31, 2016, balance sheet FIRST YEAR-2016 Allman Company, which began operations at the beginning of 2016, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of Allman's contracts provide for the customer to pay on an installment basis. Under these contracts, Allman collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year 1084 Chapter 19 Accounting for Income Taxes of completion (accrual basis); for tax purposes, Allman recognizes gross profit in the year cash is collected installment basis). Presented below is information related to Allman's operations for 2016. 1. In 2016, the company completed seven contracts that allow for the customer to pay on an installment basis. Allman recognized the related gross profit of $560,000 for finan- cial reporting purposes. It reported only $112,000 of gross profit on installment sales on the 2016 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of $112,000 in each of the next four years. 2. At the beginning of 2016, Allman Company purchased depreciable assets with a cost of $540,000. For financial reporting purposes, Allman depreciates these assets using the straight-line method over a six-year service life. For tax purposes, the assets fall in the five-year recovery class, and Allman uses the MACRS system. The depreciation schedules for both financial reporting and tax purposes are as follows. Year 2016 2017 2018 Depreciation for Financial Reporting Purposes $ 90,000 90,000 90,000 90.000 90.000 90.000 $540,000 Depreciation for Tax Purposes $108.000 172,800 103,680 62.208 62,208 31,104 $540,000 Difference $(18.000 (82,800) (13.680) 27.792 27,792 58.896 $ -0- 2019 2020 2021 3. The company warrants its product for two years from the date of completion of a contract. During 2016, the product warranty liability accrued for financial reporting purposes was $200,000, and the amount paid for the satisfaction of warranty liabil- ity was $44,000. Allman expects to settle the remaining $156,000 by expenditures of $56,000 in 2017 and $100,000 in 2018. 4. In 2016, nontaxable municipal bond interest revenue was $28,000. 5. During 2016, nondeductible fines and penalties of $26,000 were paid. 6. Pretax financial income for 2016 amounts to $412,000. 7. Tax rates enacted before the end of 2016 were: 2016 50% 2017 and later years 40% 8. The accounting period is the calendar year. 9. The company is expected to have taxable income in all future years. E19-8 (L01, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the following two temporary differ ences between its income tax expense and income taxes payable. Exercises 1097 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income 2017 $80.000 (30.000) 20,000 5830.000 2018 $910,000 (40,000) 10.000 $80,000 2019 $945.000 (10.000) 8,000 $943,000 The income tax rate for all years is 40%. Instructions (a) Assuming there were no temporary differences prior to 2017, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. (b) Indicate how deferred taxes will be reported on the 2019 balance sheet. Button's product warranty is for 12 months (c) Prepare the income tax expense section of the income statement for 2019, beginning with the line "Pretax financial income." E19-9 (L04) (Three Differences, Classify Deferred Taxes) At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. Resulting Balances in Deferred Taxes $200,000 Temporary Differences 1. Excess of tax depreciation over book depreciation 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2017. The loss will be deducted on the tax return when paid. 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment (50,000) 225,000 $375.00 In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2017, and $120,000 of the temporary difference due to the installment sale will reverse in 2017. The tax rate for all years is 40%. Instructions Indicate the manner in which deferred taxes should be presented on Belmont Company's December 31, 2016, balance sheet FIRST YEAR-2016 Allman Company, which began operations at the beginning of 2016, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of Allman's contracts provide for the customer to pay on an installment basis. Under these contracts, Allman collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year 1084 Chapter 19 Accounting for Income Taxes of completion (accrual basis); for tax purposes, Allman recognizes gross profit in the year cash is collected installment basis). Presented below is information related to Allman's operations for 2016. 1. In 2016, the company completed seven contracts that allow for the customer to pay on an installment basis. Allman recognized the related gross profit of $560,000 for finan- cial reporting purposes. It reported only $112,000 of gross profit on installment sales on the 2016 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of $112,000 in each of the next four years. 2. At the beginning of 2016, Allman Company purchased depreciable assets with a cost of $540,000. For financial reporting purposes, Allman depreciates these assets using the straight-line method over a six-year service life. For tax purposes, the assets fall in the five-year recovery class, and Allman uses the MACRS system. The depreciation schedules for both financial reporting and tax purposes are as follows. Year 2016 2017 2018 Depreciation for Financial Reporting Purposes $ 90,000 90,000 90,000 90.000 90.000 90.000 $540,000 Depreciation for Tax Purposes $108.000 172,800 103,680 62.208 62,208 31,104 $540,000 Difference $(18.000 (82,800) (13.680) 27.792 27,792 58.896 $ -0- 2019 2020 2021 3. The company warrants its product for two years from the date of completion of a contract. During 2016, the product warranty liability accrued for financial reporting purposes was $200,000, and the amount paid for the satisfaction of warranty liabil- ity was $44,000. Allman expects to settle the remaining $156,000 by expenditures of $56,000 in 2017 and $100,000 in 2018. 4. In 2016, nontaxable municipal bond interest revenue was $28,000. 5. During 2016, nondeductible fines and penalties of $26,000 were paid. 6. Pretax financial income for 2016 amounts to $412,000. 7. Tax rates enacted before the end of 2016 were: 2016 50% 2017 and later years 40% 8. The accounting period is the calendar year. 9. The company is expected to have taxable income in all future years. E19-8 (L01, 2) (Two Temporary Differences, One Rate, 3 Years) Button Company has the following two temporary differ ences between its income tax expense and income taxes payable. Exercises 1097 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income 2017 $80.000 (30.000) 20,000 5830.000 2018 $910,000 (40,000) 10.000 $80,000 2019 $945.000 (10.000) 8,000 $943,000 The income tax rate for all years is 40%. Instructions (a) Assuming there were no temporary differences prior to 2017, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. (b) Indicate how deferred taxes will be reported on the 2019 balance sheet. Button's product warranty is for 12 months (c) Prepare the income tax expense section of the income statement for 2019, beginning with the line "Pretax financial income." E19-9 (L04) (Three Differences, Classify Deferred Taxes) At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. Resulting Balances in Deferred Taxes $200,000 Temporary Differences 1. Excess of tax depreciation over book depreciation 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2017. The loss will be deducted on the tax return when paid. 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment (50,000) 225,000 $375.00 In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2017, and $120,000 of the temporary difference due to the installment sale will reverse in 2017. The tax rate for all years is 40%. Instructions Indicate the manner in which deferred taxes should be presented on Belmont Company's December 31, 2016, balance sheet