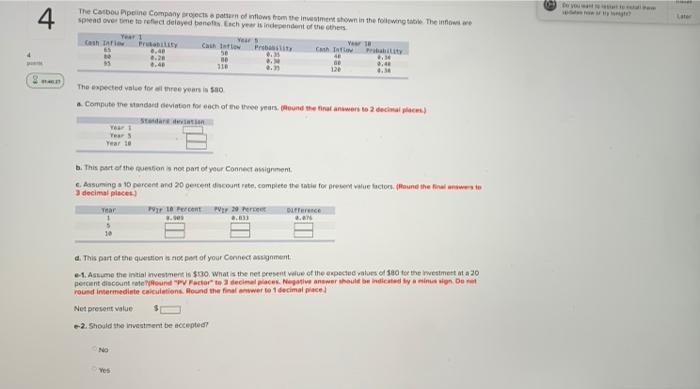

Question: Do you 4. The Carbou peline Company rejects a pattern of inflows from the insiment shown in the following. The info spread over time to

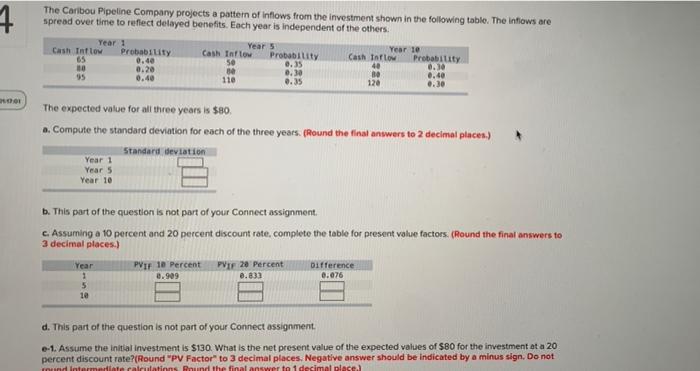

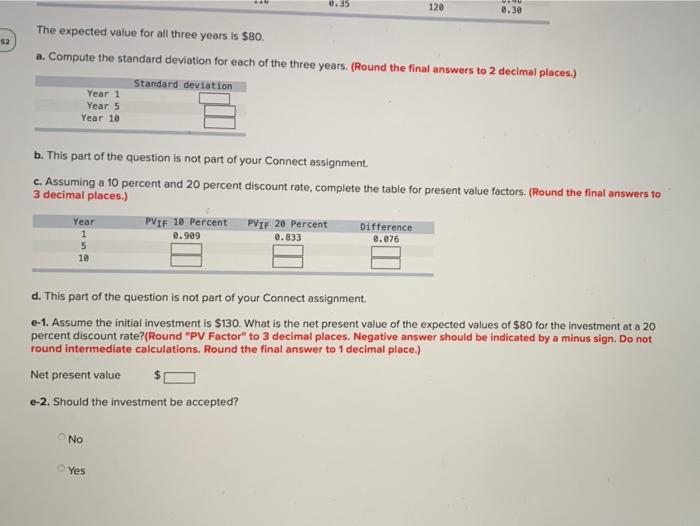

Do you 4. The Carbou peline Company rejects a pattern of inflows from the insiment shown in the following. The info spread over time to reflect delayed bones Each year is independent of the others Cathair Yew 18 65 0.40 Presi Charity 50 ..2 30 SN 40 * 35 310 3.42 4.36 4 The expected value for three years is 500 Compute med deviation for each of the venues.hound the first answers to 2 decimo) Sedan Yeart Years Year 10 b. This part of the question is not part of your connect assignment Assuming a 10 percent and 20 percent discount rete, complete the tativ for reset le fotors (Mound the finanswers to decimal places Year yr 10 percent Pere Derence 1 033 san 5 10 3.es d. This part of the question is not part of your connect assignment -- 1. Asume the initial investment is $30, what is the net present ole of the expected values of 0 to the westment at a 20 percent discount round "PV Factor" te decimaler Native answer should be indicated by a mine in De Yound intermediate caciulations found the final awwer to 1 decimal place Not present value --2. Should the investment be accepted NO Yes 7 The Caribou Pipeline Company projects a pattern of inflows from the investment shown in the following table. The inflows are spread over time to reflect delayed benefits. Each year is independent of the others Year 1 Year 5 Cash Intlom Probability Cash Inflow Probability Year 10 Cash Info 65 0.40 Probability 50 10 0.35 0.20 40 0.30 0.30 Be 95 0.40 0.40 0.35 120 0.30 110 The expected value for all three years is $80 . Compute the standard deviation for each of the three years. (Round the final answers to 2 decimal places.) Standard deviation Year 1 Year 5 Year 10 b. This part of the question is not part of your Connect assignment. c. Assuming a 10 percent and 20 percent discount rate, complete the table for present value factors. (Round the final answers to 3 decimal places.) Year 1 5 10 PVIF 10 Percent 0.999 PVIF 20 Percent 2.833 Difference 0.076 d. This part of the question is not part of your Connect assignment e-1. Assume the initial investment is $130. What is the net present value of the expected values of $80 for the investment at a 20 percent discount rate?(Round "PV Factor" to 3 decimal places. Negative answer should be indicated by a minus sign. Do not Intermediate calculations. Round the final answer to 1 decimal place 0.35 120 8.30 52 The expected value for all three years is $80. a. Compute the standard deviation for each of the three years. (Round the final answers to 2 decimal places.) Standard deviation Year 1 Year 5 Year 10 b. This part of the question is not part of your Connect assignment. c. Assuming a 10 percent and 20 percent discount rate, complete the table for present value factors. (Round the final answers to 3 decimal places.) PVIF 10 Percent PVIF 20 Percent Difference Year 1 5 10 0.989 0.833 0.076 d. This part of the question is not part of your Connect assignment e-1. Assume the initial investment is $130. What is the net present value of the expected values of $80 for the investment at a 20 percent discount rate?(Round "PV Factor" to 3 decimal places. Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 1 decimal place.) Net present value e-2. Should the investment be accepted? NO Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts