Question

Do you agree with Galeotafiore's forecast for Home Depot? How would you adjust it? Home Depots new CEO, Bob Nardelli, had expressed his intention to

Do you agree with Galeotafiore's forecast for Home Depot? How would you adjust it?

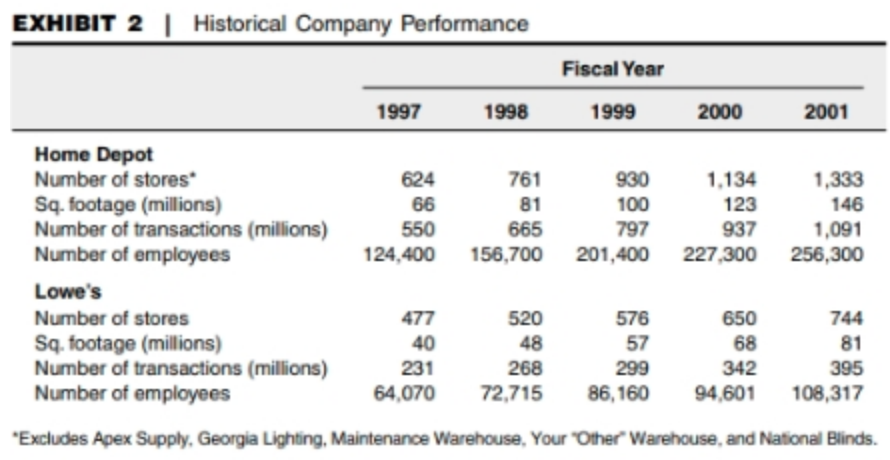

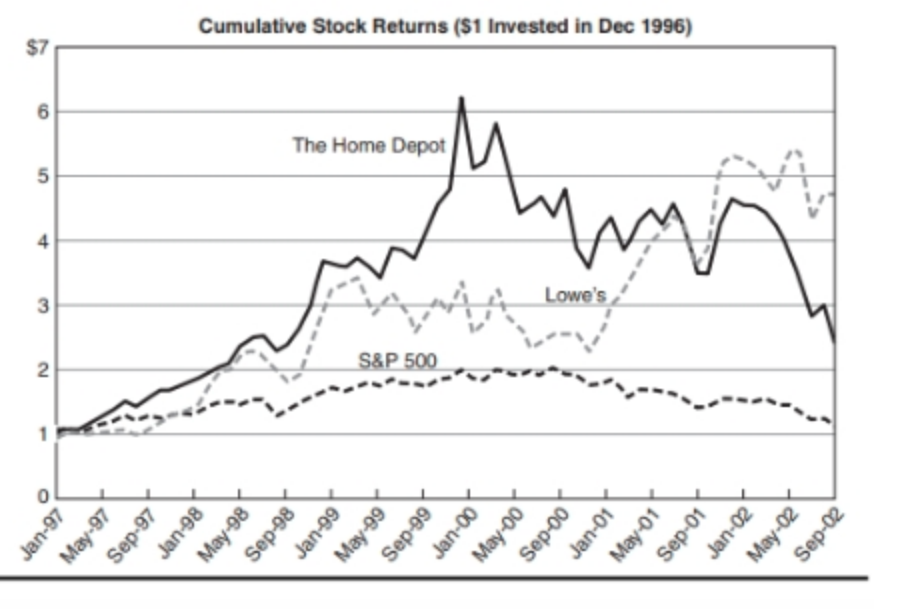

Home Depots new CEO, Bob Nardelli, had expressed his intention to focus on enhancing store efficiency and inventory turnover through ongoing system investments. He expected to generate margin improvement through cost declines from product reviews, purchasing improvements, and an increase in the number of tool- rental centers. Recently, operating costs had increased owing to higher occupancy costs for new stores and increased energy costs. Home Depot had come under criticism for its declining customer service. Nardelli hoped to counter this trend with an initiative to help employees focus on customers during store hours and restocking shelves only after hours. Home Depot management expected revenue growth to be 15% to 18% through 2004. Some of the growth would be by acquisition, which necessitated the companys maintaining higher cash levels. Home Depot stock was trading at around $25 a share, implying a total equity capitalization of $59 billion.

Galeotafiore had been cautiously optimistic about the changes at Home Depot in her July report:

Though the program [Service Performance Improvement] is still in the early stages, the do-it-yourself giant has already enjoyed labor productivity benefits, and received positive feedback from customers. . . . The Pro-Initiative program, which is currently in place at roughly 55% of Home Depots stores, is aimed at providing services that accommodate the pro customer. Stores that provide these added services have generally outperformed strictly do-it-yourself units in productivity, operating margins, and inventory turnover. Home Depot shares offer compelling price-appreciation potential over the coming 3-to-5-year pull.

Other analysts did not seem to share her enthusiasm for Home Depot. Dan Wewer and Lisa Estabrooks observed,

Home Depots comp sales fell short of plan despite a step-up in promotional activity. In our view, this legitimizes our concerns that Home Depot is seeing diminishing returns from promotional efforts. . . . Our view that Lowes is the most attractive investment opportunity in hardline retailing is supported by key mileposts achieved during 2Q02. Highlights include superior relative EPS momentum, robust comp sales, expanding operating margin, improving capital efficiency, and impressive new-store productivity. Importantly, Lowes outstanding performance raises the hurdle Home Depot must reach if it is to return to favor with the investment community.

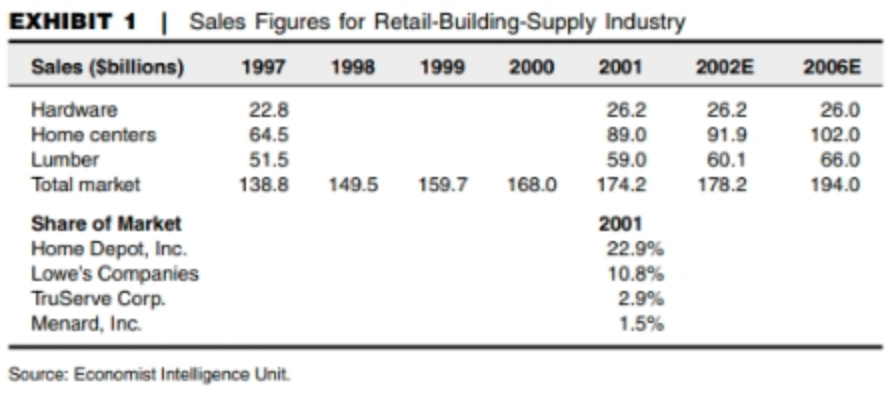

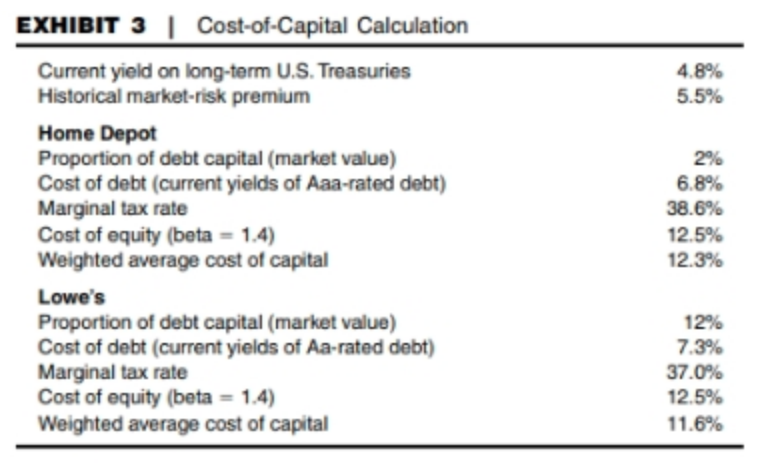

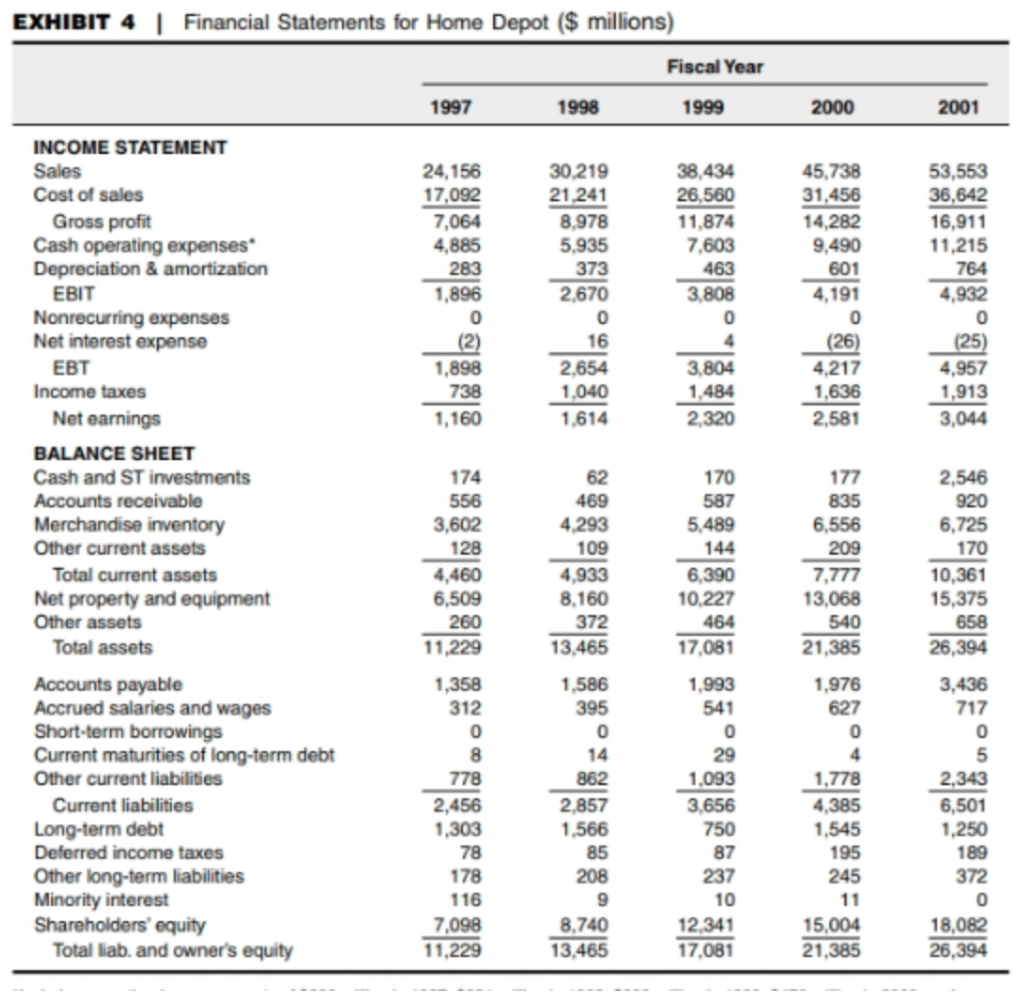

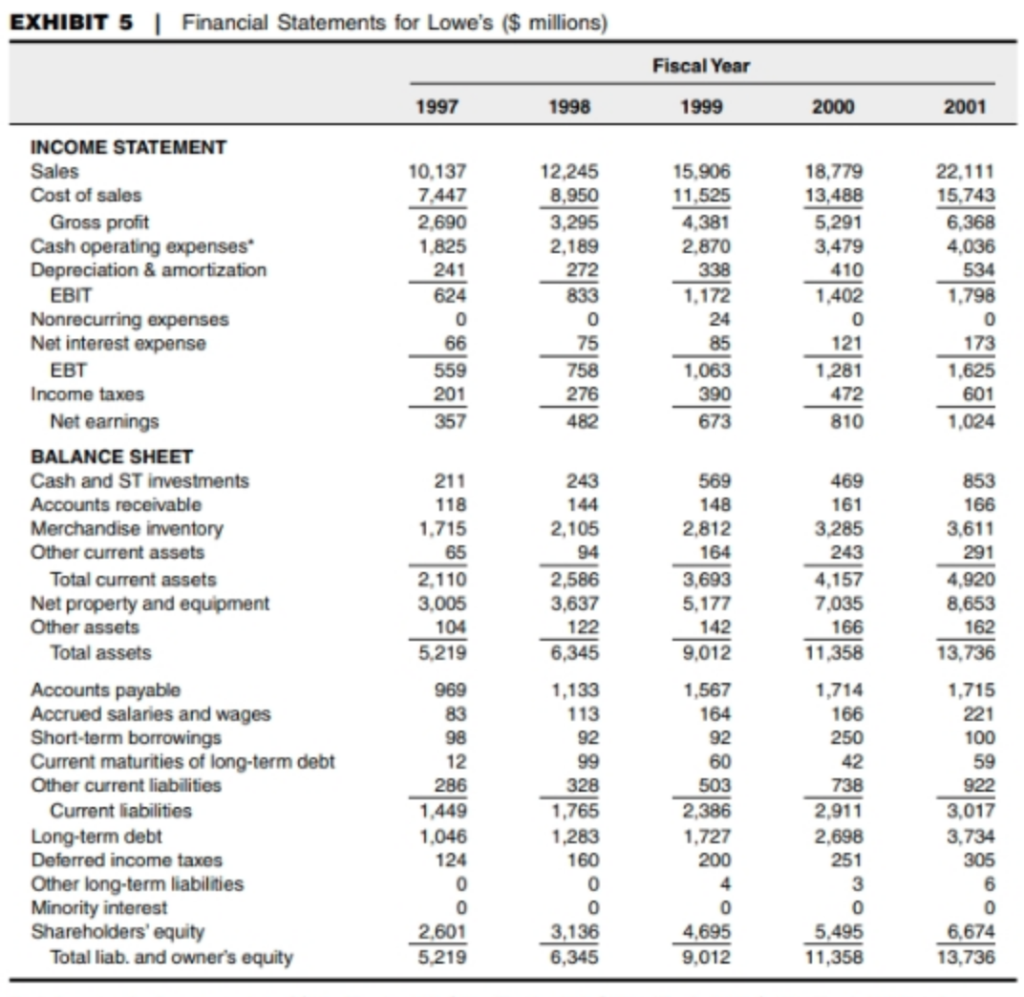

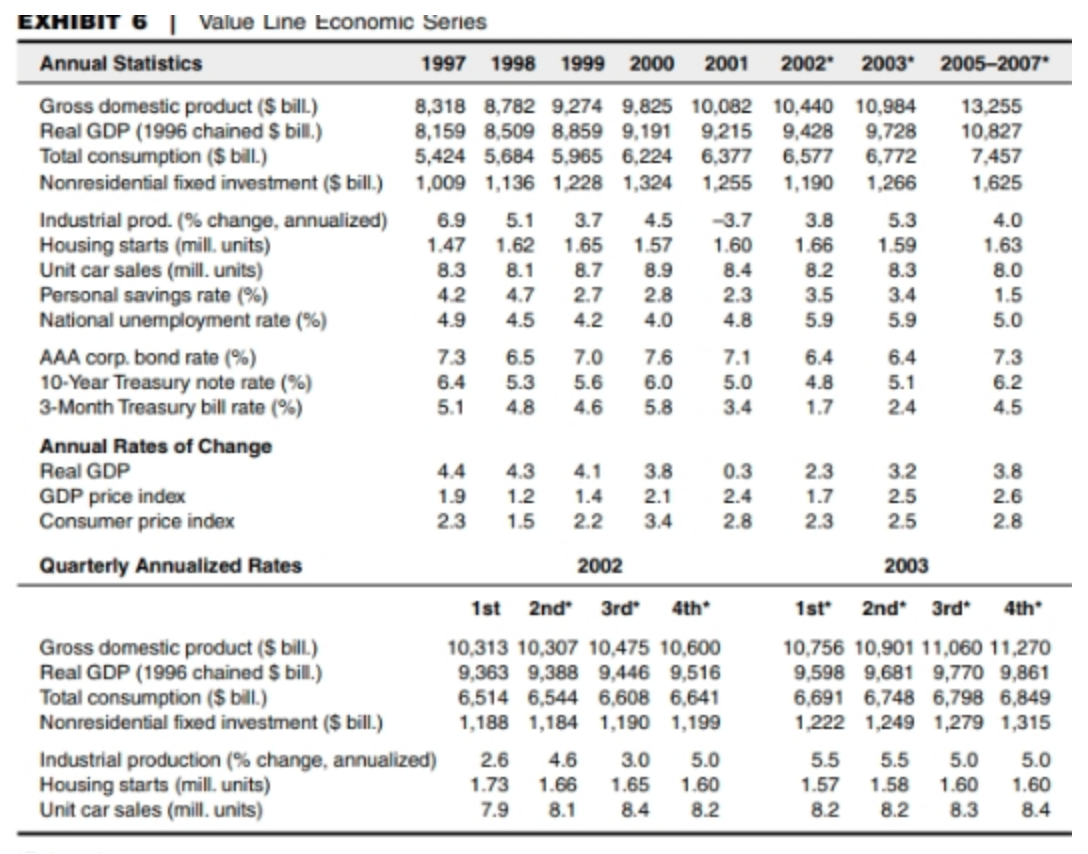

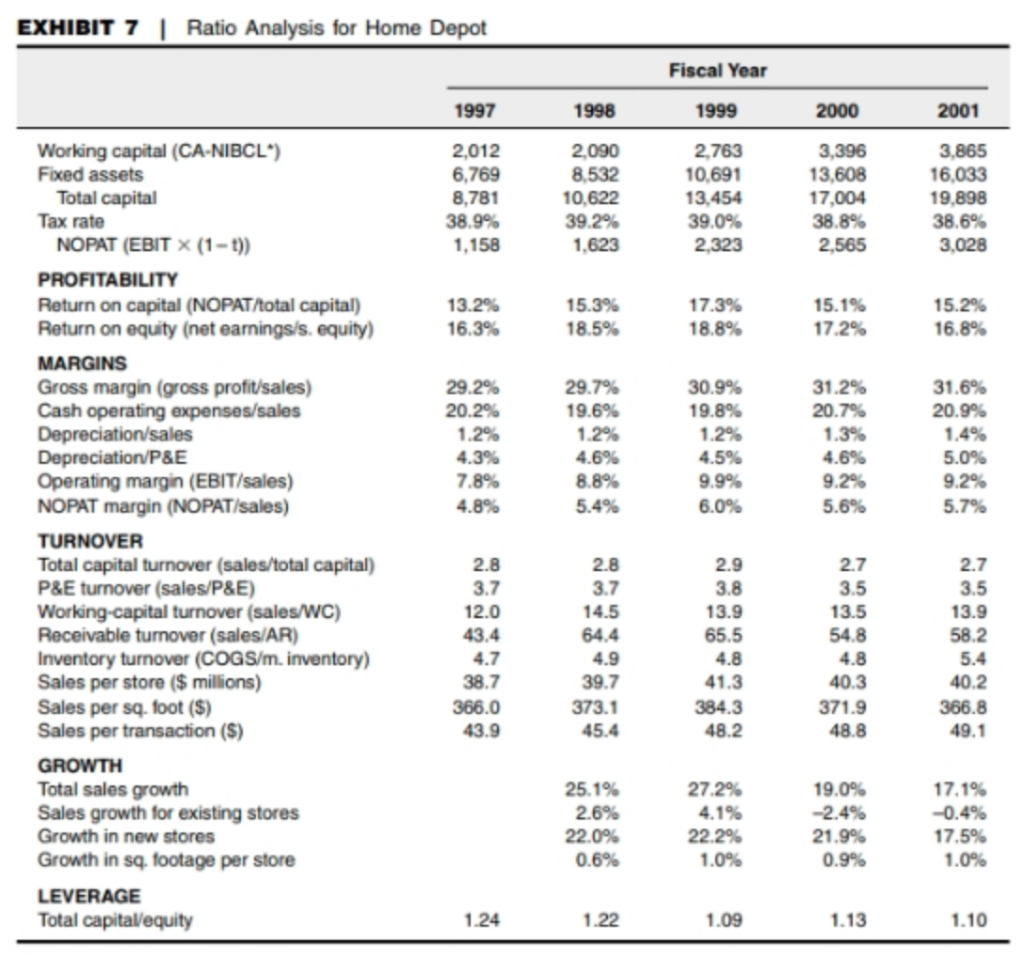

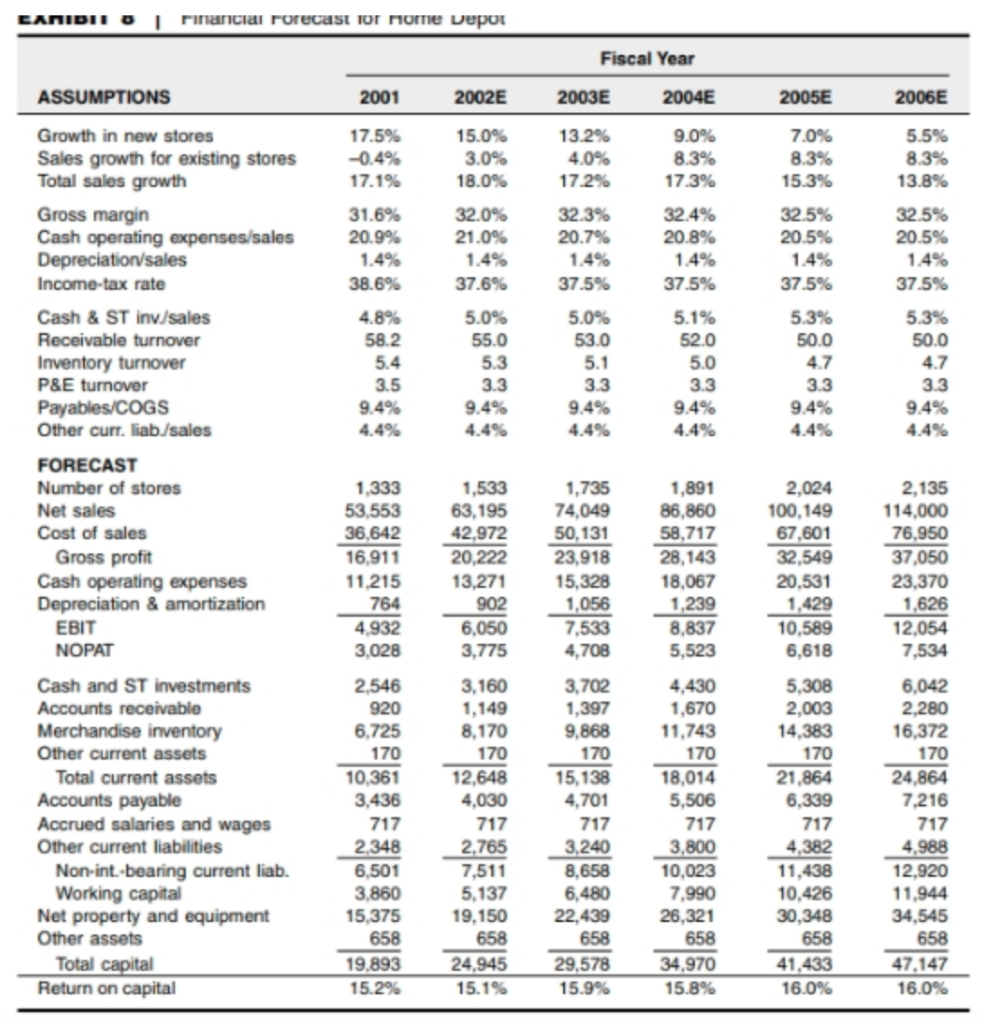

Lowes management had told analysts that it expected to maintain sales growth of 18% to 19% over the next two years. Lowes planned to open 123 stores in 2002, 130 stores in 2003, and 140 stores in 2004, and to continue its emphasis on cities with populations greater than 500,000, such as New York, Boston, and Los Angeles. To date, the companys entry into metropolitan markets appeared to be successful. Lowes planned to continue improving sales and margins through new merchandising, pricing strategies, and market-share gains, especially in the Northeast and West.3 Lowes stock was trading at around $37 a share, implying a total equity capitalization of $29 billion. Donald Trott, an analyst at Jefferies, had recently downgraded Lowes based on a forecast of a deflating housing-market bubble and a view that the companys stock price was richly priced relative to Home Depots. Galeotafiore countered that Lowes had now shown that it could compete effectively with Home Depot. She justified the Lowes valuation with an expectation of ongoing improvement in sales and gross margins. Lowes is gaining market share in the appliance category, and its transition into major metropolitan areas (which will likely comprise the bulk of the companys expansion in the next years) is yielding solid results. Alongside the positive sales trends, the homebuilding sup- pliers bottom line is also being boosted by margin expansion, bolstered, in part, by lower inventory costs and product-mix improvements. Galeotafiores financial forecast for Home Depot and Lowes would go to print next week. She based her forecasts on a review of historical performance, an analysis of trends and ongoing changes in the industry and the macroeconomy, and a detailed understanding of corporate strategy. She had completed a first-pass financial forecast for Home Depot, and was in the process of developing her forecast for Lowes. She estimated the cost of capital for Home Depot and Lowes to be 12.3% and 11.6%, respectively (see Exhibit 3). Exhibits 4 and 5 provide historical financial statements for Home Depot and Lowes. Exhibit 6 details the historical and forecast values for Value Lines macroeconomic-indicator series. Exhibits 7 and 8 feature Galeotafiores first-pass historical ratio analysis and financial forecast for Home Depot.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started