do you agree with the cost of capital estimate detailed by Kyle Brooks in Exhibit 6? why or why not? if you do not agree, how would you adjust the estimate?

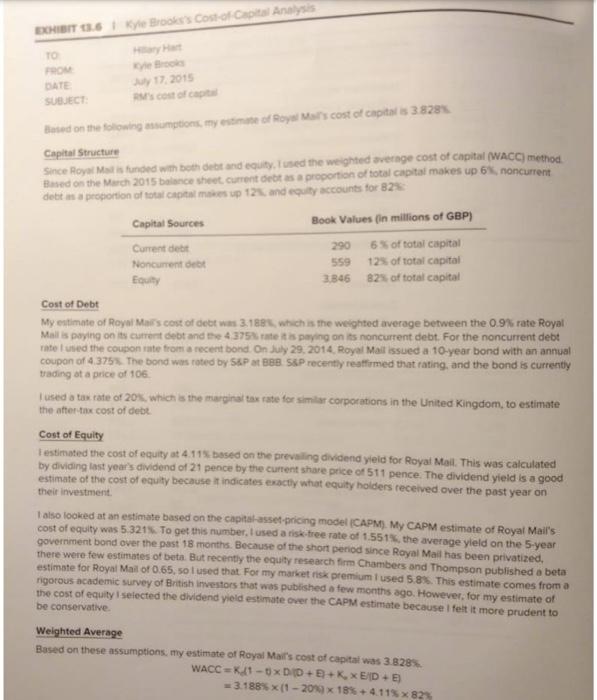

Capital Structure Since Royal Mal is funded with beet dett and equity. I used the weighted sverage cost of capital (WACC) method Hised on the March 2015 balance sheet. current dett as a proportion of total capital makes up 6 . debt an a propiortion of tatal captal makes up 127 , and equity accounts for 827 : Cost of Debt My estimate of Royai Mairs cost of debt was 3.188 which is the weighted average between the 0.9 frate Royal Mali is poying on its currert debt and the 4.375T rate it is paying on is noncurrent debt. For the noncurrent debt rate I ulied the coupon rate trom a recent bond On July 29.2014. Royal Mail issued a 10-year bond with an annual coupon of 4.375. The bond was roted by 58 . at B88. S8.P recentry restfomed that rating. and the bond is currenty trading of a price of 106 . I used a tax rate of 20K, which is the marginal tax rate for simily corporations in the United Kingdom, to estimate the attertax cost of debt. Cost of Equity I estimated the cost of equity at 4.114 bssed on the prevailing dividend yieid for Royal Mtali. This was calculated by dividing last year's dividend of 21 pence by the curtent share price of 511 pence. The dividend yield is a good estimate of the cost of equity because it indicates exacty what equity hoiders recetved over the past year on their investment. 1 also looked at an estimate based on the capital asset-pricing model (CAPM). My CAPM estimate of Royal Mall's cost of equity was 5.321. To get this number, I used a risk-tree rate of 1.551%, the average yleld on the 5 -year government bond over the past 18 months. Because of the short period since Royal Mall has been privatized. there were few estimates of beta. But recently the equity research firm Chambers and Thompson published a beta estimate for Royal Mail of 0.65, so l used that. For my market risk premium 1 used 5.85. This estimate comes from a rigotous academic survey of British irvestors that was pubtished a few months ago. However, for my estimate of the cost of equily I selected the dividend yieid estimate over the CAPM estimate because i fett it more prudent to be conservative. Weighted Average Based on these assumptions, my estimate of Royal Mair's cost of capitai was 3.8285. WACC=K(10D(D+E+K0EyD+E)