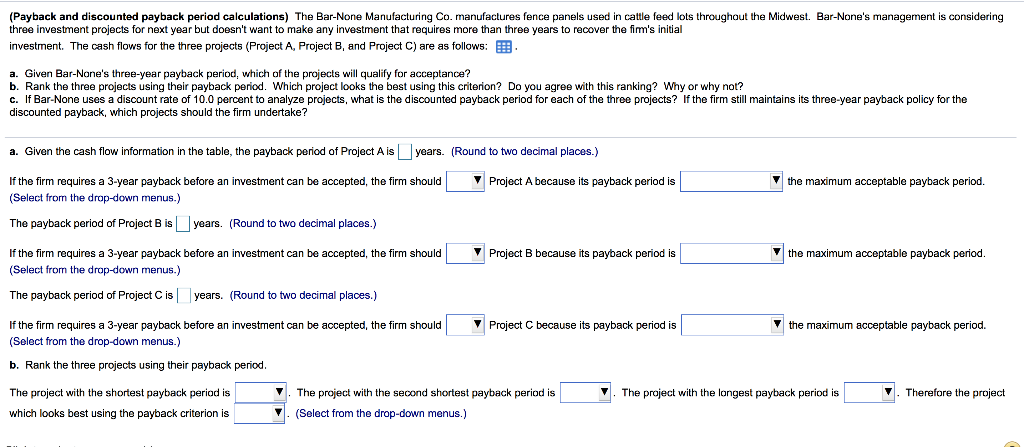

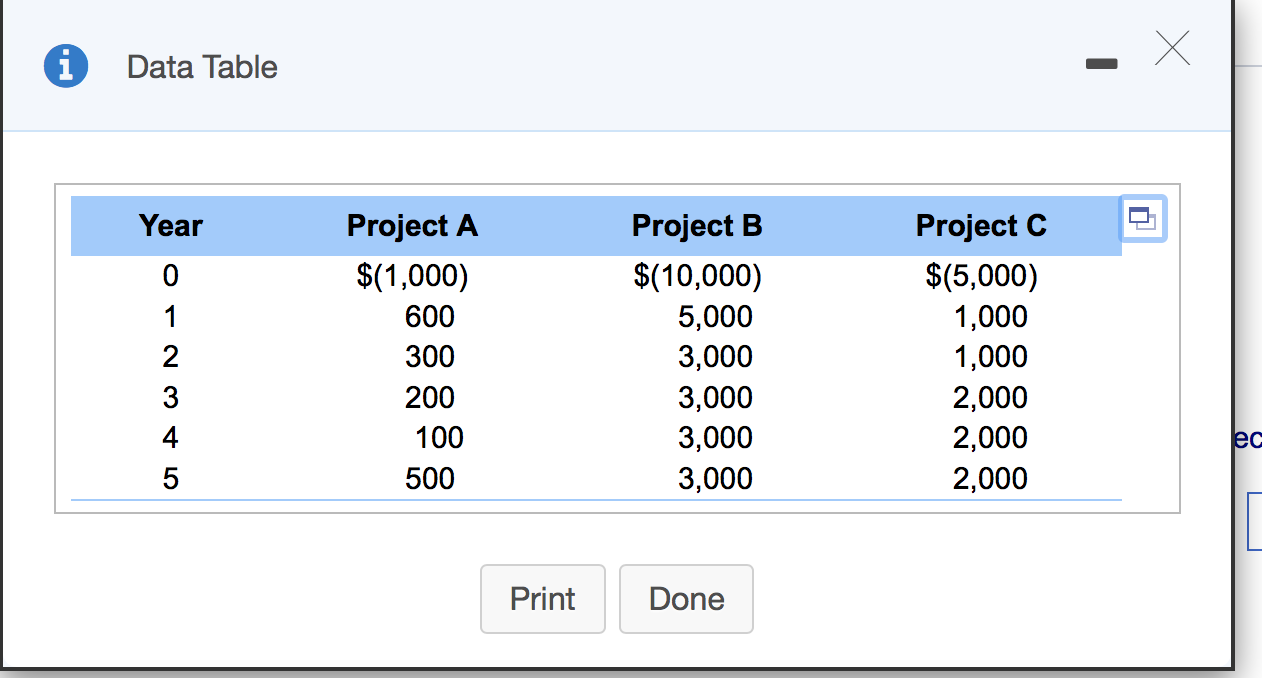

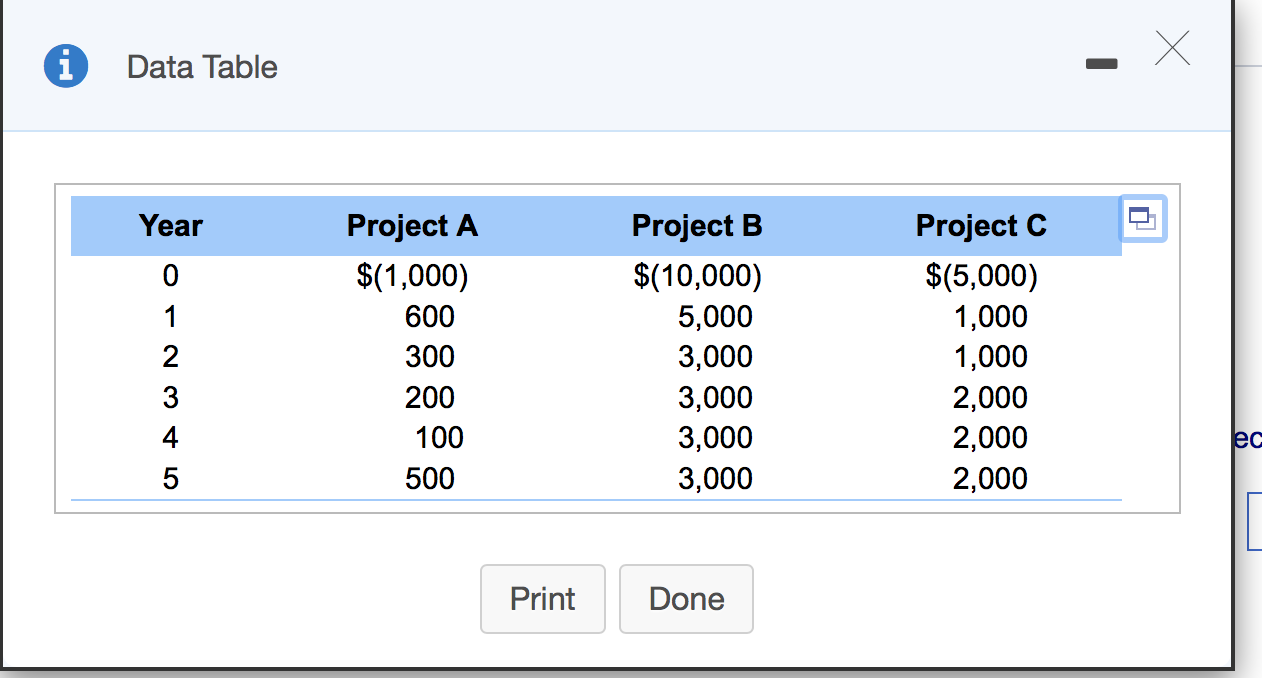

Do you agree with this ranking? Why or why not? (Select the best choice below.) O A. No, there is no clear-cut way to define the cutoff criterion for the payback period that is tied to the value creation potential of the investment. OB. No, the payback method ignores cash flows that are generated by the project beyond the end of the payback period. O C. No, the payback method ignores the time value of money. OD. All of the above. C. Given the cash flow information in the table and the discount rate of 10.0%, the discounted payback period of Project Ais years. (Round to two decimal places.) V Project A because its discounted payback period is V the maximum acceptable payback If the firm requires a 3-year payback before an investment can be accepted, the firm should period. (Select from the drop-down menus.) The discounted payback period of Project B is years. (Round to two decimal places.) Project B because its discounted payback period is the maximum acceptable payback If the firm requires a 3-year payback before an investment can be accepted, the firm should period. (Select from the drop-down menus.) The discounted payback period of Project C is years. (Round to two decimal places.) (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: B a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 10.0 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? a. Given the cash flow information in the table, the payback period of Project Ais years. (Round to two decimal places.) Project A because its payback period is V the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) The payback period of Project Bis years. (Round to two decimal places.) y Project B because its payback period is the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) The payback period of Project Cis years. (Round to two decimal places.) Project C because its payback period is the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) b. Rank the three projects using their payback period. . The project with the longest payback period is . Therefore the project The project with the shortest payback period is which looks best using the payback criterion is The project with the second shortest payback period is 7 (Select from the drop-down menus.) Data Table Year e Project A $(1,000) 600 300 a AwNto Project B $(10,000) 5,000 3,000 3,000 3,000 3,000 Project C $(5,000) 1,000 1,000 2,000 2,000 2,000 200 100 500 Print Done Do you agree with this ranking? Why or why not? (Select the best choice below.) O A. No, there is no clear-cut way to define the cutoff criterion for the payback period that is tied to the value creation potential of the investment. OB. No, the payback method ignores cash flows that are generated by the project beyond the end of the payback period. O C. No, the payback method ignores the time value of money. OD. All of the above. C. Given the cash flow information in the table and the discount rate of 10.0%, the discounted payback period of Project Ais years. (Round to two decimal places.) V Project A because its discounted payback period is V the maximum acceptable payback If the firm requires a 3-year payback before an investment can be accepted, the firm should period. (Select from the drop-down menus.) The discounted payback period of Project B is years. (Round to two decimal places.) Project B because its discounted payback period is the maximum acceptable payback If the firm requires a 3-year payback before an investment can be accepted, the firm should period. (Select from the drop-down menus.) The discounted payback period of Project C is years. (Round to two decimal places.) (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: B a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 10.0 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? a. Given the cash flow information in the table, the payback period of Project Ais years. (Round to two decimal places.) Project A because its payback period is V the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) The payback period of Project Bis years. (Round to two decimal places.) y Project B because its payback period is the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) The payback period of Project Cis years. (Round to two decimal places.) Project C because its payback period is the maximum acceptable payback period. If the firm requires a 3-year payback before an investment can be accepted, the firm should (Select from the drop-down menus.) b. Rank the three projects using their payback period. . The project with the longest payback period is . Therefore the project The project with the shortest payback period is which looks best using the payback criterion is The project with the second shortest payback period is 7 (Select from the drop-down menus.) Data Table Year e Project A $(1,000) 600 300 a AwNto Project B $(10,000) 5,000 3,000 3,000 3,000 3,000 Project C $(5,000) 1,000 1,000 2,000 2,000 2,000 200 100 500 Print Done