Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do you think that the expensing of R&D expenditure causes any damage to the company? Support your answer with relevant financialon-financial figures. And How does

- Do you think that the expensing of R&D expenditure causes any damage to the company? Support your answer with relevant financialon-financial figures. And How does the company attempt to overcome any potential damage created by the NZ IAS 38 requirement to expense research expenditure immediately? please use the company's figures to support the answer.

Yes it's an accounting question. It's ok just talk in general about expense and what to do to minimum the damage

How to overcome r&d expensed damage

What info do u need?

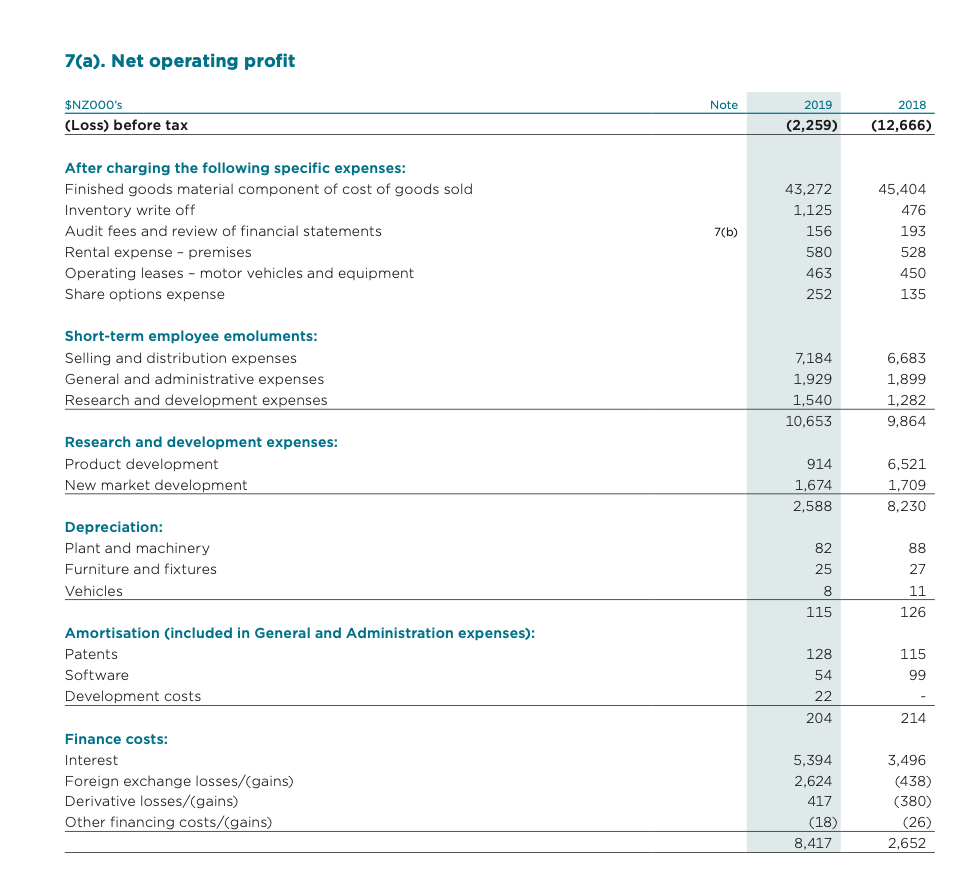

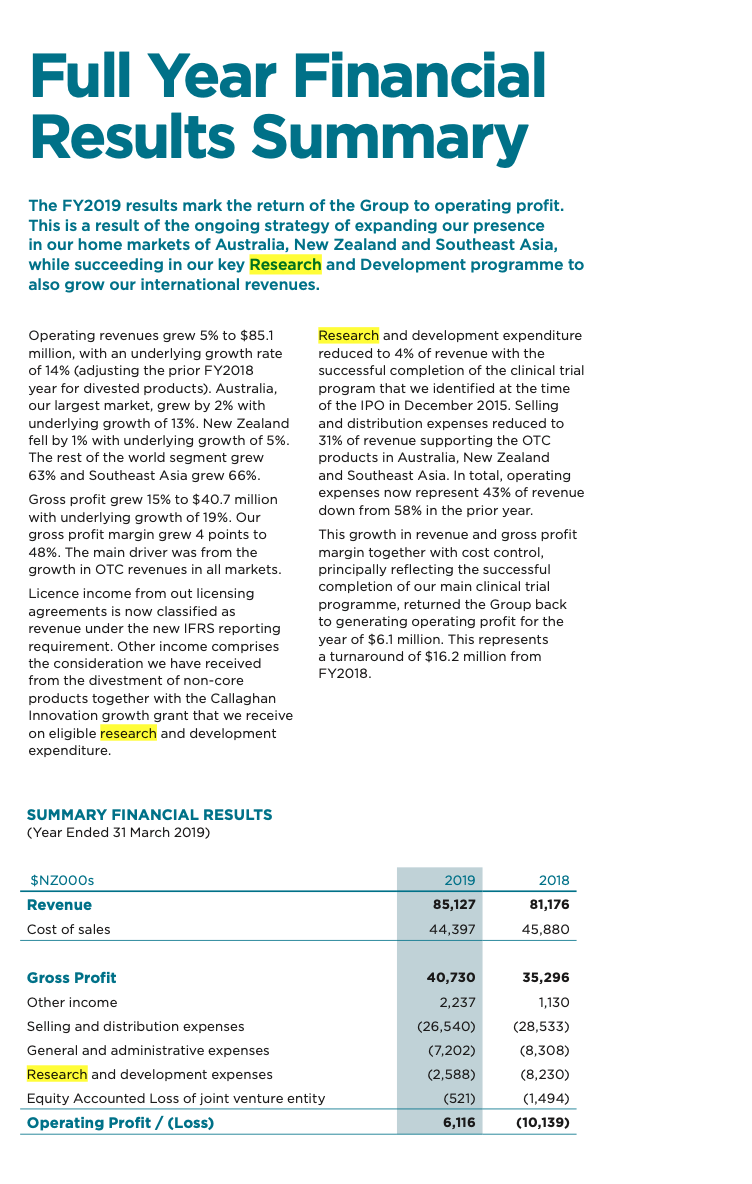

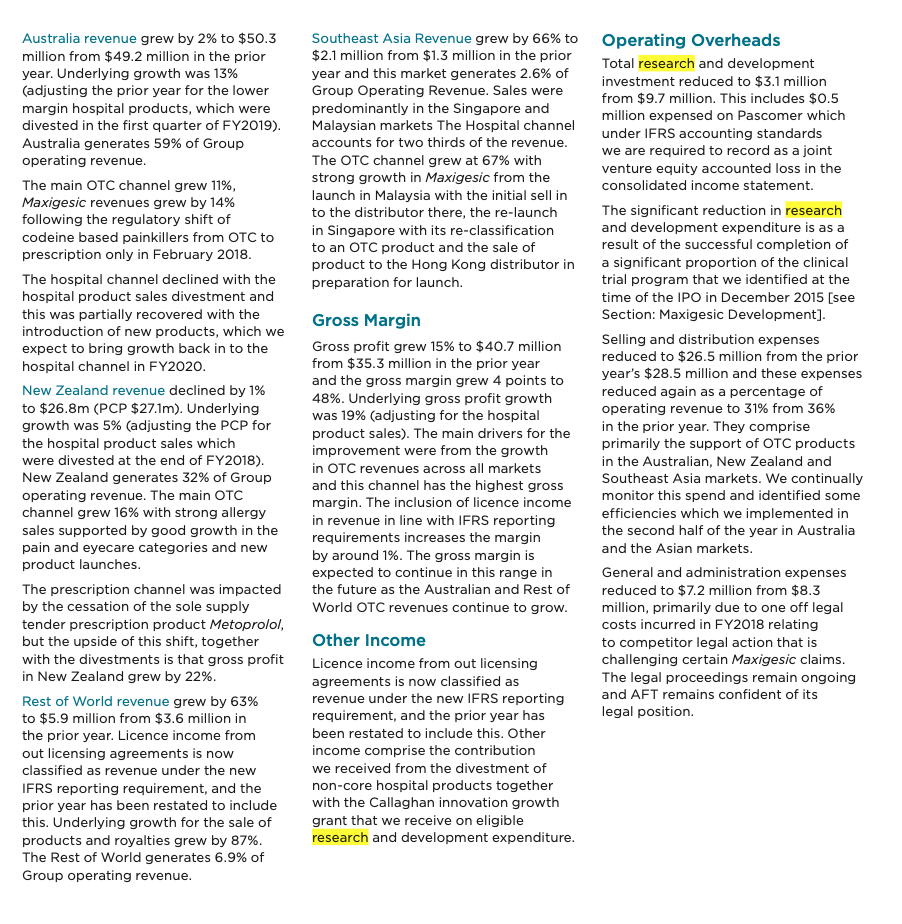

7(a). Net operating profit Note $NZ000's (Loss) before tax 2019 (2,259) 2018 (12,666) After charging the following specific expenses: Finished goods material component of cost of goods sold Inventory write off Audit fees and review of financial statements Rental expense - premises Operating leases - motor vehicles and equipment Share options expense 7(b) 43,272 1,125 156 580 463 252 45,404 476 193 528 450 135 Short-term employee emoluments: Selling and distribution expenses General and administrative expenses Research and development expenses 7.184 1,929 1,540 10,653 6,683 1,899 1,282 9.864 Research and development expenses: Product development New market development 914 1,674 2,588 6,521 1,709 8,230 Depreciation: Plant and machinery Furniture and fixtures Vehicles 82 25 88 27 11 126 8 115 Amortisation (included in General and Administration expenses): Patents Software Development costs 115 99 128 54 22 204 214 Finance costs: Interest Foreign exchange losses/gains) Derivative losses/gains) Other financing costs/(gains) 5,394 2,624 417 (18) 8,417 3,496 (438) (380) (26) 2,652 Full Year Financial Results Summary The FY2019 results mark the return of the Group to operating profit. This is a result of the ongoing strategy of expanding our presence in our home markets of Australia, New Zealand and Southeast Asia, while succeeding in our key Research and Development programme to also grow our international revenues. Operating revenues grew 5% to $85.1 million, with an underlying growth rate of 14% (adjusting the prior FY2018 year for divested products). Australia, our largest market, grew by 2% with underlying growth of 13%. New Zealand fell by with underlying growth of 5%. The rest of the world segment grew 63% and Southeast Asia grew 66%. Gross profit grew 15% to $40.7 million with underlying growth of 19%. Our gross profit margin grew 4 points to 48%. The main driver was from the growth in OTC revenues in all markets. Licence income from out licensing agreements is now classified as revenue under the new IFRS reporting requirement. Other income comprises the consideration we have received from the divestment of non-core products together with the Callaghan Innovation growth grant that we receive on eligible research and development expenditure. Research and development expenditure reduced to 4% of revenue with the successful completion of the clinical trial program that we identified at the time of the IPO in December 2015. Selling and distribution expenses reduced to 31% of revenue supporting the OTC products in Australia, New Zealand and Southeast Asia. In total, operating expenses now represent 43% of revenue down from 58% in the prior year. This growth in revenue and gross profit margin together with cost control, principally reflecting the successful completion of our main clinical trial programme, returned the Group back to generating operating profit for the year of $6.1 million. This represents a turnaround of $16.2 million from FY2018. SUMMARY FINANCIAL RESULTS (Year Ended 31 March 2019) 2019 2018 $NZOO Os Revenue Cost of sales 85,127 81,176 44,397 45,880 Gross Profit 40,730 35,296 1,130 (28,533) 2,237 (26,540) (7,202) (2,588) (521) Other income Selling and distribution expenses General and administrative expenses Research and development expenses Equity Accounted Loss of joint venture entity Operating Profit / (Loss) (8,308) (8,230) (1,494) (10,139) 6,116 Southeast Asia Revenue grew by 66% to $2.1 million from $1.3 million in the prior year and this market generates 2.6% of Group Operating Revenue. Sales were predominantly in the Singapore and Malaysian markets The Hospital channel accounts for two thirds of the revenue. The OTC channel grew at 67% with strong growth in Maxigesic from the launch in Malaysia with the initial sell in to the distributor there, the re-launch in Singapore with its re-classification to an OTC product and the sale of product to the Hong Kong distributor in preparation for launch. Australia revenue grew by 2% to $50.3 million from $49.2 million in the prior year. Underlying growth was 13% (adjusting the prior year for the lower margin hospital products, which were divested in the first quarter of FY2019). Australia generates 59% of Group operating revenue. The main OTC channel grew 11%, Maxigesic revenues grew by 14% following the regulatory shift of codeine based painkillers from OTC to prescription only in February 2018. The hospital channel declined with the hospital product sales divestment and this was partially recovered with the introduction of new products, which we expect to bring growth back in to the hospital channel in FY2020. New Zealand revenue declined by 1% to $26.8m (PCP $27.1m). Underlying growth was 5% (adjusting the PCP for the hospital product sales which were divested at the end of FY2018). New Zealand generates 32% of Group operating revenue. The main OTC channel grew 16% with strong allergy sales supported by good growth in the pain and eyecare categories and new product launches. The prescription channel was impacted by the cessation of the sole supply tender prescription product Metoprolol, but the upside of this shift, together with the divestments is that gross profit in New Zealand grew by 22%. Rest of World revenue grew by 63% to $5.9 million from $3.6 million in the prior year. Licence income from out licensing agreements is now classified as revenue under the new IFRS reporting requirement, and the prior year has been restated to include this. Underlying growth for the sale of products and royalties grew by 87%. The Rest of World generates 6.9% of Group operating revenue. Gross Margin Gross profit grew 15% to $40.7 million from $35.3 million in the prior year and the gross margin grew 4 points to 48%. Underlying gross profit growth was 19% (adjusting for the hospital product sales). The main drivers for the improvement were from the growth in OTC revenues across all markets and this channel has the highest gross margin. The inclusion of licence income in revenue in line with IFRS reporting requirements increases the margin by around 1%. The gross margin is expected to continue in this range in the future as the Australian and Rest of World OTC revenues continue to grow. Other Income Licence income from out licensing agreements is now classified as revenue under the new IFRS reporting requirement, and the prior year has been restated to include this. Other income comprise the contribution we received from the divestment of non-core hospital products together with the Callaghan innovation growth grant that we receive on eligible research and development expenditure. Operating Overheads Total research and development investment reduced to $3.1 million from $9.7 million. This includes $0.5 million expensed on Pascomer which under IFRS accounting standards we are required to record as a joint venture equity accounted loss in the consolidated income statement. The significant reduction in research and development expenditure is as a result of the successful completion of a significant proportion of the clinical trial program that we identified at the time of the IPO in December 2015 (see Section: Maxigesic Development). Selling and distribution expenses reduced to $26.5 million from the prior year's $28.5 million and these expenses reduced again as a percentage of operating revenue to 31% from 36% in the prior year. They comprise primarily the support of OTC products in the Australian, New Zealand and Southeast Asia markets. We continually monitor this spend and identified some efficiencies which we implemented in the second half of the year in Australia and the Asian markets. General and administration expenses reduced to $7.2 million from $8.3 million, primarily due to one off legal costs incurred in FY2018 relating to competitor legal action that is challenging certain Maxigesic claims. The legal proceedings remain ongoing and AFT remains confident of its legal position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started